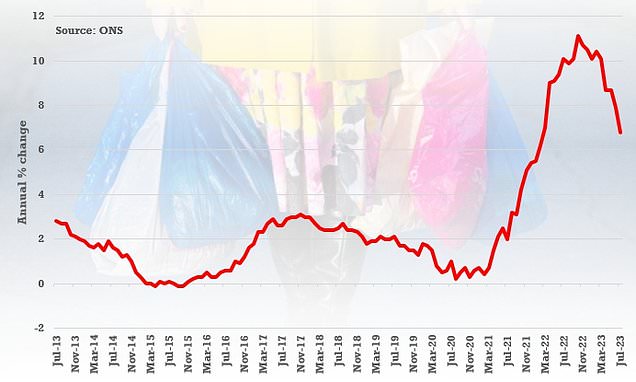

Consumer price inflation slowed to 6.8 per cent in July, in line with forecasts, though persistently high core inflation looks set to maintain pressure on the Bank of England ahead of its next rate setting meeting.

The FTSE 100 will open at 8am. Among the companies with reports and trading updates today are Aviva, Balfour Beatty, Marshalls, Plus500, Essentra and Admiral Group. Read the Wednesday 16 August Business Live blog below.

> If you are using our app or a third-party site click here to read Business Live

Higher interest rates weigh on Balfour Beatty order book

Inflation dips again to 6.8% in respite for hard-pressed Brits – with Bank of England facing knife-edge decision on how far to hike interest rates

Harrods profits beat pre-Covid levels as the luxury department store bounces back

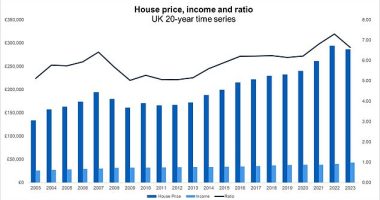

‘More pain for mortgage-holders and first-time buyers in the months to come’

‘Labour hoarding’ keeps markets tight

CPI slows to 6.8%: ‘Encouraging…but the fight against inflation is not yet over’

Inflation slows to 6.8% in July

This post first appeared on Dailymail.co.uk