Will the U.S. non-farm payrolls (NFP) report turn around the recent negative vibes in the Greenback?

Here are a few data points to know if you’re planning on trading the event:

Event in Focus:

U.S. Monthly Employment Situation Summary from the U.S. government for April 2023

When Will it Be Released:

May 5, Friday: 12:30 pm GMT, 1:30 pm London, 8:30 am New York, 9:30 pm Tokyo

Expectations:

- U.S. Non-Farm Payrolls Change m/m: 190K forecast vs. 236K previous

- U.S. Average Hourly Earnings m/m: +0.3% m/m forecast vs. 0.3% m/m previous

- U.S. Unemployment Rate: 3.6% forecast vs. 3.5% previous

Based on April’s numbers from the U.S. private sector payrolls report from ADP, as well as the ISM PMI Employment Index and S&P Global PMI data, it is likely that the upcoming U.S. non-farm payrolls report will show continued resilience in the U.S. jobs environment, but signs of cooling off.

The average earnings data point will likely be a key driver for market sentiment as well. An acceleration / deceleration of pay growth will be seen as a factor for inflation expectations, as well as expectations of workers coming back to the workforce or job switching opportunities.

Relevant U.S. Data Since the Last U.S. Non-Farm Payrolls Report:

? Arguments for Strong Jobs Update / Bullish USD

- U.S. Private sector payrolls for April: +296K (+140K forecast) vs. 142K in March

- ISM Manufacturing PMI Employment Index for April was up 3.3 to 50.2

- U.S. Weekly Initial Jobless Claims for week ending Apr. 22: 230K vs. 246K previous week

- S&P Global U.S. Manufacturing PMI for April: “Growth in private sector employment numbers was the quickest since last July”; “The rate of job creation accelerated to the fastest since September 2022 and was solid overall. Panelists stated that there was increased availability of candidates, with firms hiring to support growth in output.”

- S&P Global U.S. Services Business Activity Index survey for April: “Pressure on capacity and a modest accumulation of backlogs of work led to the fastest rise in employment at service providers since July 2022.”

- ISM Services PMI Employment Index for April dipped to 50.8 vs. 51.3 previous

? Arguments for Weak Jobs Update / Bearish USD

- U.S. Continuing Jobless Claims rose to the highest level since November 2021 at 1.87M through April 8, potentially signaling the difficulty for workers to find a new job

- U.S. initial jobless claims rose by 11K to 239K in the week ended April 8. California – the epicenter of recent tech layoffs – accounted for more than a third of the increase.

- U.S. layoffs grew to the highest levels since 2000; the quits rate fell to 2.5% (lowest in 2 years); job openings fell to 9.59M from 10M

Previous Releases and Risk Environment Influence on USD

Apr 7, 2023

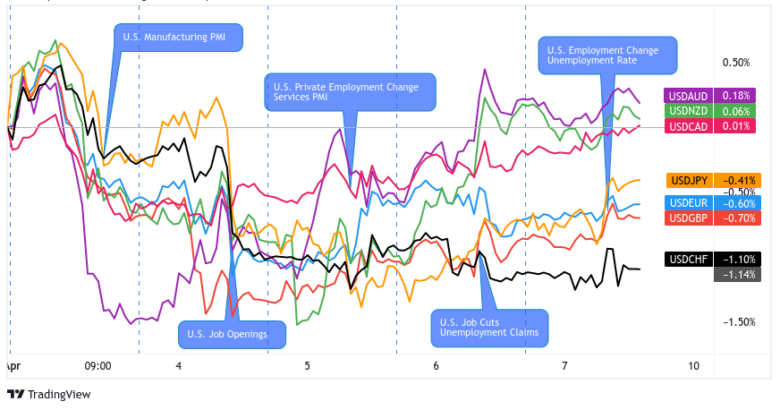

Overlay of USD Pairs: 1-Hour Forex Chart by TV

Action / results: The U.S. Non-farm Payroll report for March came basically within expectations at 236K (238K forecast) vs. upwardly revised February read of 326K.

The unemployment rate ticked lower to 3.5% from 3.6% and the average hourly earnings rate rose to 0.3% m/m, signalling resilience in the U.S. employment environment. This raised the odds a bit for the Fed to stay aggressive in their inflation fight, likely the reason for the bounce in USD ahead of the Friday close.

After event volatility was relatively muted relative to the price action earlier in the week for the U.S. dollar, likely due to the numbers coming in pretty close to expectations.

Risk environment and intermarket behaviors: This week in April was dominated by several top-tier events, but the most notable was likely the string of U.S. economic / survey updates that signaled economic slowing in the U.S.

Risk assets traded most of the week in the red, with exception to oil prices that spiked higher on a surprise announcement from OPEC+ to cut oil output starting in May.

Mar 10, 2023:

Overlay of USD Pairs: 1-Hour Forex Chart by TV

Action / results: The U.S. dollar traded broadly higher in the week leading up to the Non-Farm Payrolls release, correlating to hawkish comments from Fed Chair Powell that suggested further interest rate tightening ahead.

The Greenback finally fell during the Friday jobs release, despite the February number coming in at 311K (225K forecast). It was still below the previous month’s gain and the unemployment rate ticked higher to 3.6%.

Also, average hourly earnings came in below expectations at 0.2% m/m (0.3% m/m forecast), which lowered the argument a bit for an aggressive rate hike outlook.

Risk environment and intermarket behaviors: Broad risk sentiment was pretty averse during this trading week in April thanks to several factors including negative Chinese GDP forecasts, hawkish commentary from Fed officials on monetary policy tightening, and the infamous failure of Silicon Valley Bank.

Price action probabilities

Risk sentiment probabilities:

Based on the intemarket price action so far this week with gold prices up and everything else down, risk sentiment is leaning hard towards net negative. This is likely a result of weak PMI updates from China and Europe, as well as a notable risk averse reaction to Tuesday’s negative U.S. layoffs and job openings update.

Wednesday’s FOMC statement seems to have also had a bearish impact on broad risk sentiment, possibly on the idea the Fed has not completely close themselves off from the idea of future rate cuts ahead. This could be the main driver for broad markets, at least through the Asia and London sessions on Thursday as they have not yet had the chance to trade the event.

USD scenarios

Given that there are many data points (net jobs change, unemployment rate, average wages change, etc.) in one event to potentially influence price sentiment after the release, this is one of those events where it’s probably better to wait for the results. There are too many combinations of outcomes, lowering the probability of calling the correct event result and price reaction.

And based on recent releases, there’s likely still enough directional movement in the reaction to catch a few pips on the session, which lowers the need to jump in early on the move to create a decent reward-to-risk setup.

Base Case:

With the leading indicators pointing to a slower rate of growth but resilient net jobs environment, chances are that if the actual numbers come inline or better, traders could price in the Fed returning to more aggressive monetary policy rhetoric, especially after softening its stance a bit with today’s FOMC statement.

Dollar bulls may hop in on this scenario, especially if we see USD trade lower against the majors heading into Friday’s event, and/or risk sentiment leans bearish on Friday.

If you’re interested in a long USD position in this scenario, it’s probably a good idea to look into potential USD longs against currencies whose central banks have paused rate hikes recently, like CAD and NZD.

Alternative Scenario:

If the actual numbers come worse-than-expected, traders could price in the idea of the Fed softening further on aggressive monetary policy talk. Right now, Fed Chair Powell signaled that the door is not open on the possibility of cutting rates, but still open on the possibility of further tightening if needed.

But if the U.S. employment data signals that the jobs environment has weakened significantly, that could draw in some dollar sellers on the idea Powell may start to change his tune.

The odds rise of dollar selling if the Greenback is able to make some gains ahead of the event, and it would make sense to look at potential USD shorts against GBP and EUR, especially if we get a hawkish monetary policy statement from the European Central Bank this week.

If risk sentiment is leaning towards risk aversion, then look at short-term USD short setups on JPY and CHF due to their “safe haven” status among traders. Or at XAU/USD for solid long technical setups as gold has been doing very well against the Greenback in various environments so far this year.