Heads up, Aussie traders!

The Land Down Under will be releasing its April jobs report on Thursday 2:30 pm GMT, and here’s what you need to know if you’re trading this news event.

What happened last time?

- March employment rose by 70.7K vs. the 35.2K consensus

- March unemployment rate fell from 5.8% to 5.6%

- Full-time employment sank by 20.8K, part-time employment rose by 91.1K

The headline jobs figure for March blew market expectations out of the water, as employment rose by more than twice the consensus.

The unemployment rate also turned out better than projected, falling a couple of notches from 5.8% to 5.6%, while the participation rate ticked higher to 66.3%.

However, underlying components revealed that the increase was spurred by part-time hiring instead of full-time employment.

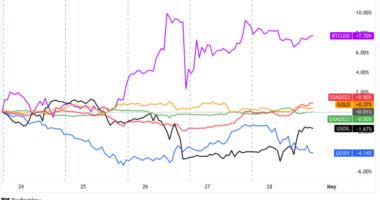

As a result, the Aussie took hits across the board, especially since the RBA has already noted that they are watching the jobs situation closely.

What’s expected this time?

- April hiring could come in at 20.3K

- Unemployment rate to hold steady at 5.6%

- End of JobSeeker program likely to be reflected

Market watchers aren’t exactly setting the bar high for Australia’s April jobs report, as the end of the JobSeeker subsidy program could impact the numbers.

Keep in mind that analyst predict jobs losses of roughly 150K now that the government’s wage stimulus has expired last March 28. This might even be enough to bring the overall unemployment rate back up to 7.0%!

Should the headline figures still print upside surprises, Aussie traders will likely scrutinize the underlying components, particularly any gains or losses in full-time hiring.

Leading indicators have a few more clues:

These leading indicators confirm that hiring gains might still be observed in April, although the pickup would likely be slower compared to the previous couple of months.

Another notable dip in full-time employment might hit the Aussie hard, though, as this might be enough to prevent the central bank from shifting to a more hawkish stance anytime soon.

If you’re planning on trading this event, don’t forget to keep tabs on the average volatility of AUD pairs, which could serve as a guide in setting entries and exits.