Bitcoin and other cryptocurrencies rose after Visa Inc. said its payments network will use a stablecoin backed by the U.S. dollar to settle transactions, as blockchain technology gains more acceptance in the established financial system.

As part of a pilot program, Visa is using USD Coin to settle transactions over Ethereum, with the help of the Crypto.com platform and Anchorage, a digital-asset bank, according to a statement Monday by the San Francisco-based payments giant. Visa will offer the service to more partners later this year.

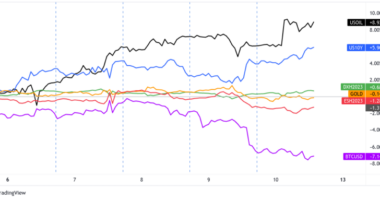

Bitcoin jumped by as much as 6.3% during the European session to climb back above $58,000. The wider Bloomberg Galaxy Crypto Index also advanced.

Bloomberg

BloombergTraditional financial companies are beginning to embrace cryptocurrencies and blockchain projects more than a decade after the creation of Bitcoin in 2009. That comes even as some remain skeptical of mainstream adoption. Blythe Masters, a former JPMorgan Chase & Co. executive who is now chief executive of Motive Capital, said the token remains mainly a vehicle for speculation and is unlikely to displace alternative stores of value.

Jack Forestell, Visa’s chief product officer, said the firm’s move is partly an effort to serve financial-technology companies.

“Crypto-native fintechs want partners who understand their business and the complexities of digital currency,” Forestell said in the statement. “The announcement today marks a major milestone in our ability to address the needs of fintechs.”