Deliveroo’s underlying earnings reached breakeven levels across all operations in the second half of last year, helping the firm to lift full-year guidance.

The food delivery giant’s adjusted earnings margin is now anticipated to be around -1 per cent of gross transaction value for 2022, because of better cost management and enhanced gross profit margins.

This is the second time in recent months that the London-based firm had upgraded its full-year profit forecasts, having previously increased its outlook to between -1.2 and -1.5 per cent in October.

Expectations: The food delivery giant said its adjusted earnings margin is now anticipated to be around minus 1 per cent of gross transaction value for 2022

Despite a more challenging economic backdrop and the relative absence of Covid-19 restrictions, orders on the company’s website continued to expand, increasing by 5 per cent to just under 300million.

They declined by 2 per cent year-on-year in the final three months of the period, but higher prices and consumer fees boosted gross transaction value (GTV) – the total value of orders processed on its platform – by £145million to about £1.8billion.

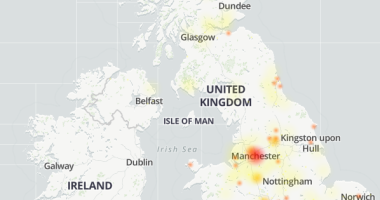

Growth was stronger in the UK and Ireland, while the international segment was affected by the decision to exit Australia and the Netherlands due to the cost of future investment and the related impact on profitability.

Since being founded a decade ago, Deliveroo has failed to turn a profit despite the pandemic leading to a surge in orders on takeaway apps as hospitality venues across the world were forced to temporarily close.

Will Shu, founder and chief executive of Deliveroo, told investors: ‘As always, we continue to be focused on strengthening our offer for each side of our marketplace through a hyperlocal lens.

‘Amidst an uncertain outlook for 2023, we remain confident in our ability to adapt financially and to make continued progress on our path to profitability.’

The London-listed business has spent considerable sums on marketing, technology and hiring new employees in order to compete with rival delivery groups like Just Eat and Uber Eats.

While it has brought costs down and expects earnings to further improve, elevated economic uncertainty and pressure on consumer incomes threaten its expansion.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, remarked: ‘Deliveroo is bullish in its ability to stay flexible financially.’

However, she cautioned: ‘At some point, customers will find it hard to stomach further prices rises, particularly given their budgets are facing a big squeeze elsewhere.’

Deliveroo shares were up 0.3 per cent to 92.3p during late Thursday morning, yet their value remains more than three-quarters below its initial public offering price.

The company’s latest trading update comes a day after Just Eat also declared that its second-half profits had progressed thanks to rising prices and delivery fees, as well as lower business expenses, even though total orders fell.

The Amsterdam-based operator reported forecast-beating adjusted earnings of €16million in 2022, having recorded a €350million loss the previous year.