Who’s ready to trade one of the most anticipated calendar events this week?

I’m talking about the Fed’s preferred inflation measure, yo!

Here are points you need to consider if you’re planning on trading Friday’s report:

Event in Focus:

U.S. Core Personal Consumption Expenditures (PCE) Price Index for May 2023

When Will it Be Released:

June 30, 2023 (Friday), 12:30 pm GMT

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

U.S. core PCE price index (m/m): 0.3% forecast vs. 0.4% previous

U.S. core PCE price index (y/y): 4.5% forecast vs. 4.7% previous

Relevant Data Since Last Event/Data Release:

? Arguments for a higher Core PCE rate update

Retail Sales for May: +0.3% m/m (+0.2% m/m forecast; +0.4% m/m previous); Core retail sales came in at +0.1% m/m (+0.1% m/m forecast; +0.4% m/m previous)

Factory orders grew by 0.4% m/m in April on strong defense spending, lower than the expected 0.8% uptick, and March’s 0.6% increase

Non-Farm payrolls for May: +339K (+180K forecast) vs. upwardly revised 294K in April; Unemployment Rate rose to 3.7% (3.5% forecast, 3.4% previous); Average hourly earnings: +0.3% (+0.4% forecast/previous)

? Arguments for a lower Core PCE rate update

Producer Prices for May: -0.3% m/m (0.1% m/m forecast; 0.2% m/m previous); Core PPI came in at 0.2% m/m (0.1% m/m forecast; 0.2% m/m previous)

CPI for May: 4.0% y/y (4.3% y/y forecast) vs. 4.9% y/y previous; Core CPI lower from 5.5% y/y to 5.3% y/y

ISM Manufacturing PMI for May: 46.9 vs. 47.1 in April; Prices Index fell 9 points to 44.2; Employment Index grew by 1.2 points to 51.4

S&P Global US Manufacturing PMI read for May: 48.4 vs. 50.2 in April

S&P Global US Services PMI for May: 54.9 vs. 53.6; “Sharpest rise in new business since April 2022”; “The rate of charge inflation eased from April but was the second-fastest since September 2022 and sharper than the long-run series average.”

New York Fed’s monthly Survey of Consumer Expectations for May: Inflation expectations fell to -0.3 from 4.1% in one year

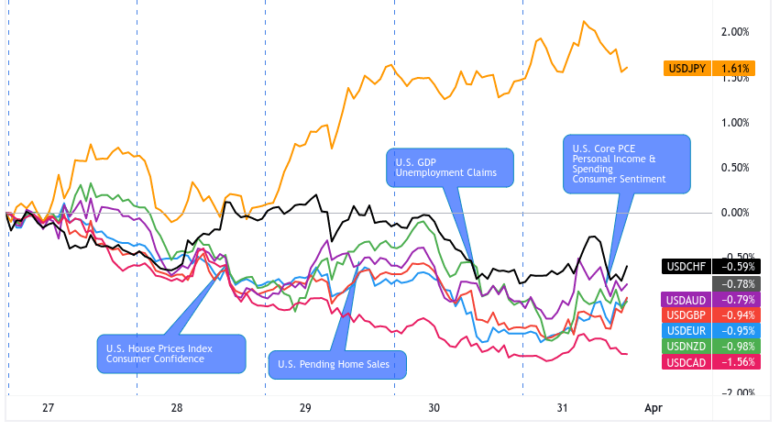

Previous Releases and Risk Environment Influence on the U.S. Dollar

May 26, 2023

Event results / Price Action: Core consumer prices rose by 0.4% m/m in April when traders expected the report to maintain the 0.3% March uptick. Ditto for the annual rate, which accelerated to 4.7% instead of keeping its previous 4.6% increase.

Keep in mind that the Fed generally targets 2% based on a broader measure but views the core gauge as a better indicator of the trend.

The U.S. dollar, which had been in relatively tight ranges during the U.S. debt ceiling talks, received a boost and made new intraday highs ahead of the event before giving back some of the gains post data release, reflecting a possible “buy-the-rumor, sell-the-news” behavior pattern play out.

Risk Environment and Intermarket Behaviors: Usually volatile catalysts like global flash PMIs and inflation updates took a back seat to U.S. debt ceiling headlines.

By Friday U.S. session, traders leaned heavily into risk-on mode after news hit the wires that White House and Republican negotiators had tentatively resolved most of the major issues of the deal, likely taking some USD longs off the table.

April 28, 2023

Event results / Price Action: As expected, core PCE prices maintained its 0.3% monthly growth in March. The annualized reading came in at 4.6%, slower than February’s upwardly revised 4.7% but higher than the expected 4.5% reading.

At the time, the quarterly employment cost index – another preferred Fed measure – exceeded 1.0% estimates at 1.2% in Q1 2023.

The U.S. dollar, which had gained pips after an earlier BOJ announcement and ahead of the core PCE release, dropped across the board on speculation that peak inflation conditions may be forming, which means a potential peak in the rate hike cycle.

The Greenback also regained its post-report losses in the first hour of the release though as the U.S. recession theme came back in focus, also possibly on short covering/profit taking ahead of the weekend.

Risk environment and intermarket behaviors: All eyes were on global banking jitters thanks to First Republic Bank reporting a huge deposit flight and its plans to downsize operations.

Interestingly, the usual safe havens like USD and JPY failed to bank on their “safe status” in the first half of the week.

This made it easier for traders to buy “riskier” bets when risk sentiment turned positive and concerns over the Fed raising its rates despite the increased recession odds dominated the second half of the week.

Price action probabilities:

Risk sentiment probabilities: The trading week is shaping up to be more similar to the April 28 release than the May 26 print. That is, traders aren’t too keen on taking risks but are also not rushing to safe havens like USD and JPY either.

But the week is still young and calendar events like the ECB’s central banker forum on Wednesday and China’s PMI releases on Friday could still influence overall risk-taking.

Best guess is that central bankers will stay hawkish in their inflation fight rhetoric, while Chinese business surveys may continue to show a weak manufacturing sector/resilient services sector. In recent history that tends to mean a risk-off sentiment lean, but we’ll just keep an eye out for the “main” market theme may be by then, then factor it in ahead the core PCE report.

U.S. Dollar scenarios:

Potential Base Scenario: There are no notable trends on the core PCE hitting or missing estimates in the last 10 releases but, based on the data above, it looks like we may see slower consumption expenditure in May.

Slower consumer spending would support a less hawkish path for the Fed, which could ease fears of a hard U.S. recession and encourage risk-taking.

In case of a risk-friendly annual core PCE print, USD may see strong bearish moves against “riskier” assets like AUD, NZD, and GBP, with higher conviction if broad risk sentiment is leaning positive (a likely scenario if China PMI surprises positive).

Potential Alternative Scenario: A stronger-than-expected core PCE figure would probably convince more traders that the Fed is serious about raising its rates at least twice before taking a chill pill this year.

Aside from hawkish Fed bets, the return of U.S. and/or global recession fears could push USD higher against its counterparts.

If markets interpret a high core PCE reading as rate hike and recession-friendly, then USD may see gains against currencies like JPY, CHF, AUD, and EUR.

In either of the above scenarios, also consider that USD will have a few potential major catalysts ahead of the Core PCE update, most notably speeches from Fed Chair Powell and the latest U.S. GDP and initial weekly jobless claims updates. If these catalysts produce higher volatility and intraweek trends, then that may affect how traders react to the Core PCE event.

Given this dynamic, a conservative strategy approach may be to just wait until the core PCE event is released, and if the actual update deviates sharply from expectations/previous, look for short-term / day trade setups like momentum scalps, support & resistance breaks, or scalping profit taking reversal plays if signs of exhaustion arise.

Whatever your strategy of choice may be, always remember to practice good risk management and limit your max risk according to your risk tolerance and circumstances!