We’re getting a parade of April business surveys from the Eurozone on Friday!

What are markets expecting and how can the reports affect EUR?

Here’s a short guide for ya:

Event in Focus: Euro Area Flash Manufacturing & Services PMIs

A purchasing managers index (PMI) comes from a survey conducted among a few hundred purchasing managers in major business sectors, such as the manufacturing and services industries.

An index reading of 50.0 and above hints at optimism and industry expansion, while a reading of 49.9 and below denotes pessimism and possible industry contraction.

While survey companies like S&P have manufacturing and services PMIs for the Eurozone, PMI trends from Germany and France – the Eurozone’s largest economies – also typically influence EUR’s price action.

When will the reports be released?

April 21, 2023, Friday: starting around 7:15 am GMT, 8:15 am London, 3:15 am New York, 5:00 pm Tokyo

Check our Economic Calendar to see what time the reports come out in your time zone!

What are markets expecting?

S&P Global Manufacturing PMI Flash: 47.9 forecast vs. 47.3 previous

S&P Global Services PMI Flash: 54.8 forecast vs. 55.0 previous

German S&P Global Manufacturing PMI Flash: 45.1 forecast vs. 44.7 previous

German S&P Global Services PMI Flash: 53.2 forecast vs. 53.7 previous

French S&P Global Manufacturing PMI Flash: 48.9 forecast vs. 47.3 previous

French S&P Global Services PMI Flash: 54.2 forecast vs. 53.9 previous

Overall, markets see manufacturing businesses to continue to work its way towards expansion after last year’s sharp declines. The services sector, which turned out to be the main growth driver in March, is expected to moderate from last month’s expansion.

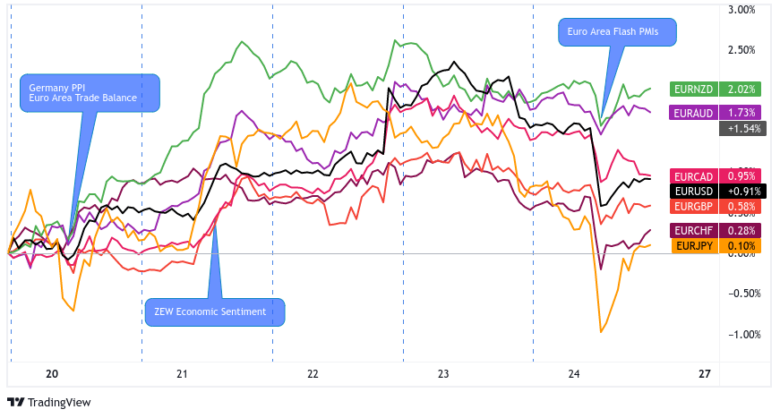

What happened and how did EUR react to the previous releases?

Mar 24, 2023

Action / results:

March manufacturing PMIs from Germany (44.4 vs. 46.3 expected), France (47.7 vs. 48.1 expected), and the Eurozone (47.1 vs. 48.5 expected) missed market estimates. Meanwhile, services PMIs from Germany (52.9 vs. 51.0 expected), France (55.5 vs. 52.4 expected), and the Eurozone (55.6 vs. 52.6 expected) came in high in the green.

This emphasized that economic growth was mainly driven by the services sector as manufacturing backlogs eased and new orders for services accelerated. EUR, which saw a sharp drop in early European session trading, started recovering from its intraday lows after the PMI reports were released.

Risk environment and intermarket behaviors:

A sudden spike higher in Deutsche Bank’s five-year credit default swaps (CDS) on the previous day tanked EUR at the start of the European session. Risk assets including EUR broadly fell throughout the morning London session before calming down ahead of the U.S. session open.

Feb 21, 2023:

Action / results:

Manufacturing PMIs from Germany (46.5 vs. 48.0 expected), France (47.9 vs. 51.0 expected), and the Eurozone (48.5 vs. 48.8 expected) saw setbacks to their return to expansion after bottoming out in October.

Luckily, service sector expansion seen in Germany (51.3 vs. 51.0 expected), France (52.8 vs. 49.7 expected), and the Eurozone (53.0 vs. 51.0 expected) services PMIs were enough to push composite PMIs into growth territory.

EUR, which was extending a downtrend from the previous day, spiked higher at the PMI releases. The reports also helped EUR find an intraweek bottom against counterparts like JPY, AUD, NZD, and GBP.

Risk environment and intermarket behaviors:

Sticky inflation and green shoots from PMI surveys supported hawkish narratives for the Fed and other major central banks. Bond yields pumped higher and risk assets like EUR generally moved into the red.

Risk Sentiment Scenario Probabilities Ahead:

Price action has generally been mixed since the start of the week, with a slight bias towards risk-taking after U.S. earnings reports and China’s data dump surprised to the upside.

USD is lowkey extending its gains as more traders go back to pricing in rate hikes from the Fed. The euro, which some consider a safe-haven in Europe, is also losing pips to “riskier” bets like AUD, CAD, and GBP

Volatility could gain traction on Wednesday and Thursday as FOMC members like Michelle Bowman, Austan Goolsbee, John Williams, Christopher Waller, and Patrick Harker share their biases ahead of the blackout period before the May meeting.

Inflation reports from Canada, U.K., New Zealand, and Japan should also keep the spotlight on global central bank policy trends.

Euro scenarios:

Based on the most recent PMI releases, the euro tends to react with strong directional bias and volatility in this market environment. But since we won’t see the PMI parade until Friday, the reports can only make or break EUR’s existing intraweek trends.

Base Scenario:

Considering the last two releases, manufacturing PMIs from Germany, France, and the Eurozone could miss estimates for another month. But, as long as the service PMIs rise high enough to pull the composite PMIs into growth territory, then EUR traders may keep on pricing in more interest rate hikes from the European Central Bank (ECB).

This would also be in line with the risk-on, rate hike-friendly trading environment that gained traction after last week’s positive U.S. data releases.

In a scenario where traders are pricing in Euro Area growth and anticipating ECB rate hikes, EUR may gain pips against currencies that have less hawkish central banks like AUD, CAD, and JPY.

Alternative Scenario:

If manufacturing PMIs miss estimates for another month and the service sector cools enough to stagnate or contract Euro Area growth, then the probability rises that markets may price in a lower rate hike or even a rate hike pause from the ECB.

Martins Kazaks, top ECB official and head of Latvia’s monetary authority, already hinted that the central bank would only raise its rates by 25 bps rather than the expected 50bps in May.

If traders focus on the ECB possibly easing the pedal from the metal or even pausing its rate hikes in the near future, then EUR may lose ground against currencies that have hawkish or optimistic central banks. Shorts against USD, CHF, and GBP could be considered for further trade idea work.