Shareholders are often told they should be ‘greedy when others are fearful, and fearful when others are greedy’, as the veteran fund manager Warren Buffett puts it.

But in the current climate, it is wise to weigh up the arguments before snapping up shares said to be ‘oversold’ and thus beguilingly cheap.

Take for example Reits – real estate investment trusts – such as British Land, Land Securities, Segro and Tritax Big Box. These groups own offices, shops, logistics sheds that serve e-commerce and data centres powering the internet.

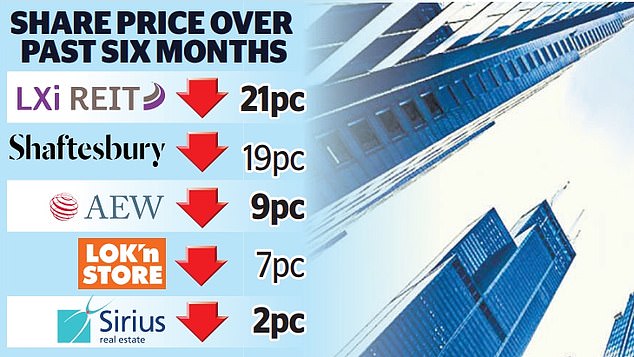

Reits shares have been brought low by higher interest rates and the mini-Budget fallout. The prices of some are at a deep discount to their net asset values, with logistics Reits hit particularly hard.

But predictions that the commercial property slump may be nearing its end are making Reits seem more appealing.

Jennet Siebrits, head of UK research at the CBRE consultancy, contends ‘green shoots of recovery will materialise’.

Matthew Saperia and James Carswell of brokers Peel Hunt agree, saying: ‘We are optimistic that the bottom is near.’ As a result they have upgraded British Land, Land Securities and ten other Reits to a ‘buy’, including Workspace and Lok’n Store, the storage group.

But Goldman Sachs is predicting commercial property values will tumble by 15-20pc by the end of 2024 – and nerves have been unsettled by the controversy over Home Reit, which specialises in social housing.

James Yardley, of Chelsea Financial Services, contends it is risky to conclude that the share price declines are overdone, since Reits are at the whim of so many macro forces. ‘Some may not be as cheap as they seem,’ he says.

Recent statements from a few Reit executives underline this uncertainty. Brian Bickell, of Shaftesbury – the major landlord in Covent Garden and Soho – said its bars and shops were busy over Christmas, but that rail strikes now pose a threat.

Andrew Coombs, boss of Sirius Real Estate – which operates business parks in Britain and Europe – is warning that ‘inflation in the UK is going to be harder for longer than it will be in Europe’.

Meanwhile, due to lockdown, employees have heightened expectations of office quality if they are to be tempted from WFH.

In 2023, a workplace has to be sustainable, with facilities such as roof terraces and in-house baristas. Listen in, as I do, to conversations between estate agents and clients viewing properties in the West End and you will hear a litany of features that must be upgraded or re-designed to lure tenants.

There are prospective buyers, but as one insider says: ‘There are such difficulties with finance that they are hanging back.’

Against this background, some property funds are trying to offload offices and shopping centres – necessitated by their ‘open-ended’ structure which obliges them to raise cash if investors want to redeem their holdings.

And some funds are barring such redemptions. Investors weighing up Reits can be reassured the ‘closed-ended’ structure of these property vehicles mean they are not under pressure to stage fire sales of assets when investors dispose of shares.

These fire sales present opportunities to Reit managers.

Laura Elkin, manager of AEW, says: ‘We’re identifying assets with robust occupational demand that are mispriced against long-term fundamentals.’ But ‘the uncertain occupational outlook’ means that she is avoiding offices. The dividend yield on AEW is 7.5 per cent. Decent yields are one of the reasons Reits are winning fans.

Ben Yearsley, of Shore Capital, says he is ‘nibbling’ at Reit shares, while acknowledging the likelihood dividends will be trimmed.

By law, a Reit must pay out 90 per cent of its taxable profits in dividends every year. But in some cases, these payouts are not fully covered by earnings and may be cut.

I have resolved to be a more audacious investor in 2023, which means I am contemplating a small adventure in Reit land.

Numis recommends the LXi Reit and Industrials Reit, for their management. I am also considering Land Securities, a FTSE 100 firm with 24m sq ft of office, retail and other space. Its portfolio includes the Piccadilly Lights – the large screens in central London.

Its answer to the WFH doctrine are office buildings such as the capital’s Forge, with all the new essentials. I hope its managers ‘work’ this – and the other assets.