With no major catalysts expected from the forex calendar, we’re checking out the crypto markets as bitcoin could get moving in the Tuesday session. Will the first bitcoin futures ETF bring in the bulls or bears on ETH/BTC?

Before moving on, ICYMI, today’s Daily U.S. Session Watchlist looked at a trend continuation setup in GBP/JPY, so be sure to check that out to see if there is still a potential play!

Intermarket Update:

| Equity Markets | Bond Yields | Commodities & Crypto |

|

DAX: 15474.47 -0.72% FTSE: 7203.83 -0.42% S&P 500: 4486.46 +0.34% NASDAQ: 15021.81 +0.84% |

US 10-YR: 1.591% +0.015 Bund 10-YR: -0.149% +-0.001 UK 10-YR: 1.145% +0.008 JPN 10-YR: 0.089% +0.008 |

Oil: 82.35 +0.09% Gold: 1,764.50 -0.21% Bitcoin: $61,245.42 +1.12% Ether: $3,742.55 -0.64% Cardano: $2.14 +0.96% |

Upcoming Potential Catalysts on the Economic Calendar

Reserve Bank of Australia Meeting Minutes at 1:30 am GMT (Oct. 19)

Swiss Trade Balance at 6:00 am GMT (Oct. 19)

Reserve Bank of India Interest Rate decision at 7:30 am GMT (Oct. 19)

Spain Trade Balance at 8:00 am GMT (Oct. 19)

ECB Elderson speech at 11:10 am GMT (Oct. 19)

ECB Panetta speech at 12:00 pm GMT (Oct. 19)

BOE Governor Bailey speech at 12:05 pm GMT (Oct. 19)

If you’re not familiar with the forex market’s main trading sessions, check out our Forex Market Hours tool.

What to Watch: ETH/BTC

We’re not seeing top tier catalysts from the forex calendar in the upcoming Asia-London sessions, so we’re turning to the crypto space for potential short-term setups. And none are likely better at the moment that a potential pop in volatility for bitcoin.

Up ahead in the Tuesday session, expectations are that we will see the first bitcoin futures ETF trade in the U.S. This expectation is likely why we saw bitcoin dominate the rest of the crypto space over the past week, with potential for the king of crypto to keep the rally going as this event opens up whole new world of investors who have yet to invest in the digital space.

Of course, since it’s likely this event has already been priced into BTC, it’s also possible to keep in mind that a “sell-the-news” scenario may play out this week and bring at least short-term weakness to bitcoin. The odds of a bearish bitcoin scenario grows if there is an announcement that the ETF is delayed.

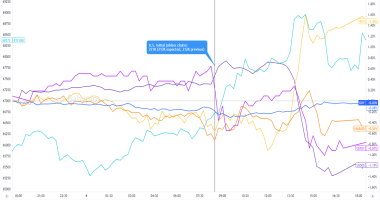

If that’s the case, then one market to watch is ETH/BTC, which as we can see in the one hour chart above, is back at a previous swing low area around the 0.0600 BTC handle. If you’re bearish on BTC, then trading in your bitcoin for ether is a move to consider. If bearish BTC sentiment takes hold this week, ETH/BTC could make its way up to the next potential resistance area between 0.06200 – 0.06300 (a reachable target given its daily average true range of around 0.002 BTC).

Now, if you’re bullish on BTC, then there’s two price scenarios to keep an eye on. First a break below the 0.0600 BTC level is one to watch for momentum to start gaining traction, or for a break-and-retest scenario to play out. Those two setups would likely draw in not only technical short traders seeing a descending triangle (bearish price pattern signal), but also fundamental traders if the market reaction is positive to the bitcoin futures ETF release.

The second setup to watch out for is a move to that falling trendline and bearish reversal patterns form around 0.06200 – 0.06400. If we don’t get negative headlines or reaction to the bitcoin futures ETF tomorrow, then that area could draw in both trend traders and fundamental traders for the short-term.