Seeking another opportunity to trade the Aussie week? Well, you’re in luck because the action may get hot with the latest jobs data release from Australia coming right around the corner.

Before you set up, check out the latest expectations on Australia’s job update and potential AUD reactions from traders!

Event in Focus:

Australia’s September Employment Data: Employment Change, Unemployment Rate

When Will it Be Released:

October 19, 2023 (Thursday) 1:30 am GMT

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

15K net jobs added for the month of September vs. 64.9K jobs added in August

Unemployment rate to hold at 3.7%

Forecasts as of Oct. 17, 6:00 pm GMT

Relevant Data Since Last Event/Data Release:

Australia’s job advertisements dipped by 0.1% (vs. 1.7% previous) in September; In the three months to September, “ads had been concentrated in education and healthcare, which helped offset weakness in tech and food preparation.”

NAB business confidence index remained at 1 in September, inline with August and July reads

Westpac Consumer Confidence Index for September: 82.0 (79.1 forecast; 79.7 previous)

Judo Bank flash Australian PMIs showed manufacturing PMI down from 49.6 to a three-month low of 48.2; services PMI picked up from 47.8 to a four-month high of 50.5; “employment levels across both manufacturing and services continued to rise at the end of the third quarter as firms hired to cope with ongoing operations”

Previous Releases and Risk Environment Influence on the Australian Dollar

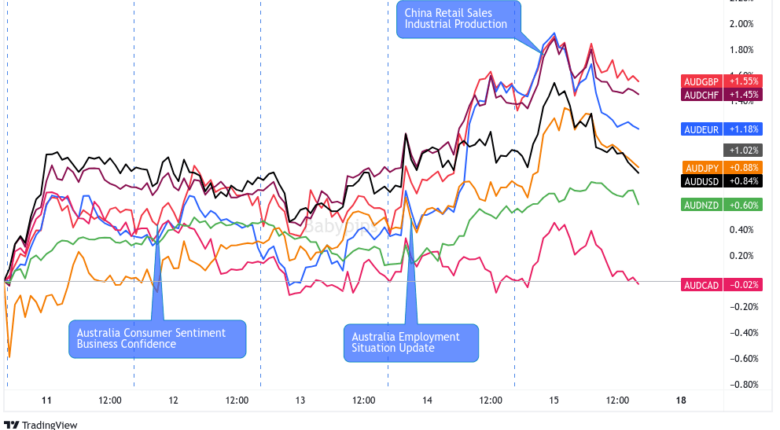

September 13, 2023

Event Results / Price Action:

Australia’s unemployment rate remained at 3.7% in August but the participation rate edged up from 66.9% to 67.0%; Employment gains higher at 64.9K (vs. 25.4K expected, -1.4K previous) but part-time gains (+62.1K) outpaced full-time job increases (+2.8K).

This was taken as a relatively weak update as the Aussie dipped on the news after a pre-event pop, likely on the idea the bulk of the net job gains was part-time positions.

That dip was short-lived though as the Aussie was mainly driven by broad risk sentiment, which was leaning positive due to bullish broad market narratives from both China and the U.S.

Risk Environment and Intermarket behaviors:

As mentioned above, risk sentiment was generally net positive during this trading week, supported by net positive economic updates from the U.S. and news of potential efforts from China to stimulate their economy, including another reserve requirement cut for cash lenders.

August 17, 2023

Event Results / Price Action:

The Australian economy lost 14.6K jobs in July, contrary to the expected 14.6K increase in hiring. This brought the jobless rate up from 3.5% to 3.6% during the month, surpassing the consensus at 3.6%.

Not surprisingly, AUD continued its ongoing selloff for the week when the dismal jobs numbers were printed. Earlier in the week, the RBA’s meeting minutes showed that members already believe that they can achieve their inflation target “with the cash rate staying at its present level.”

Risk Environment and Intermarket behaviors:

Risk sentiment also wasn’t doing the Aussie any favors throughout the week, beginning with weekend news that a large property company in China might be due to default on its debt obligations.

Although the PBOC surprised the markets with an aggressive stimulus announcement, the positive vibes were mostly overshadowed by significantly downbeat retail trade and industrial production data from the country.

Then there was the FOMC meeting minutes which fueled expectations for stronger inflation and therefore more interest rate hikes, keeping investors on edge about recession risks.

Price action probabilities:

Risk sentiment probabilities:

Broad risk sentiment has been improving so far this week, recovering from extremely negative vibes due to the Israel-Hamas conflict sparking geopolitical market fears last week.

The situation is very fluid and still has the potential to ignite market volatility once again, but for now, it looks like traders are focusing on a busy economic calendar.

In particular, the monthly round of economic updates from China tends to influence economic sentiment (and Aussie price sentiment), so keep an eye on the data there and the market reaction for a clue on what traders may be feeling around the Australia jobs release.

If China’s data falls inline with the recent trend of improving numbers and economic resiliency in some parts of the globe, then risk-on vibes may continue to grow, barring exogenous negative catalysts like flare ups in the fresh Israel-Hamas conflict.

Inflation updates are also very important to watch to gauge risk sentiment as sticky updates will likely drive bond yields higher, which tends to put negative pressure on broad risk sentiment.

Australia Dollar scenarios:

Potential Base Scenario:

Based on the latest jobs releases, the Aussie job event will likely spark a notable rise in volatility and directional move, but it is likely traders will quickly return focus to broad market drivers after the initial reaction.

So, if Australia signals the jobs situation at or below expectations in September, and if the Aussie is still grinding higher after finding an intraweek bottom on Tuesday, it’s possible this data outcome may draw in short-term profit takers and fresh shorts.

This reaction would likely hold through the London session, where broad market drivers will come back into focus as an Aussie driver, and if China’s data dump was better-than-expected and prompted further broad risk-on sentiment, the bulls may buy Aussie on the dip, barring an Aussie jobs number that is way below expectations/previous reads.

Potential Alternative Scenario:

The Australian employment change numbers has a long history of surprising the markets, so don’t be surprised if the net jobs change data comes out way worse or better than expectations.

With this dynamic in play, a good practice would be to consider waiting to see the actual number and market reaction before developing a directional bias and risk management plan, which would probably up the odds of success as you’ll likely have time to assess the broad sentiment environment as well.