When Aled Jones was robbed of his watch near his home in South-West London earlier this month, the teenage thug who wielded a machete at the singer and TV presenter knew he would soon be in possession of a £17,000 Rolex.

Jones, 52, is just one of a string of recent high-profile ‘Rolex ripper gang’ victims along with boxer Amir Khan, Olympic cyclist Mark Cavendish and Hollywood director Paul Feig.

They have joined more than 11,000 watch theft victims in the past year, according to data from luxury watch specialist Watchfinder & Co. It’s a figure that’s nearly double the one for 2021.

More than 60 per cent of thefts are in London, with the average watch stolen in the capital valued at £9,000. And the chances of recovery are slim – only one in five are returned to the owner.

Former watch dealer and expert Paul Thorpe is not surprised. He says theft of expensive watches to sell on the black market is more lucrative than selling drugs. He adds: ‘Watch theft is an industry all in itself and has overtaken drugs as the crime of choice for some criminal gangs.’

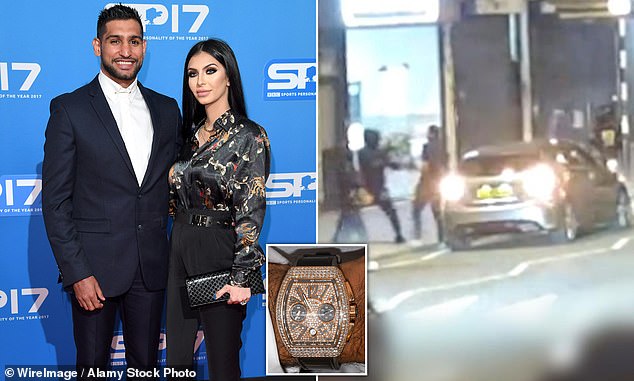

Target: Amir Khan, left with wife Faryal Makhdoom, and above as a raider grabs his diamond watch, right

Some savvy brands are adapting. Luxury Swiss watchmaker Audemars Piguet offers a watch face cover to prevent opportunist mugging. Owners can also register their watch on its website in case of theft. It offers free theft insurance for two years.

There are two reasons why this crime wave should prompt all of us to be more vigilant.

First, unlike cars, most luxury watches increase in value – so it is crucial that you check how much yours is worth each year as it may well be underinsured.

Ann Owen, managing director of Aviva Private Clients, says, ‘High net worth customers have always bought and insured expensive watches.

‘However, we are seeing an increase in the value of these watches. For example, watches that may have been owned for many years are being revalued and often double or more than double in value.’

Other customers, she says, have been actively investing in watches to build significant collections ‘which can, in some instances, be worth millions of pounds’.

Most high street jewellers will value a watch. You can then amend cover if needed.

Second, in response to an exponential rise in claims, insurers are reviewing what they will agree to cover. Watches are usually covered as part of home insurance but you need to declare items of jewellery worth more than £1,000 on most policies. And check that the cover extends to when you’re out of the house, such as on holiday.

You may need specialist watch cover if you already have other valuable items, as Angela Pilley, home insurance expert at product ratings firm Defaqto, warns.

She says: ‘Insurers will have an overall limit for all the valuable items you own.’

There are also specialist policies just to cover watches. Take a Rolex Submariner, worth £10,000, as an example – policy prices range from £245.36 to £327.50 a year. These policies are tailor-made for high-value watches, and include payouts for accidental loss and theft, with no excess.

In contrast, the average house-plus-contents policy – excluding very expensive items – is £300 a year, according to the Association of British Insurers.

‘We’ve been aware of this particular crime trend and last year it hit its zenith,’ says Andrew Cheney, chief risk and valuation adviser at high net worth insurer Hiscox. ‘It was a new modus operandi that was becoming rife across the country.

‘The problem is the good guys try to bolt everything down and make everything secure around the house. So criminals have to come up with a new take on carrying out their activities.’

It’s also important to check what your policy includes. For example, an Aviva high net worth policy covers watches for ‘all risks’, which includes loss or damage anywhere in the world.

By contrast, an Aviva standard home policy only covers watches and jewellery in the home for up to £10,000, and up to £2,000 for a single item. Items worth more than £2,000 need to be specified.

Owen adds: ‘As watch values can fluctuate, we encourage customers to take time to review their policy and consider regular valuations to ensure their cover is adequate.’

Insurance broker Miller says on its website: ‘The big-name high street insurers won’t touch a luxury watch and very few will offer cover for a watch valued at £2,000.’

Annabel Fell-Clark of the fine art and specialist division explains: ‘With an increase in watch theft, some of the mid-market insurers have withdrawn from the market – they are not prepared to cover high value watches while the person is wearing them.’

She adds: ‘What is sad is that many people who may own a valuable watch may now find it difficult to get cover for it.’

Cheney of Hiscox agrees: ‘Insurers recognise that the price of everything is going up and that we don’t want to penalise people for wider trends.

‘But it is fair to say some are looking at protecting themselves by adding stipulations around the ownership of certain expensive items.’

He adds: ‘The classic stipulation is that a watch is not insured for theft unless it’s being worn by you or is kept in a proper safe.

‘And I would recommend people double-check when they last gave a replacement value to their insurer. If they haven’t done so in the last three years, the likelihood is that they will be underinsured.’