EUR/GBP has been on the move, and with potential catalysts ahead from both the U.K. and Germany, there may be a little more action left in the pair before we get to the weekend.

Before moving on, ICYMI, today’s Daily U.S. Session Watchlist looked at USD/JPY ahead of lots of Fed speak today, so be sure to check that out to see if there is still a potential play!

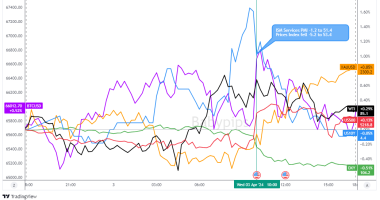

Intermarket Update:

| Equity Markets | Bond Yields | Commodities & Crypto |

|

DAX: 14610.39 -0.35% FTSE: 6712.89 0.20% S&P 500: 3889.14 -0.55% NASDAQ: 12961.89 -2.01% |

US 10-YR: 1.607 % -0.031 Bund 10-YR: -0.362% -0.006 UK 10-YR: 0.75% -0.008 JPN 10-YR: 0.067% -0.01 |

Oil: 60.74 +5.16% Gold: 1,733.10 +0.46% Bitcoin: 54,146.75 -1.025% Ethereum: 1,612.70 -3.66% |

Fresh Market Headlines & Economic Data:

Dow erases a 300-point loss and rises 200 points in volatile trading

Powell praises economic recovery and sees Fed pulling back help after ‘substantial’ progress

BIS’s Coeure says bitcoin failed test on being a currency

Oil prices drop 4% as new lockdowns undermine hopes for economic recovery

Massive ship blocking the Suez Canal brings billions of dollars in trade to a standstill

U.S. SEC rolled out law aimed at delisting Chinese tech stocks

Economy will bounce back as people spend again – BoE’s Haldane

Biden says he plans to run again, defends U.S.-Mexico border policy

Treasury yields spike after weak seven-year auction

Bitcoin Traders Brace for Record $6B in Options to Expire Friday

Upcoming Potential Catalysts on the Economic Calendar

Japan Tokyo CPI at 11:30 pm GMT

U.K. Retail Sales at 7:00 am GMT (Mar. 26)

Spain GDP at 8:00 am GMT (Mar. 26)

Germany Ifo Business Climate at 9:00 am GMT (Mar. 26)

Italy Business & Consumer confidence at 9:00 am GMT (Mar. 26)

Bank of England Saunders speech at 12:00 pm GMT (Mar. 26)

What to Watch: EUR/GBP

On the one hour chart above of EUR/GBP, we can see the pair has formed a range over the past few weeks, trading between 0.8550 and 0.8635. Over the past few session, 0.8550 was tough cookie to crack, likely drawing in sellers as pointed out by my main man Pipcrawler earlier in the week to play euro weakness.

EUR/GBP is now not too far away from retesting the bottom of the range, less than 20 pips away from retesting the 0.8550 minor psychological level. Will the buyers take back control from here?

Well, we’ve got mid-tier catalysts ahead that may keep the action going and determine the short-term direction, most notably U.K. retail sales data and German ifo sentiment data. They are not normally big market movers for their respective currencies, but they are not to be completely ignored either.

With the current momentum favoring the bears, we’d say the odds currently favor them in the short-term, especially with pandemic fears/lockdown protocols likely being the main driver for the euro at the moment. Unfortunately for the bears though, with the weekend ahead to possibly encourage profit taking and unless we get more fresh negative covid catalysts from Europe, further moves lower may be limited but still worth watching out for.

For EUR/GBP bulls, there’s a chance the support may hold, again on profit taking from that swift move lower from the range top, but also if we see better-than-expected German Ifo sentiment data and weakness in U.K. retail data. If this scenario plays out and bullish reversal patterns form around the 0.8550 handle, a short-term range play makes sense, but it definitely also makes sense to keep it short-term given the longer-term trend lower.