This week could be an exciting one for euro pairs since the ECB will be announcing its policy decision. Here’s what market watchers are expecting.

ECB Policy Statement (Dec. 10, 1:45 pm GMT)

- Press conference to follow at 2:30 pm GMT

- No changes to 0.00% benchmark interest rate expected

- Expansion of Pandemic Emergency Purchase Program eyed at around 400-600B EUR

- Extension of PEPP also expected until end of next year or even early 2022

- ECB might also offer longer-term loans at much lower interest rates

- Additional stimulus could be bullish for the shared currency since the economy needs this boost and it has been priced in for some time already

- German industrial production (Dec. 7, 8:00 am GMT) up by 1.8% in October

- Eurozone Sentix investor confidence index (Dec. 7, 10:30 am GMT) to drop from -10.0 to -11.8 in December

- ZEW economic sentiment indices (Dec. 8, 11:00 am GMT) to improve from 39.0 to 45.2 for Germany, from 32.8 to 37.5 for eurozone

Low-tier Swiss reports

- SNB foreign currency reserves (Dec. 7, 9:00 am GMT) to hint if central bank has been intervening in the FX market

- Unemployment rate (Dec. 8, 7:45 am GMT) to rise from 3.3% to 3.4%

Overall market sentiment

- These lower-yielding European currencies tend to benefit from risk-off flows

- Increased focus on vaccine developments and distribution could keep risk appetite in play, which would likely be bearish for the euro and franc

Technical Snapshot

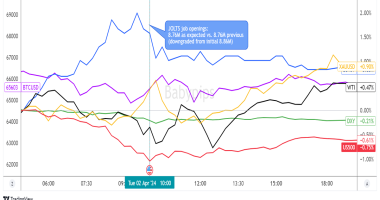

- Long-term trend strength analysis suggests that most euro pairs are looking bullish.

- Moving averages place only EUR/AUD and EUR/NZD in the bearish territory while the rest could see more gains

- However, RSI suggests that EUR/USD is giving off bearish vibes in the overbought region

- Meanwhile, Stochastic shows that CHF/JPY is overbought while USD/CHF is oversold

Missed last week’s price action? Read EUR & CHF’s price recap for Nov. 30 – Dec. 4!