CAD/CHF seems to have gone into snooze mode at the moment, but we’ve got major data coming up from Canada that could spark a tradable breakout.

Before moving on, ICYMI, today’s Daily U.S. Session Watchlist looked at a potential short setup on USD/JPY ahead of the Fed meeting minutes, so be sure to check that out to see if there is still a potential play!

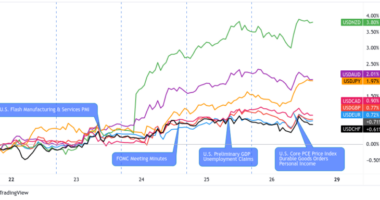

Intermarket Update:

| Equity Markets | Bond Yields | Commodities & Crypto |

|

DAX: 15202.68 +0.17% FTSE: 6942.22 +0.83% S&P 500: 4097.17 +0.42% NASDAQ: 13829.31 +1.03% |

US 10-YR: 1.623% -0.031 Bund 10-YR: -0.342% -0.009 UK 10-YR: 0.746% -0.004 JPN 10-YR: 0.093% -0.009 |

Oil: 59.75 -0.03% Gold: 1,756.80 +0.87% Bitcoin: 57,689.50 +2.81% Ethereum: 2,060.30 +4.03% |

Fresh Market Headlines & Economic Data:

S&P 500 notches another record high as major tech stocks gain

U.S. weekly jobless claims unexpectedly rise, but labor market improving

U.S. Mortgage rates drop to 3.13% in first slide since January

Fed’s Kashkari says he would not panic if he saw a 4% inflation rate

Fed’s Powelll says uneven vaccination rollout poses risk

U.K. Construction output expands at sharpest pace since September 2014

Roadmap for lifting lockdown leads to substantial increase in U.K. hiring activity in March

German factory orders up for 2nd straight month in February

Industrial producer prices up by 0.5% y/y in the euro area & by 0.7% y/y in the EU in February 2021

Eurozone Construction PMI: Renewed expansion in eurozone construction activity in March

Upcoming Potential Catalysts on the Economic Calendar

Australia Services Index at 10:30 pm GMT

Australia Building Permits, RBA Financial Stability Review at 1:30 am GMT (Apr. 9)

China Inflation Rate at 1:30 am GMT (Apr. 9)

Germany Trade Balance, Industrial Production at 6:00 am GMT (Apr. 9)

Spain Industrial Production at 7:00 am GMT (Apr. 9)

ECB Guindos speech at 7:30 am GMT (Apr. 9)

U.K. Halifax House Price Index at 7:30 am GMT (Apr. 9)

Italy Retail Sales at 8:00 am GMT (Apr. 9)

Canada Employment Change & Unemployment Rate at 12:30 pm GMT (Apr. 9)

What to Watch: CAD/CHF

On the one hour chart above of CAD/CHF, we can see price action has quieted down substantially after a two swift move lower. It’s likely that Loonie traders are likely holding off from making fresh moves ahead of the latest Canadian employment update tomorrow.

For those who don’t currently have a bias on CAD/CHF, a simple strategy to consider is a news straddle setup, basically buying/selling the break of the consolidation pattern and trying to catch the momentum. This is essentially a move to catch a short-term pop in volatility and directional momentum for quick pips.

For those looking to add a little bit of fundamental analysis to improve their odds, consider that expectations are for another month of improving jobs data from Canada.

If that’s the scenario that plays out and Loonie rallies, odds are pretty good short-term momentum could take the pair higher. We could see a move in the range of one half to a full daily ATR (around 60 pips), similar to what we saw with last month’s data when CAD/CHF went from 0.7411 to peak around 0.7458 before the session close.

Of course, we’ve gotta be open to the very small possibility that the Canadian update will disappoint, and if that scenario plays out, a break below the consolidation area could take the pair to the next major psychological level of 0.7300 before momentum potentially runs out of steam.