Charles Stanley Direct is the latest provider to launch a savings platform, This is Money can reveal.

Its savings platform, Cash Savings, is powered by Bondsmith and savers can open an account with a minimum investment of £1.

Cash Savings will offer savers a range of savings accounts – easy access, fixed term, and notice accounts.

The savings platform launches with a fixed term rate of up to 5.95 per cent with Ahli United Bank and 4.5 per cent in an easy-access savings account through GB Bank.

You can have all your eggs in one basket with savings platforms as they allow you to hold several savings accounts in one place

A raft of providers have launched savings platforms over the past few months, including over-50s specialist Saga and Savings Champion.

Charles Stanley’s Rob Morgan says the launch of Cash Savings is a ‘symptom of the times’.

He says: ‘If you rewind 18 months – there wasn’t much difference between earning a competitive interest rate account and earning nothing as interest rates were so low.

‘But there has been a complete sea change and savers have an opportunity to make the most of their cash through some of the best interest rates in 15 years.

‘This opportunity is here to stay for at least the next year as rates plateau and we believe access to savings platforms will help savers to grasp it.’

Charles Stanley Direct’s Cash Savings is branded as a one-stop-shop to allow savers to access some of the most competitive savings rates on the market via a single online account.

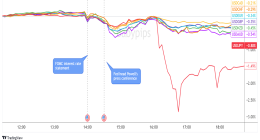

With the top savings rates changing rapidly as the bank of England’s base rate decision looms, getting the best deals involves time and legwork.

Savings platforms are gaining popularity because they are seen as taking the work out of staying on top of the best savings accounts. They are websites that allow you to hold several savings accounts in one place.

The benefit is that you can hold multiple savings accounts with a number of providers in one place, accessible throught one portal.

John Porteous, managing director of Charles Stanley Direct, says: ‘The period of ultra-low interest rates lasting for much of the past decade offered little opportunity for savers to improve their position.

‘But with the Bank of England base rate now above 5 per cent, managing savings effectively can make a significant difference.

‘Many large banks have typically been slow to pass on rate rises to savers and haven’t been doing so in full.

‘The best way for cash savers to capitalise on today’s higher rates is to use a savings platform to secure highly competitive interest and move easily between offers and account types from different banks as rates change and needs evolve.

There is no fee to use Cash Savings but Bondsmith keeps a 0.1 per cut of the rates on Cash Savings.

The minimum deposit amount of £1 is low compared to some other savings platforms which have launched recently.

Customers must have a minimum of £40,000 to be eligible to open an account with Saga’s savings platform and £50,000 to be able to open an account with Savings Champion’s platform.

Morgan says: ‘These platforms are designed for higher net worth savers. We wanted to give as many people as possible to option to save with us, which is why you only need £1 as a minumum.’

For those with larger amounts to put into savings accounts, a key advantage of using a savings platform is in spreading the FSCS protection that is given to each individual banking licence.

The Financial Services Compensation Scheme (FSCS) is the UK’s deposit guarantee scheme, which offers protection up to £85,000 per person or £170,000 in the case of joint accounts with each eligible bank or building society they sign up with.

By allowing savers access to more than one provider, savings platforms enable them to spread the FSCS protection across their multiple holdings.

For example, were they to save with six different banks that are all covered by the FSCS on the platform, they would be protected up to £85,000 in each account – notwithstanding any additional funds they might hold with the bank separately outside of the platform.

You can access Cash Savings through Charles Stanley Direct’s login, you will need to have an account.

This post first appeared on Dailymail.co.uk