The U.K. is about to drop its May GDP figures!

Will growth figures encourage more rate hikes or a higher-for-longer stance from the BOE?

More importantly, how can this week’s release affect GBP’s price action?

Event in Focus:

U.K. Gross Domestic Product (GDP) for May 2023

When Will it Be Released:

July 13, 2023 (Thursday), 6:00 am GMT

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- May GDP m/m: -0.2% m/m forecast vs. +0.2% m/m previous

- May GDP y/y: -0.2% y/y forecast vs. +0.5% y/y previous

Relevant Data Since Last Event/Data Release:

May flash manufacturing PMI fell from an upgraded 47.8 figure to 46.9 vs. 47.9 estimate, flash services PMI tumbled from upgraded 55.9 reading to 55.1 vs. 55.5 forecast to indicate slower growth

CBI survey showed the retail sales index falling from +5 to -10 in May, but outlook is optimistic

BRC price shop index accelerated from 8.8% to record high of 9.0% year-over-year in May to reflect even stronger pace of inflation in retail stores

S&P Global / CIPS UK Manufacturing PMI for May: 47.1 (a four-month low) vs. 47.8 previous

S&P Global / CIPS UK Construction PMI for May: 51.6 vs. 51.1 in April; while costs are still rising, May was the weakest rate of inflation in about two-and-a-half years

S&P Global / CIPS UK Services PMI for May: 55.2 vs. 55.9 in April; “wage pressures push up cost inflation to a three-month high”

BRC: U.K.’s retail sales slowed from 5.2% to a seven-month low of 3.7% in May as shoppers reduced non-essential spending amidst soaring food prices

Claimant counts fell by 13.6K instead of posting the estimated 21.4K rise in joblessness in May, earlier reading revised to show a smaller 23.4K increase in unemployment from initially printed 46.7K

Retail sales slowed down from 0.5% m/m to 0.3% m/m in May (vs. -0.2% m/m expected) thanks in part to warm weather boosted non-store retail activity

Mortgage approvals for May: 50.5K vs. 49K previous; net consumer credit by individuals: £1.1B vs. £1.5B previous

Previous Releases and Risk Environment Influence on GBP

June 14, 2023

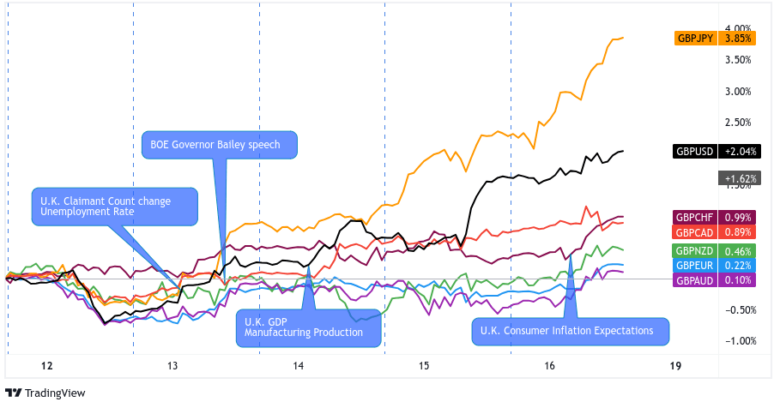

Overlay of GBP vs. Major Currencies Chart by TV Charts by TV

Event results / Price Action: As expected, the economy expanded by 0.2% from March to April. The service sector, which was a drag in March, gained 0.3% in April. Annualized growth also improved from 0.3% to 0.5%, which was mostly in line with market estimates.

Like in the May print, GBP didn’t have a notable reaction during the report’s release. But the improvement in the GDP likely contributed to GBP’s upswing during the London session until other U.S. session-related headlines inspired choppy GBP price action near the end of the day.

Risk environment and intermarket behaviors: Talks of the Fed pausing its tightening supported risk-taking early in the week. Unfortunately, crude oil’s demand outlook concerns and China’s downbeat data limited the gains of higher-yielding bets. If not for currency-specific bullish data surprises, more high-yielding currencies would end the week lower against the dollar.

May 12, 2023

Overlay of GBP vs. Major Currencies Chart by TV Charts by TV

Event results / Price Action: Heavy rains and strikes managed to help shrink the U.K. economy by 0.3% from February to March, which was weaker than the flat reading that markets had expected.

The annualized growth managed to eke out a 0.3% gain, though, while Q1’s 0.1% uptick exceeded the BOE’s 0.0% estimates.

The British pound showed minimal initial reaction to the report. However, the GDP miss, which followed a dovish BOE rate hike the previous day, helped drag GBP down from its intraday highs against USD, CHF, and CAD.

Risk environment and intermarket behaviors: With the U.S. debt ceiling deadline, U.S. CPI release, and China’s CPI and trade data under the spotlight, risk aversion and USD-buying were the main headlines that week.

Other major currencies like GBP had a choppy week, which ended with the currency trading mostly lower against the safe havens.

Price action probabilities:

Risk sentiment probabilities: Market sentiment on Thursday are likely to be mainly influenced by Wednesday’s U.S. CPI update. Odds are in favor of another slowdown print in U.S. inflation which would likely fuel broad risk-on sentiment, especially if risk-off flows dominate on Wednesday ahead of the CPI report

The RBNZ and BOC‘s policy announcements will also be out ahead of the U.K. GDP event, which could paint a clearer picture of the trend with major central banks’ biases AND how markets feel about risk-taking before we see the U.K. GDP report.

British pound scenarios:

Base case: Based on the weaker business surveys and retail sales data, the U.K. could see slower growth reading than the 0.2% m/m uptick in April.

Like in the last two releases, though, we’re not expecting major fireworks right after the actual release. With GDP expected to miss, that could weigh on the pound as the BOE is likely to factor in slower growth more into their calculations, especially if the U.K. production reports due at the same time as the GDP report miss as well.

Positioning ahead of the report may also play a factor; if pound catches a bid ahead of the event, then the odds rise that fundie traders take some longs off the table if a weaker-than-expected print hits the wires. Drawing in fresh shorts is not a likely scenario without a really weak GDP read, but it’s something to think about as well.

In the scenario described above, odds are we could see short-term weakness in GBP against recently hawkish central bank currencies like USD, EUR, CHF, especially if U.S. CPI sparks broad risk-on sentiment.

Alternative Scenario: A stronger-than-expected monthly GDP report keeps the BOE focused more on fighting high inflation with less consideration needed towards slower economic growth. This may draw in fundie GBP bulls in the short-term, with rising odds of that playing out if Sterling takes a dip ahead of the U.K. GDP release.

Odds of success for a short-term bullish move likely rise against currencies with dovish (or recently dovish) central banks like JPY (especially if broad risk-on sentiment dominates), and possibly NZD & CAD if their central banks turn dovish this week.