You know what’s better for volatility players than an interest rate decision?

A policy announcement where markets aren’t 100% sure about the outcome!

What exactly are the markets expecting from the BOC and potential price scenarios the event? Read up on the points you need to know!

Event in Focus:

Bank of Canada (BOC) Monetary Policy Statement

When Will it Be Released:

July 12, 2023 (Wednesday): 2:00 pm GMT

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- BOC to raise its interest rates by 25 basis points to 5.00%

- Policymakers to reiterate that they’re still willing to hike if data calls for it

- BOC will also publish its quarterly Monetary Policy Report with the latest growth, inflation, and risk projections

Relevant Australian Data Since the Last BOC Statement:

? Arguments for Hawkish Monetary Policy / Bullish CAD

Retail Sales for April 2023: +1.1% m/m (+0.2% m/m forecast; -1.5% m/m previous); core retail sales was +1.3% m/m (+0.2% m/m forecast; -0.4% m/m previous)

New Housing Price Index for May: +0.1% m/m (-0.2% m/m forecast; -0.1% m/m previous)

Canada added a net 60K jobs in June (5K forecast; -17.3K previous); the unemployment rate ticked higher from 5.2% to 5.4% as more people looked for work

Ivey PMI for June: 50.2 vs. 53.5; Employment Index: 57.6 vs. 56.2 previous; Prices Index: 60.6 vs. 60.3

? Arguments for Dovish Monetary Policy / Bearish CAD

Industrial PPI for May: -1.0% m/m vs. -0.6% m/m in April; Raw Materials Price Index fell -4.9% m/m vs. +1.8% m/m in April

CPI for May: 3.4% y/y (3.6% y/y forecast; 4.4% y/y previous); on a monthly basis: 0.4% m/m (0.5% m/m forecast; 0.7% m/m previous)

In a quarterly outlook survey, the BOC said that both consumers and businesses foresee improvements in inflation conditions and demand for goods and services

S&P Manufacturing PMI for June: 48.8 vs. 49.0 in May; market demand subdued due to clients postponing spending decisions (likely due to high-interest rates and macroeconomic uncertainty); modest rise in input costs; “firms on average chose to cut their employment levels”

Previous Releases and Risk Environment Influence on CAD

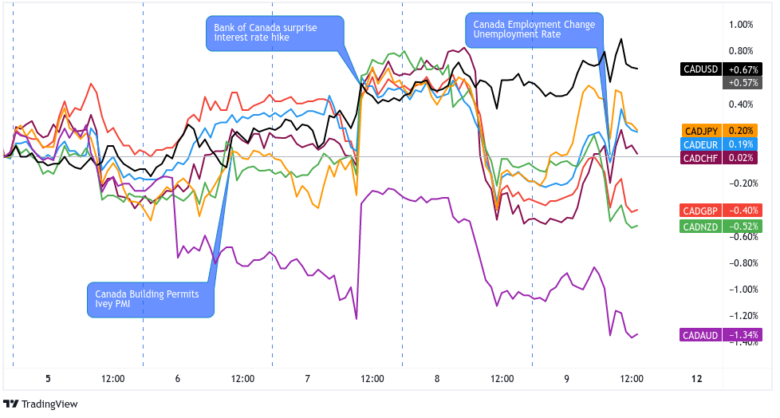

June 7, 2023

Action / results: After keeping its interest rates steady in the March and April meetings, the BOC surprised markets with its first rate hike since January. The central bank raised its main interest rates by 25 basis points to 4.75% instead of pausing at 4.50% as markets had expected.

In its statement, BOC members noted their concerns that high inflation “could get stuck materially above the 2% target” as well as their belief that their previous policies weren’t “sufficiently restrictive” just yet.

The surprise (and hawkish!) rate hike, which came a day after the RBA executed its own rate hike, boosted the Canadian dollar sharply during the U.S. session and ended the day not far from its intraday highs.

Risk environment and Intermarket behaviors: The release of weaker-than-expected ISM services PMI in the U.S. and disappointing trade data from China made it tricky to sustain risk rallies throughout the week.

“Risky” bets like crude oil, AUD, and CAD popped higher on specific headlines like stronger oil demand data and the RBA and BOC’s hawkish rate hikes. Even then, the assets soon lost ground and fell in line with the overall risk-averse trading environment.

April 12, 2023

Action / results: The BOC kept its main interest rate unchanged at 4.50% in April, with policymakers projecting inflation to decelerate sharply to around 3% by mid-year, down from an earlier 5.2% forecast in February.

However, Governor Macklem still maintained that they’re unlikely to cut interest rates in the near future.

Even so, the Loonie had a bearish reaction to the report, as traders likely adjusted positions to account for a much longer tightening pause. CAD dropped at the report’s release and saw minimal pullback before it ended the day lower than its major counterparts.

Risk environment and Intermarket behaviors: Risk assets actually started the week on strong footing, as market players seemed to be pricing in lower odds of interest rate hikes from the major central banks.

Crude oil even got a midweek boost when private inventory data revealed a surprise draw in stockpiles. However, the correlated Loonie failed to benefit from the rally since the BOC sounded cautious.

Soon after, risk-off flows returned and dragged the commodity currency further south, as downbeat U.S. retail sales data kept global recession fears in play.

Price action probabilities

Risk sentiment probabilities: Much like in the June release, market players are starting the week in a cautiously optimistic mood as they price in the nearing end of the Fed’s tightening cycle as well as their optimism for the upcoming earnings reports.

At the same time, data prints like Friday’s U.S. NFP report and today’s Chinese inflation numbers are reminding traders of the high-interest rate environment and the possibility of slower growth.

Canadian Dollar scenarios

Base case: Traders believe that the BOC won’t stop at one rate hike after pausing for two consecutive meetings.

For one thing, June’s jobs data and Ivey PMI reports point to the labor market tightening sharper than the inflation dip that we saw in May. Meanwhile, BOC’s latest business survey mentioned that businesses and consumers are expecting improved inflation conditions for goods and services.

If the BOC implements a “hawkish hike” while traders are pricing in their optimism near the end of the Fed’s rate hike cycle, then CAD may see gains against counterparts that don’t have hawkish central banks. CAD could gain against USD, JPY, AUD, and NZD.

Alternative Scenario 1: If the BOC raises its interest rates but hints at another pause, then CAD may give up some of its gains in the U.S. or Asian trading sessions.

CAD could lose some pips to currencies with more hawkish central banks like EUR and GBP but maintain its gains against counterparts like USD, JPY, and AUD.

Alternative Scenario 2: The BOC could pull off another surprise, this time with a rate hike pause.

Because some traders have already priced in a rate hike, a surprise rate hike pause may drag CAD against safe havens like USD, JPY, and CHF and even currencies with not-so-hawkish central banks like AUD and NZD.