THOUSANDS of vulnerable people, including care leavers, will get more cash to pay their rent, thanks to changes to new benefit rules coming into force today.

The changes, which are being introduced two years earlier than scheduled, are expected to help Universal Credit and Housing Benefit claimants.

The changes are to something called the Shared Accommodation Rate (SAR) which determines how much young people can get paid towards their rent.

The SAR is applied to renters aged under 35 who are claiming support through their Local Housing Allowance (LHA).

Universal Credit uses the Local Housing Allowance to calculate how much housing benefit claimants are entitled to, with rates based on the private rental market in the local area and set at the same level for all.

Under the system, most single people aged under 35 are only entitled to a set amount to help towards the cost of a room in a shared house – known as the Shared Accommodation Rate, the lowest LHA band.

In a nutshell, this adjusts the benefit to the cost of renting a room in shared accommodation, but there is a higher, one-bedroom rate available for people who need to rent solo housing.

There are two key changes that have come into force today.

- Care leavers can now claim the higher one-bedroom LHA rate for longer, as the maximum age limit has been raised to 25, from 22.

- Anyone who has lived in a homeless hostel, regardless of age, will also now be able to claim the higher rate, as the age limit has been removed.

A care leaver is a person who has been in Local Authority care (e.g. residential or foster care) for 13 weeks or more since they were age 14, and ending after age 16.

The government says that the changes could mean claimants get hundreds of pounds more towards their rent costs.

For instance, in Harlow and Stortford a single care leaver aged 23 could expect to receive up to £387 additional housing support per month as a result of the change.

Minister for Welfare Delivery Will Quince said: “These changes are an immediate boost for some of the most vulnerable young people in our communities.

“We know that having a safe, secure home is vital to getting on your feet and often into work.

“By bringing these changes in early, we’re able to help more people right now, as we all look to recover from the pandemic.”

How to apply for housing benefit and Universal Credit

If you already get Universal Credit, you should apply for housing payments in your online account.

Otherwise, your first step is to apply for Universal Credit. To do this, you’ll need an email address and to be able to verify your identity online.

If you do not have a permanent address to apply with, you can use the address of:

- a hostel where you are staying

- a family member or friend

- You can use your local Jobcentre Plus address if you do not have any other address you can use.

If you don’t have a bank account you can use the details of a trusted friend or family member to get your payments, open a Post Office card account or use the Payment Exception Service.

To find out more about claiming, use the government’s website.

What to do if you have problems claiming Universal Credit

IF you’re experiencing trouble applying for your Universal Credit, or the payments just don’t cover costs, here are your options:

- Apply for an advance – Claimants are able to get some cash within five days rather than waiting weeks for their first payment. But it’s a loan which means the repayments will be automatically deducted from your future Universal Credit payout.

- Alternative Payment Arrangements – If you’re falling behind on rent, you or your landlord may be able to apply for an APA which will get your payment sent directly to your landlord. You might also be able to change your payments to get them more frequently, or you can split the payments if you’re part of a couple.

- Budgeting Advance – You may be able to get help from the Government for emergency household costs of up to £348 if you’re single, £464 if you’re part of a couple or £812 if you have children. These are only in cases like your cooker breaking down or for help getting a job. You’ll have to repay the advance through your regular Universal Credit payments. You’ll still have to repay the loan, even if you stop claiming for Universal Credit.

- Cut your Council Tax – You might be able to get a discount on your Council Tax by applying for a Council Tax Reduction. Alternatively, you might be entitled to Discretionary Housing Payments to help cover your rent.

- Foodbanks – If you’re really hard up and struggling to buy food and toiletries, you can find your local foodbank who will provide you with help for free. You can find your nearest one on the Trussell Trust website.

Universal Credit doesn’t cover cost of renting a room in a shared house.

12 pensioner benefits going unclaimed including heating help, council tax reductions and pension credit.

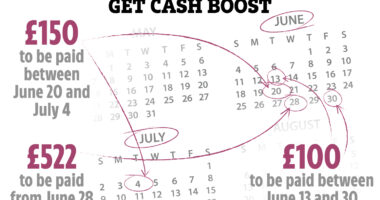

May Bank Holiday payment dates 2021: When will my Universal Credit, child benefit or state pension be paid?