The ECB will be making its monetary policy decision this week ahead of the release of January flash PMIs while Switzerland’s schedule looks clear.

Here are the potential catalysts for the euro and franc:

ZEW economic sentiment figures (Jan. 19, 11:00 am GMT)

- German ZEW economic sentiment index to tick higher from 55.0 to 55.1 in January

- Euro zone ZEW figure to dip from 54.4 to 54.1 in the same month

- Readings above 0.0 reflect optimism, below 0.0 indicates pessimism

ECB monetary policy decision (Jan. 21, 1:45 pm GMT)

- Press conference to follow at 2:30 pm GMT

- No expected changes to interest rates or bond purchases

- ECB already increased its pandemic stimulus fund by 600 billion EUR in earlier policy announcement

- Markets expecting remarks on euro’s appreciation and bond volatility from ECB head Lagarde

Euro zone flash PMIs (Jan. 22, starting 9:15 am GMT)

- French flash services PMI to hold steady at 49.1 this month

- French flash manufacturing PMI to dip from 51.1 to 50.3

- German flash manufacturing PMI to fall from 58.3 to 57.3 in January

- German flash services PMI to slip from 47.0 to 45.1

- Euro zone flash manufacturing PMI to drop from 55.2 to 54.6

- Euro zone flash services PMI to decline from 46.4 to 45.0

Overall market sentiment

- These lower-yielding European currencies tend to benefit from risk-off flows

- The focus could shift to political uncertainty this week ahead of U.S. President-elect Biden’s inauguration

- Volatile bond yields in the region might also have an impact on euro direction, as rising COVID-19 cases and the prospect of more stimulus spur inflation concerns

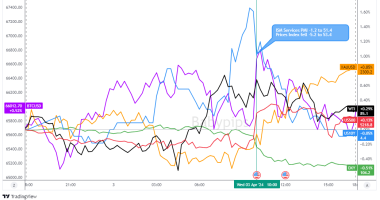

Technical Snapshot

- Long-term moving averages place EUR/NZD, EUR/GBP, EUR/CAD and EUR/AUD in bearish territory

- The rest are in the bullish region, with EUR/CHF seeing a weakening trend

- Meanwhile, Stochastic shows that the euro pairs are all poised for more gains!

- The euro has been most volatile against the Kiwi in the past seven days, moving close to a hundred pips per day

- As for franc pairs, Stochastic paints a mixed picture, with majority in bearish territory and only NZD/CHF on neutral grounds

Missed last week’s price action? Check out the EUR & CHF Price Review for Jan. 11 – 15!

This post first appeared on babypips.com