For the 12.5 million retirees in the UK, the state pension triple lock was undoubtedly the quiet hero of 2023.

As the cost of essentials from butter and eggs to fuel and clothes soared, the triple lock made these price rises more bearable for those in retirement.

That is because the state pension forms the bedrock of most retirees’ incomes.

Therefore, so long as it rises every year, retirees are protected from the worst ravages of inflation.

The triple lock promises to increase the state pension every year by the rate of inflation, average wage growth or 2.5 per cent — whichever is highest.

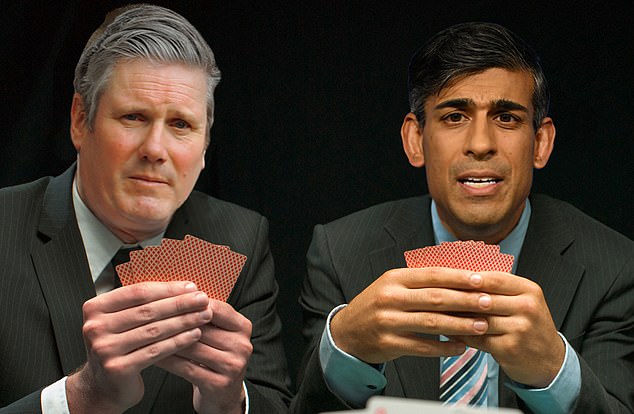

Calling our bluff? Both the Tories under Rishi Sunak (right) and Labour under Kier Starmer (left) have kept schtum on their plans for the triple lock should they win the 2024 election

That resulted in a record increase of 10.1 per cent in April 2023 thanks to soaring inflation.

It has been in place since 2010 and every year steadily increases the value of the state pension in real terms.

However, like every benefit it comes at a cost. Raising the state pension by just one percentage point adds another £900 million to the bill according to financial firm Canada Life.

At a time when Government budgets are squeezed, every policy and every pound of spending is under scrutiny.

So it is no wonder that pension experts believe the triple lock’s days are numbered. The only question is how long it will survive — and what it will be replaced by?

Will the system get through 2024?

Regardless of the long-term future of the triple lock, pensioners can be assured of one thing: an increase to the state pension is guaranteed this year.

Chancellor Jeremy Hunt committed in his Autumn Statement in November to an 8.5 per cent increase in the state pension from April 6 this year.

Thanks to the triple lock, the state pension will increase to match the level of average wage growth enjoyed by workers last year.

The triple lock promises to increase the state pension every year by the rate of inflation, average wage growth or 2.5% – whichever is highest

From this date, eligible pensioners will receive £221.20 a week for the new full state pension, or £11,502 a year, and £169.50 a week for the old basic state pension, or £8,814 a year. Yet what will happen beyond this is less clear.

The General Election — expected to be this year — is the next event that will inevitably shed some light.

Both main parties have kept schtum on their plans for the triple lock should they win. But they will be under pressure to show their hand in their party manifestos or as the election draws nearer.

Steven Cameron, a director at pension firm Aegon, likens this process to ‘state pension poker’.

‘While the triple lock will be honoured in April, its future post-election is very much up for grabs whether Labour or the Conservatives are in power,’ he says.

‘Neither have made any commitments — it’s a bit like state pension poker — no one wants to show their hand. As it’s so valuable to millions, any weakening of the triple lock could lose votes.’

Steve Webb, a former pensions minister and now partner at pension consultants LCP, predicts that the triple lock is simply too valued by voters for either party to abandon.

Financial burden: The cost of the state pension is already £124.3bn and rising steadily thanks to the triple lock and an ageing population

‘It seems unlikely that the Conservatives will now ditch the triple lock for their manifesto,’ he says.

‘In terms of voting intention, the single best predictor is age, and the current pattern is that the remaining Conservative support is heavily concentrated among older voters.

‘It would be very surprising if the Conservatives implemented a policy shift that was “laser-focused” on their core support.’

Webb adds that although the Labour party will be looking to make cost savings, it would be unlikely to ditch the triple lock if the Conservatives don’t as its strategy is to avoid controversy and difference.

However, not all experts are so confident the triple lock will survive. Helen Morrissey, at wealth platform Hargreaves Lansdown, is one. ‘The future of the triple lock looks precarious to say the least,’ she says.

Morrissey cites research that suggests she is far from alone in her scepticism. ‘We conducted research that found 18 per cent of people do not believe the state pension will exist when they retire. A further 26 per cent were unsure,’ she says.

What could come next?

Former pensions minister Ros Altmann predicts that the triple lock will survive until the next election, but will be changed under whichever Government is in place.

A proper review would come none too soon, she argues. Altmann proposes a ‘double lock’ model as a suitable replacement, which ditches the 2.5 per cent element — a number that adds to the long-term cost and has been set seemingly arbitrarily.

However, she is urging whichever government is in power to have a much deeper look at how the state pension is set, in an effort to make it fairer for everyone.

Security: Thanks to the triple lock, the state pension will increase to match the level of average wage growth enjoyed by workers last year

That is because if you dig into the detail, not all pensioners benefit from the triple lock promise. Pensioners aged under 72 are fully protected, because they receive the new state pension.

But those who are older than this and therefore receive the old state pension only enjoy the triple lock on the basic element; other components that top up the state pension, such as Serps and deferred payments, are not subject to it.

‘And the triple lock has never applied to Pension Credit which the poorest pensioners need to top up their income to avoid penury,’ Altmann adds.

Are there other options?

The cost of the state pension is already £124.3 billion and rising steadily thanks to the triple lock and an ageing population.

In the past, the Government has kept the bill in check by increasing the state pension age.

This is one option a future Government could take. It is due to rise to 67 between 2026 and 2028 and 68 between 2044 and 2046, but this second date could be brought forward.

However, life expectancies are not increasing at the pace they once were — and many people simply cannot work into their mid and late 60s.

Experts including Ros Altmann argue that pensioners in poorer health would be unfairly penalised by rises to the state pension age, while those who are wealthier and healthier would be better placed.

Could it all just be left alone?

The second alternative is to keep the triple lock in place and accept that it is doing a valuable job even if it is flawed.

After all, although rising, the state pension is less generous in the UK than that offered in most other advanced economies.

Tom Selby, at wealth platform AJ Bell, says: ‘By keeping the triple lock in place, the Government is effectively admitting the state pension is too low.

‘Retaining it allows policymakers to dodge the thorny question of precisely at what level the state pension should be set, instead leaving it to economic currents to determine future increases.’