The BOE decision is coming up this week!

Will they hike interest rates again as expected?

Here’s what you can expect for the event and how you might be able to make pips from it.

Event in Focus:

Bank of England Monetary Policy Statement

When Will it Be Released:

May 11, Thursday: 11:00 am GMT

Expectations:

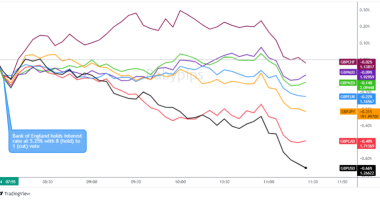

- BOE to hike interest rates by 0.25% from 4.25% to 4.50%

- No changes to asset purchases expected

Market players are counting on another 0.25% interest rate hike from the folks over at the Bank of England, as the economy continues to grapple with stubborn inflationary pressures.

Just as in their earlier decision, a couple of dovish dissenters are expected to vote for no change in the benchmark rate while the rest are likely to push for an increase.

The minutes of their policy meeting and the Monetary Policy Report, as well as BOE head honcho Bailey’s speech scheduled for 11:30 am GMT, would provide more insight on their decision and whether or not they’d carry on with this pace of tightening in the coming months.

Relevant Australian Data Since the Last BOE Statement:

? Arguments for Hawkish Monetary Policy / Bullish GBP

March headline consumer price index fell from 10.4% to 10.1% year-over-year versus expected 9.8% figure, still well-above annual inflation target

March core consumer price index held steady at 6.2% year-over-year instead of dipping to the 6.0% consensus

Average earnings index for three-month period ending in February held steady at 5.9% instead of declining to the projected 5.1% reading

April flash services PMI improved from 52.9 to 54.9 to reflect faster pace of industry expansion versus estimated 52.9 reading

? Arguments for Dovish Monetary Policy / Bearish GBP

February monthly GDP showed no growth instead of the projected 0.1% expansion, January figure upgraded from 0.3% to 0.4%

March retail sales tumbled by 0.9% month-over-month versus estimated 0.5% dip, previous reading downgraded from 1.2% to 1.1% to reflect slightly weaker consumer spending

March claimant count increased by 28.8K instead of declining by 2.5K, previous reading revised to show larger increase in hiring of 18.8K from initially reported 11.2K figure

March BRC retail sales monitor held steady at 4.9% year-over-year instead of improving to the estimated 5.1% figure, pointing to stagnating consumer spending

April flash manufacturing PMI fell from 47.9 to 46.6 to signal faster pace of industry contraction versus estimated 48.3 figure

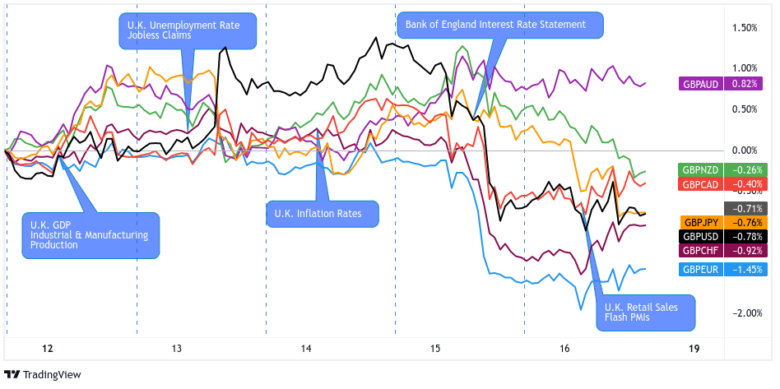

Previous Releases and Risk Environment Influence on GBP

Feb. 2, 2023

Action / results: BOE policymakers voted 7-2 for a 50 bps interest rate hike to 4.00%, but sterling had a bearish reaction to the announcement.

While Governor Bailey did mention signs of a potential peak in inflation rates, he also reiterated that the BOE would continue to tighten until they were “absolutely sure” inflation was cooling down, likely fueling recession speculation ahead for the U.K.

Risk environment and Intermarket behaviors: Risk sentiment was pretty shaky throughout the week since traders had to contend with multiple central bank statements lined up.

While most of these resulted in hawkish decisions, the key takeaway was that policymakers are staying true to their pledge of warding off inflation but at the same time are wary of slower economic activity.

Dec. 15, 2022

Overlay of GBP Pairs: 1-Hour Forex Chart

Action / results: The BOE hiked the key interest rate by 50 bps to 3.5% and hinted that there is more to do. However, sterling still had a bearish reaction to the event.

Risk environment and Intermarket behaviors: Days before their actual announcement, the central bank issued a warning regarding “considerable pressure” on consumers and companies as a result of rising inflation and borrowing prices.

Price action probabilities

Risk sentiment probabilities: It seems that traders are kicking off the week hungry for more risk as commodities and comdolls are off to a positive start, thanks to easing U.S. recession jitters.

U.K. banks were closed on Monday in honor of King Charles’ coronation, giving pound traders time to price in their expectations for this week’s top-tier releases.

British pound scenarios

Base case: Another interest rate hike from the BOE has been priced in for quite some time already, as policymakers pretty much have their hands tied to their price stability mandate.

However, central bank officials are likely to stress that the consumer sector has already been taking huge hits from higher borrowing costs, so they might have to consider pausing soon.

An increase in dovish votes from MPC members could mean that the odds are tilting in favor of a tightening pause in their next decision.

If that’s the case, the BOE would join the likes of the Fed when it comes to having no choice but to rethink their tightening plans. This would put GBP on much bearish footing against currencies with relatively hawkish central banks like EUR and NZD.

Alternative Scenario: BOE Governor Bailey and other hawkish members might reiterate the need to act fast when it comes to fighting inflationary pressures, dashing hopes of pausing or cutting anytime soon.

Don’t forget that updated growth and inflation forecasts are up for release, so any significant upgrades to these figures would increase the odds of more tightening moves from the U.K. central bank.

In this scenario, the pound could stand to resume its rally against currencies with dovish central banks like the Japanese yen.