Heads up, Loonie traders! Canada will be printing its jobs report on Friday 12:30 pm GMT.

Planning on trading the event? Here are the points you need to know first:

How did the previous release turn out?

- Canada lost 207.1K jobs in April vs. the projected losses of 160.5K

- The unemployment rate jumped from 7.5% to 8.1%

- Total hours worked dropped while labor underutilization increased

Canada’s April jobs report was a huge disappointment, as the economy lost 207.1K jobs and saw a significant increase in its unemployment rate.

As many expected, the latest wave of COVID-19 cases and resulting lockdowns led to several layoffs in industries affected by public health restrictions.

Majority of the job losses were reported in Ontario and British Colombia, where stay-at-home orders and “circuit breaker” measures were implemented.

The number of Canadians working from home was more or less unchanged, but total hours worked for the month took a hit even among the self-employed.

What’s expected this time?

- Employment losses of 23.5K are expected for May

- The jobless rate could still tick higher to 8.2%

A slower increase in unemployment is expected for the month of May, although this would still likely bring the unemployment rate up a notch to 8.2%.

It’s worth noting that Markit’s manufacturing PMI dipped from 57.2 to 57.0 in May.

Underlying data reflected an uptick in hiring, as businesses added to their workforce to keep up with a surge in output and new orders.

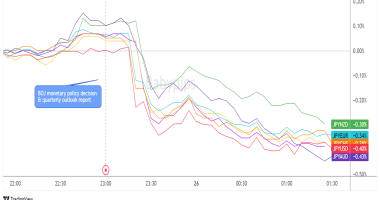

If you’re trying to decide which currency to trade against the Loonie, check out this MarketMilk™ performance ranking of CAD pairs to help you gauge which might be the strongest bullish or bearish rivals:

Not feeling confident about trading the event at all? That’s okay, you can always stay in the sidelines and observe the Loonie’s reaction to the release.

This post first appeared on babypips.com