Reversal alert!

I just spotted this head and shoulders breakdown on EUR/NZD, and the upcoming catalysts might draw more bears in.

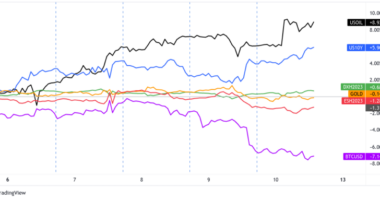

Before we look at the setup, let’s review price action and the latest happenings during the previous trading sessions.

Upcoming Potential Catalysts on the Economic Calendar:

- Italian trade balance at 9:00 am GMT

- Euro zone flash employment change q/q at 9:00 am GMT

- Euro zone flash GDP q/q at 9:00 am GMT

- Euro zone and German ZEW economic sentiment index at 9:00 am GMT

What to Watch: EUR/NZD

This pair just broke below the neckline of its head and shoulders pattern, indicating that a selloff is in the works.

Will more sellers hop in on a pullback?

There could be room for a quick bounce as Stochastic is indicating oversold conditions and the 100 SMA is still above the 200 SMA. If so, better keep close tabs on the broken neckline around the 1.6750 minor psychological mark since this could hold as resistance!

The shared currency could enjoy some volatility in the upcoming London session since the region will be printing its ZEW economic sentiment index, flash employment and GDP figures.

Note that the Kiwi is enjoying some upside, thanks to risk-on flows and a strong rebound in visitor arrivals reported by New Zealand.

Weaker than expected euro zone figures could lead to more declines for EUR/NZD, possibly dragging it south by at least a hundred more pips, which is the same height as the reversal formation.

Note that this pair moves an average of 120 pips on Tuesdays, which covers the potential downside if the drop carries on.