Uncle Sam is about to give an update on the Q2 GDP figures.

Are any revisions likely to push USD pairs around midweek?

Read on for the major points you need to know if you’re planning on trading the release:

Event in Focus:

U.S. Preliminary GDP (1st revision) figure for Q2 2023

When Will it Be Released:

August 30, 2023 (Wednesday), 2:00 pm GMT

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- No revisions expected to initially reported 2.4% q/q growth figure

- No revisions to preliminary price index of 2.2% q/q as well

Relevant Data Since Last Event/Data Release:

🟢 Arguments for Upgrade / Likely Bullish USD

June final wholesale inventories revised from 0.3% m/m decline to 0.5% drop, suggesting higher business purchases than initially reported

June business inventories stayed flat again vs. estimated 0.2% uptick, reflecting stronger spending to replenish stockpiles during the month

June trade balance showed that imports were at $313.0 billion, $3.1 billion less than May imports

U.S. Retail Sales stayed positive but trended lower. For April: +0.4% m/m vs. -0.7% m/m previous; for May 2023: +0.3% m/m; for June: +0.2% m/m

U.S. Average Hourly Earnings was positive and mostly beat forecasts: in April: +0.4% m/m; +0.3% m/m in May and +0.4% m/m in June

U.S. Durable Goods Orders rate increased. April: +1.1% m/m; for May: +1.7% m/m; for June: +4.7% m/m

U.S. Core PCE for April: +0.4% m/m (+0.3% m/m forecast) vs. +0.3% m/m previous; +4.7% y/y vs. 4.5% y/y forecast

U.S. Non-Farm Payrolls for April: 253K; 339K for May

U.S Consumer sentiment improved from 63.5 in April to 63.9 in June

ISM Services PMI signaled expansionary conditions: 51.9 in April, 50.3 in May, 53.9 in June

🔴 Arguments for Downgrade / Likely Bearish USD

June trade balance showed that export activity stood at $247.5 billion, $0.3 billion less than May exports

U.S. Building Permits held steady above 1.42 each month in Q2

U.S. factory orders growth trended lower in Q2: 0.9% m/m in Apr.; 0.4% m/m in May; 0.3% m/m in June

U.S. Non-Farm Payrolls for June fell below expectations and previous read at 209K

ISM Manufacturing PMIs were contractionary and worsened: 47.1 in April, 46.9 in May, and 46.0 in June; Manufacturing Prices Index declined from 53.2 in April to 41.8 in June

Previous Releases and Risk Environment Influence on the U.S. Dollar

May 25, 2023

Event results / Price Action:

The U.S. Q1 GDP reading was upgraded from 1.1% growth to 1.3% expansion quarter-over-quarter instead of staying unchanged. The Q1 preliminary price index also revised higher from 4.0% to 4.2% quarter-on-quarter, suggesting stronger inflationary pressures.

Dollar price action was subdued early on in the week, as traders had been bracing for updates on the debt ceiling negotiations.

The release of the FOMC meeting minutes spurred a bit more volatility when Fed head Powell and other officials hinted at extending their rate hikes past June. Upbeat preliminary GDP data underscored this hawkish view and allowed the dollar to sustain its rally, along with mostly stronger U.S. reports and safe-haven flows.

Risk environment and intermarket behaviors:

This trading week was characterized by relatively low volatility, as market players were feeling jittery while U.S. debt ceiling talks were ongoing.

Fortunately for the lower-yielding dollar, safe-haven flows also worked in its favor, even after credit rating agency Fitch put the U.S. government on “negative watch.”

Hints that U.S. lawmakers were edging close to a deal by the end of the week still lifted the U.S. currency’s spirits since this might allow the government to avoid a debt default.

Feb 23, 2023

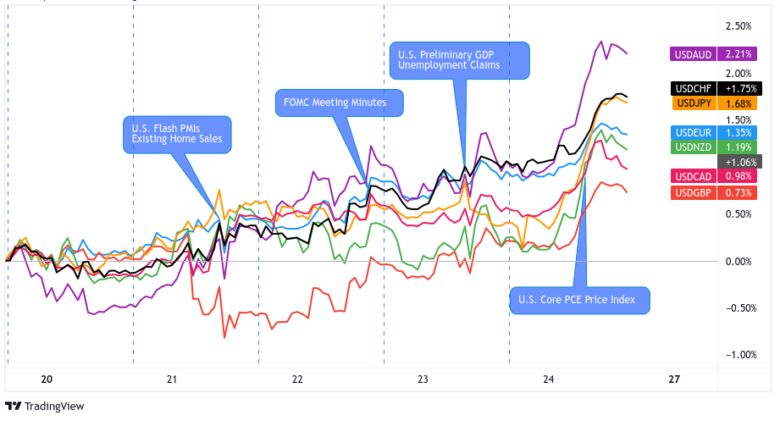

Overlay of USD vs. Major Currencies Charts by TV

Event results / Price Action:

The Q1 GDP reading was downgraded from the initially reported 2.9% growth figure to just 2.7% quarter-over-quarter due to negative revisions to consumption data.

On the other hand, the preliminary GDP price index for the same period was upgraded from 3.5% to 3.9% instead of staying unchanged, reflecting stronger inflationary pressures.

The dollar had already been banking on strong U.S flash PMIs and an upbeat FOMC meeting minutes prior to the preliminary GDP release, so it was no surprise that bulls managed to brush off the small downgrade.

Besides, it seems that USD traders paid closer attention to the upgraded price index, as the higher than expected inflation reading bolstered hopes for more tightening moves.

Risk environment and intermarket behaviors:

Risk-off flows stemming from resurfacing geopolitical tensions and the possibility of higher borrowing costs raising the possibility of a global recession were already keeping safe-havens like USD supported for the most part of the week.

Global bond yields were also on the rise, thanks mostly to upbeat PMI readings from the U.S. and Europe, lifting the dollar in the process as well.

Price action probabilities:

Risk sentiment probabilities:

The upcoming trading week is filled to the brim with top-tier catalysts, including the U.S. NFP report and a handful of global inflation updates.

Prior to the release of the U.S. preliminary GDP report on Wednesday, Australia and a couple of eurozone big shots (Germany and Spain) will be printing their CPI figures for August. These could set the tone for monetary policy expectations, which would likely impact overall market sentiment midweek.

Leading jobs indicators like the ADP report and the JOLTS job openings figure might also influence dollar price action earlier on, especially since the FOMC is waiting on employment data to gauge if a September hike is possible.

Don’t forget that Powell’s Jackson Hole speech last week hinted that “restrictive” monetary policy may still be appropriate in order to bring inflation back to target, so an upgrade in the price index could spur tightening bets.

U.S. Dollar scenarios:

Potential Base Scenario:

Trade activity and business inventory data, which have been typical sources of revisions in previous preliminary GDP reports, are mostly pointing to small upgrades in growth data.

With that, a positive revision in the Q2 GDP could be in the cards, and a significant upgrade to the headline figure AND the price index could tilt the odds towards a September hike.

Stronger than expected leading jobs indicators may also put the dollar on a positive trajectory early in the week, possibly giving USD enough momentum to go on with its climb.

In this case, the safe-haven currency might once again be able to bank on risk-off flows if recession jitters return in anticipation of higher borrowing costs.

If this is the case, look out for bullish USD bets against currencies with mostly dovish central banks, such as EUR and JPY or those that are hitting the pause button with their tightening cycle like the commodity currencies.

Potential Alternative Scenario:

A significant downgrade to the Q2 GDP reading and price index may be enough to dash hopes for a September hike, spurring expectations for a pause or even rate cuts early next year.

A surge in risk appetite might also drag the “safe haven” dollar south, especially if market watchers see notable declines in global inflation figures.

If this happens, stay on the lookout for bearish USD bets against central banks with more hawkish biases like GBP and possibly AUD if the latest CPI figure surprises to the upside.