We don’t have a ton of top-tier reports coming our way but that doesn’t mean we won’t see volatility among the major dollar pairs!

Today I’m checking out EUR/USD’s short-term uptrend.

Before moving on, ICYMI, yesterday’s watchlist looked for a potential reversal on AUD/USD’s 1-hour time frame. Be sure to check out if it’s still a valid trade!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

Lagarde: no signals that inflation will rise high enough to “require measurable tightening”

Lagarde: “A rate hike will not occur before our net asset purchases finish”

Japan real wages down by 2.2% in Dec, the biggest drop since May 2020

Japan’s household spending fell by 0.2% (vs. -0.3% expected) in Dec, the fifth straight month of decrease

BRC: U.K. retail sales up by 8.1% from a year ago in Jan (vs. 0.7% expected, 0.6% in Dec) due to easing lockdown restrictions

AU NAB business confidence survey showed business conditions falling by 5 points but confidence rebounding by 15 points in Jan

U.S. and Japan agree to cut steel tariffs. The U.S. will stop charging a 25% levy on Japanese steel imports, excluding aluminum, up to a 1.25m metric ton annual threshold

European equity markets trading higher ahead of US inflation data

U.S. trade balance at 1:30 pm GMT

Canada’s trade balance at 1:30 pm GMT

AU Westpac consumer sentiment at 11:30 pm GMT

NZ quarterly inflation expectations at 2:00 am GMT (Feb 9)

Japan’s preliminary machine tools orders at 6:00 am GMT (Feb 9)

Germany’s trade balance at 7:00 am GMT (Feb 9)

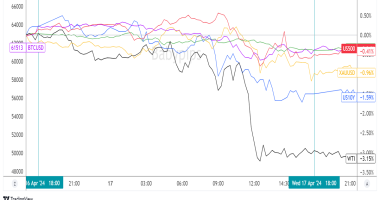

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! ? ?️

What to Watch: EUR/USD

U.S. session traders won’t be seeing top-tier reports today but that doesn’t mean the major dollar pairs won’t see decent volatility!

EUR/USD is hanging out at the 1.1400 major psychological handle, which is near the 100 SMA on the 1-hour chart; the 38.2% Fibonacci retracement of February’s upswing, and a trend line support that’s been around since late January.

A lack of catalysts just might extend EUR/USD’s short-term uptrend. European equities have opened a bit higher today thanks in part to positive earnings reports.

But will the good times last for euro bulls? Uncle Sam will be releasing January’s inflation tomorrow and, if we see faster-than-expected consumer price growth, then the Fed could step up its tapering/tightening timeline and push the dollar higher across the board.

EUR/USD could solidify its bounce from the 1.1500 zone and head towards the major area of interest near 1.1300.

If U.S. and Asian traders catch the risk-taking bug, however, then EUR/USD may find support from the trend line and 100 SMA and knock on the 1.1500 for another time in the next trading sessions.

Stochastic is currently favoring the euro with an oversold signal but keep your eyes peeled in case we start to see bullish candlesticks and then momentum above the 1.1400 psychological level.