In a few days, China will publish its August inflation reports.

Will it lead to more concerns over the economy’s growth?

Let’s talk about what the markets are expecting and how the report can impact the Australian dollar:

Event in Focus:

China Consumer Price Index (CPI) and Producer Price Index (PPI) for August 2023

When Will it Be Released:

September 9, 2023 (Saturday), 1:30 am GMT

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- Headline CPI m/m: +0.3% forecast vs. 0.2% previous

- Headline CPI y/y: -0.4% forecast vs. -0.3% previous

- Headline PPI y/y: -3.0% forecast vs. -4.4% previous

Relevant Data Since Last Event/Data Release:

🟢 Arguments for potentially stronger-than-expected CPI update

The unemployment rate ticked higher from 4.0% to 4.2% in July (vs. 4.0% expected)

Fixed asset investment up by 3.4% in the first seven months of 2023 from the same period a year earlier (vs. 3.8% expected and previous)

Non-manufacturing PMI: input costs increased for a second straight month and at a steeper pace

Caixin manufacturing PMI rose from 49.2 to 51.0 in August; “Cost pressures picked up slightly…with average input prices rising for the first time in six months…Firms continued to reduce their selling prices.“

🔴 Arguments for potentially weaker-than-expected CPI update

Retail sales eased from 3.1% y/y to 2.5% y/y in July, the slowest since December 2022

Industrial production slowed from 4.4% y/y to 3.7% y/y in July

Average new home prices in 70 major cities fell 0.1% m/m in July, reversing the 0.01% m/m increase in June. Annual declines deepened from 0.51% to 0.64% in July.

China Manufacturing PMI improved from 49.3 to 49.7 in August; “Manufacturers lowered ex-factory prices of their products.”

Caixin services PMI slowed from 54.1 to 51.8 in August; “The rate of input cost inflation cooled to a six-month low, while selling prices increased at the slowest rate since April. ”

Previous Releases and Risk Environment Influence on AUD

Aug 9, 2023

Event results / Price Action: Data showed that consumer prices dipped by 0.3% from a year earlier in July, which marked the first CPI decline since February 2021. Producer prices also fell by 4.4% y/y in July, a bit slower than the 5.4% decrease seen in June.

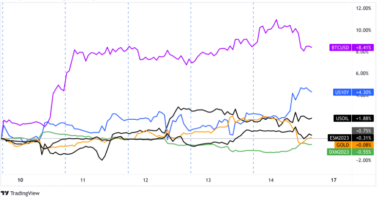

The Aussie dollar, which responds to major Chinese data updates, initially rallied on the idea that the prospect of weaker prices may incite stimulus action from the government. However, when no stimulus came, AUD lost ground against its major counterparts.

Rumors that China’s state-owned banks were selling the dollar versus the yuan also contributed to the dollar’s decline.

Risk Environment and Intermarket Behaviors: Cautious remarks from Fed members during the U.S. session prior to China’s CPI release encouraged USD selling and made it easier to buy “risk” assets like AUD.

It was tough to find momentum for the major currencies during this week as traders were juggling several market themes including global growth concerns, expectations of additional stimulus from China, and a peak in the Fed’s rate hike cycle.

Jul 10, 2023

Event results / Price Action: China’s annualized CPI 0.0% y/y (vs. +0.2% expected, +0.2% previous) and PPI -5.4% yy/ (vs. -5.0% expected, -4.6% previous) reports both showed further deceleration in June.

After a lot of consolidation and a bit of a rally versus the dollar, AUD pairs started the week on shaky footing when China printed weaker-than-expected inflation data.

The Aussie sold off across the board, chalking up the steepest losses to the franc, yen, and euro, while also falling behind its comdoll buddies.

Meanwhile, the safe haven dollar gained ground as more traders braced for a possibly weak U.S. CPI discouraging the Fed from further rate hikes.

Risk Environment and Intermarket Behaviors: Like in the June release, data flow and volatility were light during the Asian session. Unlike in June, however, the Monday inflation release came ahead of a more closely watched U.S. CPI report.

The lack of “noise” at the start of the week enabled the major currencies to react more directly to China’s deflation prospects. Comdolls like AUD, NZD, and CAD traded lower until the start of the U.S. session when other catalysts moved the markets.

Price action probabilities:

Risk sentiment probabilities: Much like in the July release, it looks like traders are worrying about China’s growth following a few data misses, as evidenced by the bearish reaction to the weaker-than-expected Caixin Services PMI update on Tuesday.

Unless we hear of stimulus adjustments that are big and/or crafty enough to ease the investors’ concerns, we’ll likely see global growth worries limit risk-taking in the markets, especially if we get more commentary from Federal Reserve officials that further rate hikes are still needed.

Australian dollar scenarios:

Potential Base Scenario: Based on the leading indicators, it looks like there’s reason to suspect that selling prices have somewhat cooled in August. Both the NBS and Caixin manufacturing PMIs mentioned manufacturers reducing their selling prices while input prices continued to rise at mixed paces.

We could see the headline CPI decrease at a slightly faster annual pace (from -0.3% to -0.4%) while the headline PPI could show another 3.3% decline after a 4.4% y/y downtick in July.

As in the previous releases, AUD may see directly correlated reactions to the event at the open of trade on Monday, likely falling against USD, JPY, and NZD if broad risk sentiment is leaning negative. That is, growth concerns could weigh on the comdoll as traders focus more on short-term growth concerns over sticky inflation conditions/further rate hikes ahead.

Potential Alternative Scenario: If the consumer and producer prices surprise to the upside, then the government will have fewer reasons to stimulate the economy.

Faster price increases could decrease calls for government stimulus. See, while inflation is decelerating all over the world, China’s situation is a bit trickier as it flirts with deflation. For newbies out there, deflation could lead to less consumer spending, tighter corporate profits, and maybe lower employment.

And don’t forget that the report will come out during the weekend after the market close. So, unless the results get leaked early or the government makes preemptive policy changes ahead of the CPI release, the event may not influence AUD’s prices until the Monday morning open.

If we see faster price increases, AUD may see gains against common counterparts like USD, JPY, CHF, NZD, and CAD, with rising probabilities if broad risk sentiment leans risk-on ahead of the weekend.