SHENZHEN, China — On the long list of disputes between the United States and China, electric vehicles enjoy an increasingly prominent role.

Growing stars of the auto world, EVs are also now the subject of intense commercial competition and national security concerns for the world’s two largest economies.

And this metropolis known as China’s Silicon Valley is at the heart of the country’s bid for dominance in the lucrative global market.

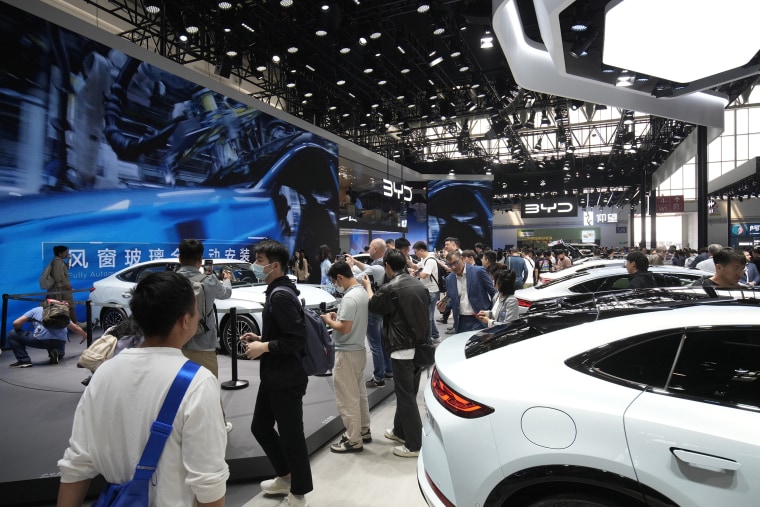

Chinese companies such as BYD, the biggest global rival to America’s Tesla, are forcing Western automakers to change their approach to electric vehicles if they want to remain competitive in a growing industry.

“They’re not ready,” said Stella Li, chief executive of BYD Americas. “For BYD, we are ready. We are ready for technology, and we are more ready on supply chain,” she told NBC News in an exclusive interview in April at BYD headquarters in the southern city of Shenzhen, where SUVs, sedans and other gleaming models are displayed in the cavernous lobby.

Despite lower price tags, Chinese EVs often have more powerful batteries and more advanced technology.

But they are not available in the U.S., where they face high trade barriers and allegations that Chinese government subsidies have given them an unfair advantage. The Alliance for American Manufacturing, an advocacy group, says the introduction of Chinese cars to the U.S. market would be an “extinction-level event” for the U.S. auto industry.

China says its edge in EVs comes from “constant innovations,” a well-established supply chain system and market competition. But U.S. officials and others have raised concerns that years of government support for the industry have created overcapacity, raising the risk that excess Chinese products could flood overseas markets and undercut domestic production.

‘A real threat to the U.S.’

BYD is a privately owned company that began as a battery manufacturer in 1995. The company, whose name stands for Build Your Dreams, controls most of its own low-cost EV supply chain, from basic components to the ships that transport its vehicles overseas.

In the last quarter of 2023, BYD surpassed Tesla as the world’s top EV maker by sales, though Tesla reclaimed the title in the first quarter of this year when BYD reported a 43% drop in sales compared with the previous quarter.

The rise of BYD and the Chinese EV industry in general has been aided by more than a decade of strong support from Beijing in the form of subsidies, tax breaks and consumer incentives — in line with what the ruling Communist Party has billed as a larger strategy to fulfill its global climate commitments but what industry experts widely view as a competitive means to build a Chinese auto industry.

The competition among hundreds of Chinese EV makers has spurred rapid innovation.

“What the Chinese have been able to do in the past 10 to 12 years in terms of quality of the vehicles is pretty amazing,” said Mark Fields, former chief executive of Ford. “The designs have improved a lot, the quality has improved a lot.”

This year, up to 45% of the cars on Chinese roads could be electric vehicles, compared with 25% in Europe and about 11% in the U.S., according to a report by the International Energy Agency.

All this could add up to trouble for U.S. automakers struggling to catch up.

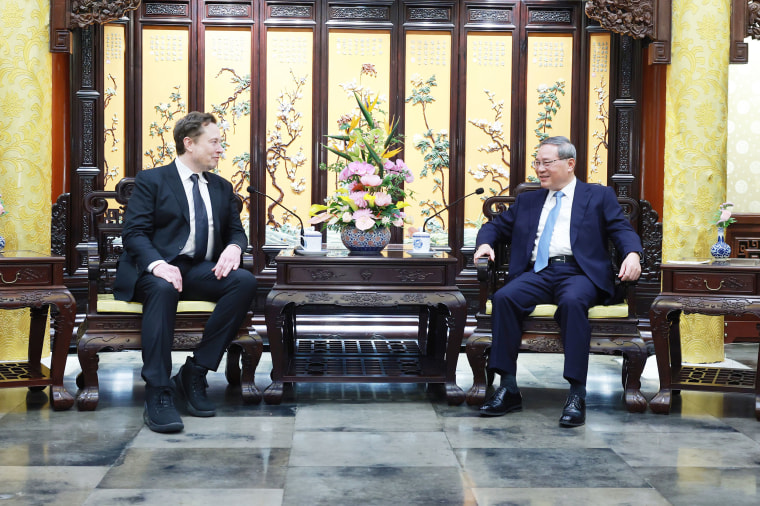

Even Tesla CEO Elon Musk, who made a surprise visit to Beijing last week, has said that without trade barriers Chinese EV makers would “demolish” their competitors.

Chinese EVs tend to be smaller, cheaper and more accessible to the masses — BYD’s Seagull, a small all-electric hatchback, starts at less than $10,000. In the U.S., by contrast, EV makers have emphasized larger, more luxurious models targeted at wealthier buyers, though Musk said in April that the company would begin production of new affordable EV models by early next year.

With sales slowing down at home, Fields said, Chinese automakers are looking for new markets for their lower-priced inventory, including eventually the U.S.

“It’s not unlike a playbook that they’ve used in other industries, whether it’s steel or aluminum or solar panels,” he said, “and that could be a real threat to the U.S. and the Western automakers.”

Western EV makers can’t avoid competing with Chinese companies in a global industry, but it will take time for them to catch up, particularly on price, Fields said.

“At the end of the day, the consumer votes with their pocketbook, and when it comes time for the the mainstream consumer to really get behind EVs, you know that’s going to dominate their thinking,” he said.

One thing buying U.S. automakers some time is a 27.5% import tax on any vehicles that are made in China and shipped to the United States. Lawmakers from both parties are calling for those tariffs to be increased. China, in turn, has filed a case with the World Trade Organization accusing the U.S. of discriminating against Chinese products in its own electric vehicle subsidies.

The European Commission is also considering whether to impose punitive tariffs on imports of Chinese EVs as part of an investigation into Chinese government subsidies that Beijing has criticized as protectionist and stacked against Chinese manufacturers. According to a report in April by Rhodium Group, European Union tariffs would need to be as high as 55% to curb imports of Chinese EVs.

With BYD seeking to set up a factory in Mexico, there are concerns that it and other Chinese automakers could try to evade the tariffs by exporting cars to the U.S. from there. (Li said the company’s Mexico operations are focused only on local sales and that BYD currently has no plans to enter the U.S. market.)

“I think it’s going to take not only just potentially higher tariffs but also trade restrictions,” Fields said.

In addition to tariffs and trade restrictions, Chinese EV makers would face a number of regulatory and compliance hurdles to selling cars in the U.S. It would take time to set up a sales and distribution network, Fields said, and Chinese EV makers could face a perception issue among American consumers.

The Biden administration is also investigating Chinese-made “smart cars,” whose features it says could be used to collect personal information about American drivers.

Li said there was no data to support such an investigation and that U.S. concerns about national security were “overblown.”

“If you have national security concerns, you should be more concerned about your cellphones,” most of which are also produced in China, she said.

She added that BYD has “world-class” standards for the protection of personal data.

China has had its own privacy concerns about Tesla, whose EVs are said to have been barred from some government-related properties in the country over concerns about what information they might be collecting. During Musk’s visit last week, the China Association of Automobile Manufacturers announced that certain models from Tesla, BYD and four other Chinese manufacturers had passed China’s data security requirements.

The move could clear the way for approval in China of Tesla’s highest level of self-driving software, whose safety and performance was criticized by U.S. regulators in a recent report.

Li said the atmosphere in the U.S. was similar to decades past, when American automakers felt threatened by imports from South Korea and Japan. The American brands survived, she said, and that “positive competition” ultimately benefited consumers.

The auto market has “never been taken by one company or never been taken by one country,” she said. “That’s never happened if you see all the history.”

Source: | This article originally belongs to Nbcnews.com