MILLIONS of savers are to get a major boost to their savings this week.

Premium Bonds holders are more likely to get a bumper prize after NS&I changes to the draw.

The government savings arm has now added an extra 460,000 prizes, with the prize fund rate reaching a 15-year high, edging up from 3.7% in July to 4% in August.

It means the odds of each £1 Premium Bond winning a prize will improve to 22,000 to one from 24,000 to one.

Savers will have a higher chance of winning prizes worth between £50 and £100,000 each month.

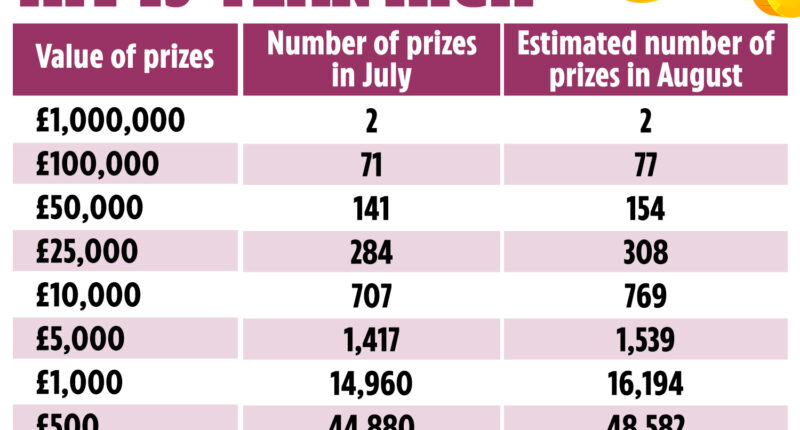

The changes include 77 £100,000 prizes in August, up from 71 in July.

And 154 £50,000 prizes, up from 141 in July, as well as 308 £25,000 prizes, up from 284 in July.

The number of £1 million prizes remains the same, at two.

Premium Bonds are a prize draw so although your chances of winning have increased, there’s still no guarantee that you’ll get anything.

Dax Harkins, NS&I chief executive said: “Premium Bonds are one of the nation’s favourite savings products and I’m delighted that we’re able to improve the odds to the best they have been in almost 15 years, with more prizes, more excitement and more life-changing wins for savers up and down the country.

Most read in Money

“These changes will benefit millions of NS&I’s savers who have money in Premium Bonds, Direct Saver and Income Bonds.”

We’ve explained everything you need to know about Premium Bonds below.

What are Premium Bonds?

Premium Bonds are a type of savings account that don’t offer interest payments like conventional accounts.

Instead, you’re given the chance to win a prize worth up to a whopping £1million.

Premium Bonds can be bought from the government-backed National Savings and Investments (NS&I) which also offers a variety of other savings products too.

More than 22million people buy into Premium Bonds.

You can put money in and take it out whenever you want.

You need to put in a minimum of £25 to get started and you can invest up to £50,000.

Each £1 you put in Premium Bonds is an entry into the monthly prize draw.

Because Premium Bonds are government-backed, your money is safe and there’s no risk of losing your cash.

What are the Premium Bond prizes?

The draw is held each month and the winning number is picked by a computer called ERNIE (which stands for electronic random indicator equipment).

There are three kinds of prizes:

- Higher value prizes of £5,000, £10,000, £25,000, £50,000, £100,000 and £1million

- Medium value prizes of £500 and £1,000

- Lower value prizes of £25, £50 and £100

How likely am I to be a winner?

The chance of winning a prize with an individual bond right now is 24,000 to one.

Each bond has an equal chance of winning and the more you buy, the more your chances improve.

Most Premium Bond savers will find that their investments fail to keep pace with inflation, but it’s hard to find any savings accounts at all that beat inflation.

You can check your odds depending on how many bonds you have and how long you’ll keep them using MoneySavingExpert.com’s helpful calculator.

This makes it easier to see if Premium Bonds are right for you, or if you’d be better off with another savings account.

It’s also worth noting that Premium Bond winnings are tax-free.

Anyone who has used up their annual ISA limit or personal savings allowance could benefit by saving into Premium Bonds.

How do I check if I have won?

You can use the NS&I Premium Bond prize checker online to see if your numbers have come up.

You’ll need to know your bond holder number which can be found on your Bond record or through your online account.

If you’ve lost track of your numbers you can ask NS&I for them.

There’s also an official app for iPhones and for Androids for checking prizes too, and even an App for Amazon Echo which means you can just ask Alexa.

For this you will need to use your NS&I number.

It’s 11 digits long and will be on any communication you’ve had with NS&I.

You don’t always need to check your numbers as you can get prizes under £5,000 paid straight into your bank account, or automatically buying more Premium Bonds.

For higher value prizes worth more than £5,000 NS&I will contact you by post and if you scoop the £1million jackpot, someone will pay you a visit to let you know!

NS&I will no longer send out prize cheques in the post.

How do premium bonds compare?

Before you sign up, it’s important to check how it compares to the rest of the market to make sure you get a good deal.

We used MoneyFactsCompare to weigh up NS&I’s rate for its Direct Saver account to other easy-access accounts on the market today.

Chip’s easy access saver is currently offering 4.51% interest.

But savers could also get a higher rate by locking their cash away in Atom Bank’s 1 Year Fixed Saver to get 6.05% back.

The only downside to fixed bond accounts is that you’re forced to lock away your cash for a defined period of time.So it’s also worth weighing up to see what’s best for you.

We’ve previously explained how to find the best savings accounts to suit your needs.