SAVERS could be earning more interest on their nest egg simply by switching bank account.

Many banks have bumped up their rates after the Bank of England raised the base rate again, to 4.25% – the highest in 14 years.

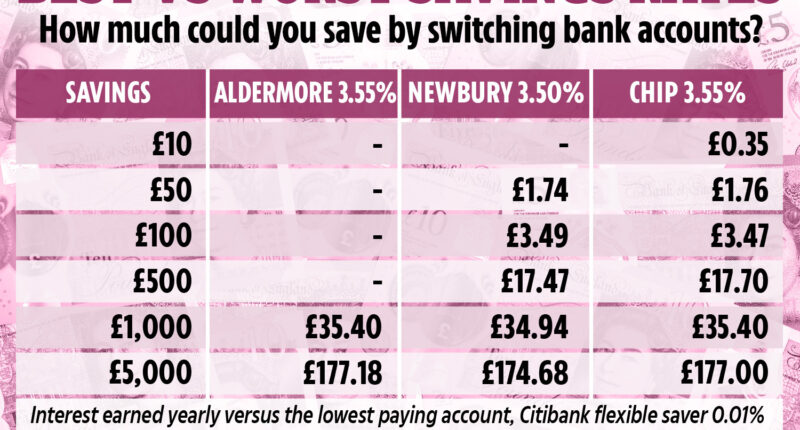

The Sun analysed easy access saving rates and found that savers on the worst rate are missing out on £177.18 a year.

That’s based on having £5,000 in the worst paying account versus the best.

But even for more moderate amounts, savers could still be better off moving their money.

As banks are shaking up rates on the regular at the moment, it’s important to keep up to date with the top paying ones so you can make the most of your money.

We’ve rounded up the current highest paying and lowest paying easy-access bank accounts so you don’t have to.

Of course, always weigh up whether a switch is best for you and your circumstances, and if need be, do consult with a finance professional.

The best and worst easy-access accounts – up to 3.55%

Easy-access savings accounts do what they say on the tin – they usually allow unlimited cash withdrawals.

However, this perk means they tend to come with lower returns, but there are a number of accounts worth considering.

Most read in Money

Currently, the best easy-access saver is Aldermore, which is offering 3.55%, according to MoneyFactsCompare.co.uk.

However, you’ll need to put in a minimum of £1,000 to kick it off.

Over one year, you’d earn £35.50 in interest.

Your second best option is Newbury Building Society, but there’s a minimum investment of £50 – though this is more doable.

Newbury offers 3.49% in interest – over one year, you would earn £1.75 in interest with a £50 deposit.

While Chip is offering customers 3.55% in interest when they open an easy-access account.

You’ll be able to open it and put just £1 in to start with.

If you paid £100 over a year, you’d accrue roughly £3.55 in interest.

if you saved £500, you’d get around £17.75 in interest.

On the other end of the spectrum, there are some very low rates also being offered.

According to data from MoneyFactsCompare.co.uk, Citibank is only offering 0.01%.

Over one year, you’d earn zero interest on a £10 saving, while for £50 and £100, you’d get 1p back.

If you saved £1,000, you’d get 10p in interest.

We compared these interest rates with each other and the table above shows how much you’re missing out on in interest by remaining on a 0.01% rate instead of switching.

Rachel Springall, finance expert at MoneyFactsCompare.co.uk, said: “Savers who compare the top easy access rates will find they currently pay 3% or more, and every brand has the same protections in place as the big bank brands do, being covered by the Financial Services Compensation Scheme (FSCS).

“However, every institution can have its own reasons and margins in place that leads it to assess its savings rates.

“Mutuals may be worth considering, not just for their savings rates, but also for their principles and the support of local communities and charities.

“It will be down to savers to compare the rates on offer and move their money, so it is wise to review any accounts often and not presume they will see their rate rise in line with base rate.

Here’s how the best and worst easy-access accounts compare and the difference between the interest you could earn over a year:

How can I find the best savings rates?

With your current rates in mind, don’t waste time looking at individual banking sites to compare rates – it’ll take you an eternity.

Research websites like MoneyFactsCompare and price comparison websites such as Compare the Market, Go Compare and MoneySupermarket will help save you time and show you the best rates available.

These sites let you tailor your searches to an account type that suits you.

It’s also worth considering opening an Individual savings account (Isa).

These can pay high interest but come with high withdrawal fees and are unlikely to be beneficial if you’ve less than £65,000 in savings.

However, Lifetime Isas are great for anyone aged 18-39 hoping to buy a house or save for retirement.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected]