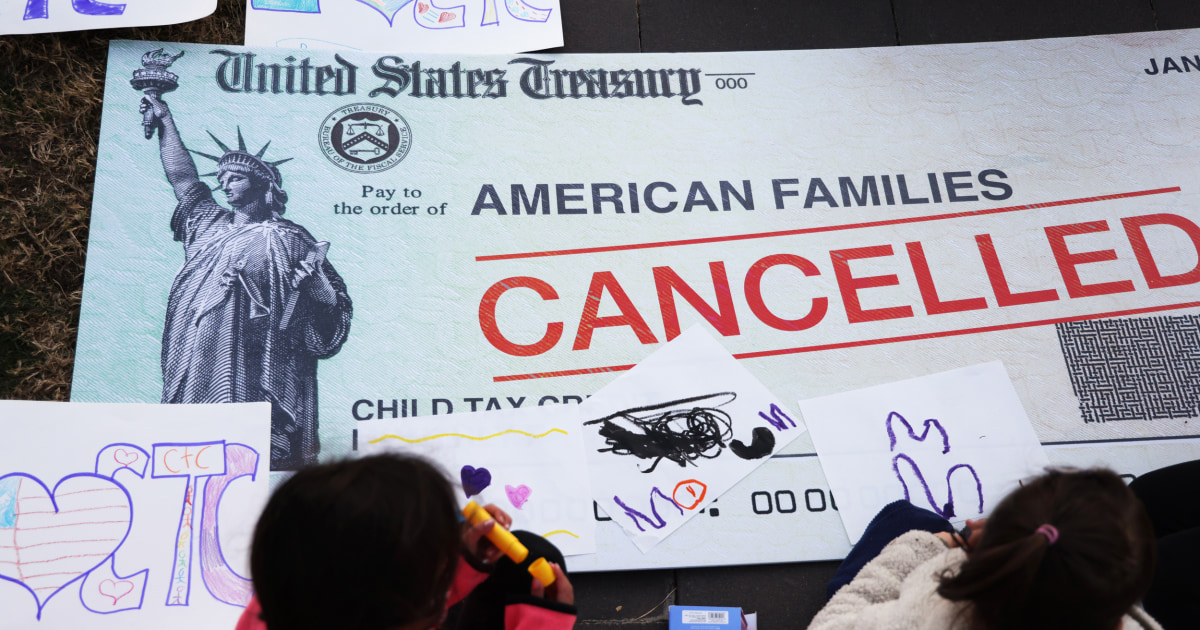

WASHINGTON — Advocates of child tax credit payments say they’re outraged after Sen. Joe Manchin, D-W.Va., said Sunday that he would not vote for President Joe Biden’s Build Back Better Act, which includes a one-year extension to the benefits.

The news that Sen. Joe Manchin, D-W.Va., will not vote for President Joe Biden’s Build Back Better Act dims hopes of immediately extending child tax credit payments, which millions of families have been reliant on since July.

On Dec. 15, ten days before Christmas, qualifying families nationwide received their last checks of 2021 as part of the expanded monthly child tax credit payments. It may be the last check that families receive if the Senate is unable to pass Biden’s $1.7 trillion economic plan.

“Today’s news is a crushing blow to millions of families relying on the expanded Child Tax Credit to make ends meet,” said Bethany Robertson, co-director of ParentsTogether, a family advocacy nonprofit.

Manchin and Republicans “have turned their back on struggling families,” Robertson said. “Families will continue to fight for an extension of the monthly Child Tax Credit and other policies to help them thrive.”

The group MomsRising, another family advocacy group, said that Manchin’s announcement is “a stinging, heartbreaking disappointment to families and businesses in his state who have been coming to him for the last year urging him to vote yes on universal preschool, affordable child care, paid family medical leave, the child tax credit, lower prescription drug prices, and more.”

“Today, Senator Joe Manchin betrayed his prior commitment to support Build Back Better — and to represent moms and families in his state. And we know this is a betrayal for families like yours across the nation, too,” the organization said.

Manchin has said he would support a separate bill to extend the payments, which the White House has ruled out.

“In order to do that, we need the 60 votes in the Senate and we just don’t have that, right?,” White House deputy press secretary Karine Jean-Pierre told reporters last week. “So that is not an option here.”

Sen. Michael Bennet, D-Colo., a major proponent of the child tax credit, tweeted Sunday, “We simply cannot double childhood poverty in this country. I will keep fighting to extend the Child Tax Credit to millions of American families.”

Rep. Rosa DeLauro, D-Conn., another prominent advocate of the measure and the chairwoman of the House Appropriations Committee, said in a statement Sunday that failure to pass the package “hurts the more than 346,000 children in West Virginia benefiting from the Child Tax Credit.”

Rep. Bonnie Watson Coleman, D-N.J., co-chair and co-founder of the Congressional Caucus on Black Women and Girls, said in a tweet Sunday, “94% of children in West Virginia benefit from expanded child tax credits. Manchin says he’ll vote against them. Someone ask him who told him to oppose this.”

Manchin deflated Democratic hopes of an extension on Sunday when he said he would oppose the legislation aimed at transforming the nation’s social safety net.

“I can’t vote for and I cannot vote to continue with this piece of legislation. I just can’t,” Manchin said on “Fox News Sunday.” “I’ve tried everything humanly possible. I can’t get there.”

White House press secretary Jen Psaki fired back at Manchin for indicating a reversal in his position, while noting its impact on the child tax credit.

“Maybe Senator Manchin can explain to the millions of children who have been lifted out of poverty, in part due to the Child Tax Credit, why he wants to end a program that is helping achieve this milestone—we cannot,” Psaki said in a statement.

The American Rescue Plan, enacted in March, expanded the existing child tax credit by $3,000 from $2,000 with a $600 bonus for kids under the age of 6 for the 2021 tax year. The first half was delivered in monthly payments, from July to December, of $300 for children younger than 6 years old and $250 for those aged 6 to 17. The second half will be delivered when families file 2021 tax returns next year.

The legislative package increased the child tax credit for more than 65 million children across the country, according to the Center for Budget and Policy Priorities, a liberal research organization. The West Virginia Center on Budget & Policy, citing CBPP’s analysis, warned that not passing the Build Back Better Act would result in a reduced or eliminated child tax credit for 346,000 children in West Virginia and would drive 50,000 of the lowest income children in the state below the poverty line or further into poverty.

About 10 million children could sink into poverty or deeper into poverty if the credit is discontinued, according to CBPP. The poorest 20 percent in the U.S. would experience a 35 percent increase to their incomes if the credit was extended through next year, according to a study by the Institute on Taxation and Economic Policy.

Within weeks of the first payment in July, the Census Bureau’s Household Pulse Survey data showed that 55 percent of middle-income families spent their payments on food, more than 26 percent spent it on clothes, and 23 percent spend it on costs related to school and after school.

In December alone, the Treasury Department and IRS sent out more than $16 billion in tax relief to about 61 million eligible children as part of the sixth monthly payment of the tax credit. The department said that since the first payments were distributed in July, the administration has delivered nearly $93 billion to families.

The Treasury Department said that data shows parents have spent the money on essential items, like food, clothes and school-related expenses.

Source: | This article originally belongs to Nbcnews.com