As an investor, you need sometimes to look beyond a wall of worry.

There is, for example, every excuse to be pessimistic about continental Europe at present.

The German finance minister Christian Lindner says his country is merely ‘a tired man after a short night in need of a good cup of coffee’.

But the sundry woes of the eurozone’s largest economy require more than caffeine.

The impact of higher energy and interest costs is being felt throughout the bloc, while farmers’ protests in France and Holland reflect wider grievances about bureaucracy and policy.

But this unappealing background should not stop you from considering the individual merits of Europe’s mega-businesses – whose balance sheet strength lies behind the forecast from Goldman Sachs that the pan-European Stoxx 600 index will rise by 6 per cent this year.

Europe’s big names include ASML, the Dutch group which is the world’s leading supplier of semiconductor equipment, luxury goods leviathan LVMH and Novo Nordisk, maker of the weight-loss drugs Ozempic and Wegovy.

Such is the call for these injectables that the $398billion Danish company was forecast this week to be worth $1trillion by 2030.

Oliver Collin, co-head of European equities at Invesco, argues that these businesses and Europe’s other key players are ‘global entities’, whose fortunes are not dependent on the countries in which they are domiciled.

Companies that are listed in the eurozone derive less than a third of their revenues from this area.

Collin adds: ‘These companies are universally unloved – and thus could be seen as ‘compellingly-priced’, or even ‘hugely cheap’.

bIG NAMES: Europe’s big names include ASML, the Dutch group which is the world’s leading supplier of semiconductor equipment and luxury goods leviathan LVMH

‘The opportunity set extends across a broad range of sectors – from Italian bank Unicredit with its dividends and share buybacks, to the French pharmaceutical giant Sanofi whose drug development is on an upward trajectory.’

The oil major Total, one of the stakes in the Invesco European Equity fund portfolio, is trading on seven times future earnings against 11 times for its US counterpart Chevron.

Zehrid Osmani, manager of the Martin Currie Global Portfolio trust, which holds shares such as ASML and L’Oreal, acknowledges the issues facing Europe. Its cyclical economy will be affected by the slowdown in China, although lessening the eurozone’s dependence on this nation is one of the priorities of Ursula von der Leyen, European Commission president.

But Osmani believes that, despite these headwinds, ‘Europe could be a good place to be’.

Over the past year, the prices of US tech stocks have soared thanks to generative Artificial Intelligence excitement.

But Osmani says that ASML’s technology is crucial to the delivery of the huge increase in computing power and data storage required for the AI revolution.

Marcel Stotzel, manager of Fidelity European Fund and Fidelity European Trust, says that two software companies, the French Dassault Systemes and the German SAP are among the other ‘strong long-term winners’ from AI innovation.

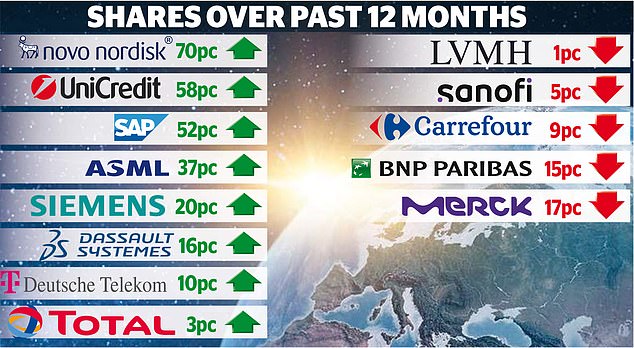

The Fidelity European trust owns ASML, Novo Nordisk and SAP. Their share prices have all risen strongly over the past year, with further increases expected by analysts.

Yet the trust’s own share price is at an 8.78 per cent discount to its net asset value (NAV), reflecting the level of disaffection surrounding European stocks whose attractions have been eclipsed by the love affair with everything American.

There are even wider discounts – 10.78 per cent and 10.73 per cent, respectively – at the European Opportunities and Henderson European Focus trusts, although both have substantial stakes in Novo Nordisk.

These discounts reflect British disaffection with Europe, regardless of the prospects of its companies.

Many investors withdrew cash from European funds and trusts in 2023. If they are minded to return, the trusts that are standing at a discount would seem to offer a bargain route not only to the eurozone, but also to the UK.

Our stock markets are also seen as unfairly overshadowed by US tech’s dazzling glamour.

About 30 per cent of the European Opportunities portfolio is invested in the UK. Scanning factsheets (available online) I discovered that I have some exposure to Europe through such funds and trusts as Brunner and 3i Group, whose largest asset is a majority holding in Action, Europe’s leading convenience store chain.

I did hope for short-term weakness in the prices of ASML, Novo Nordisk and SAP but this did not materialise. The sound you hear is me gritting my teeth and preparing to buy.