It was another mixed day in the financial markets, as pre-NFP jitters had traders reacting quickly to leading U.S. jobs indicators.

Meanwhile, a surprise build in crude oil inventories didn’t seem enough to stop the commodity’s rally, along with gold which carried on with its ascent to the $2,300 mark.

Headlines:

- Earthquake of 7.5 magnitude near Taiwan reported, tsunami warnings issued in Japan

- Euro Area Flash CPI for March: 2.4% y/y (2.6% y/y forecast/previous); Core CPI at 2.9% y/y (2.8% y/y forecast; 3.1% y/y previous)

- Euro Area Unemployment Rate for February remained at 6.5% vs. 6.4% forecast

- ADP National Employment Report showed 184K net job adds in March vs. upwardly revised 155K jobs in February

- ISM Services PMI for March: 51.4 (52.4 forecast; 52.6 previous); Prices Index was -5.2 to 53.4; Employment Index was +0.5 to 48.5

- EIA Crude Oil Stocks rose 3.21M w/w vs. 3.17M w/w previous

- New Zealand building consents for February: +14.9% m/m vs. -8.6% previous

- New Zealand ANZ commodity prices for March: -1.3% m/m vs. +3.6% previous

- Australia building approvals for February: -1.9% m/m (+3.0% forecast, -2.5% previous)

Broad Market Price Action:

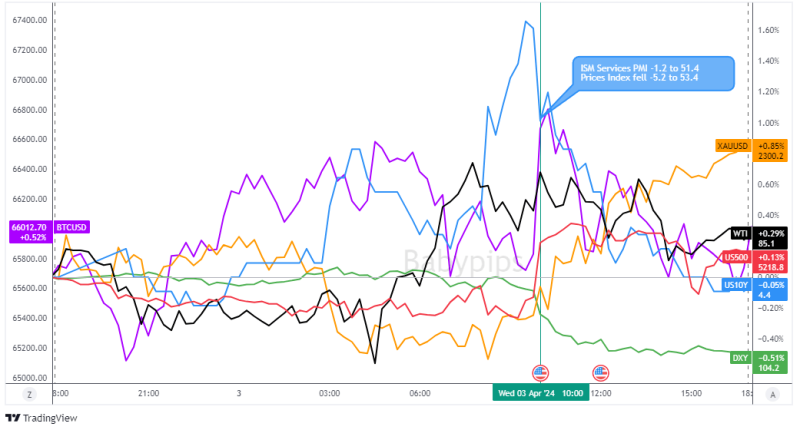

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

A few risk-off flows came in play early Wednesday on reports of a major earthquake hitting Taiwan and spurring tsunami warnings in Japan. Treasury yields carried on with their ascent before the tables turned during the release of the ISM services PMI.

Although the ADP employment report turned out stronger than expected, dollar traders paid closer attention to the jobs sub-index of the PMI survey, which reflected the third consecutive month of contraction in the labor market.

This likely spurred expectations for a potential NFP miss, leading U.S. yields and the dollar index to retreat. On the flip side, gold pulled higher and made its way to the $2,300 mark while crude oil shrugged off the surprise build in EIA stockpiles.

FX Market Behavior: U.S. Dollar vs. Majors

Overlay of USD vs. Major Currencies Chart by TradingView

Most majors were moving sideways in the earlier trading sessions, as traders were likely playing it safe ahead of another batch of leading U.S. jobs indicators.

The dollar started turning slightly lower as the European session rolled along, although the upbeat ADP jobs report managed to spur a bit of a bounce at the start of the U.S. session.

However, the disappointing ISM services PMI figure pulled the rug from under the dollar’s feet and spurred a steep tumble against its forex peers, except against the Japanese yen.

Not only did the the headline figure fall short of estimates and indicate a slower pace of growth instead of the expected acceleration, but the jobs component also reflected yet another month in contraction.

Powell’s speech later in the day did little to stem the dollar’s decline, as he simply repeated earlier remarks on needing more evidence to gauge if inflation is indeed returning to target.

Upcoming Potential Catalysts on the Economic Calendar:

- Swiss CPI at 6:30 am GMT

- ECB monetary policy meeting accounts at 11:30 am GMT

- U.S. Challenger job cuts at 11:30 am GMT

- U.S. initial jobless claims at 12:30 am GMT

- FOMC member Barkin’s speech at 4:15 pm GMT

- FOMC member Mester’s speech at 6:00 pm GMT

- Japanese household spending at 11:30 pm GMT

Unlike previous Swiss CPI releases, the upcoming one might be worth paying extra close attention to, especially since the SNB just recently surprised with an interest rate cut. Also, the ECB meeting minutes are up for release and might highlight June rate cut bets.

During the New York session, the spotlight will likely be on the Challenger job cuts report, which might provide a few more insights into the upcoming NFP release. The initial jobless claims also tends to spur intraday volatility among USD pairs, so keep an eye out for that as well.

Looking for your own spot to record your market observations & trading statistics? If so, then check out TRADEZELLA! It’s an easy-to-use journaling tool that can lead to valuable performance & strategy insights! You can easily add your thoughts, charts & track your psychology with each and every trade. Click here to see if it’s right for you!

Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe to a service using our affiliate links, this helps us to maintain and improve our content, a lot of which is free and accessible to everyone–including the School of Pipsology! We appreciate your support and hope that you find our content and services helpful. Thank you!