Wilko, founded 97 years ago in Leicester, has become the latest retail casualty. Will the main beneficiary of its demise now be FTSE 100 member B&M, the discount variety goods chain born in Blackpool in 1978, but nowadays based in Liverpool?

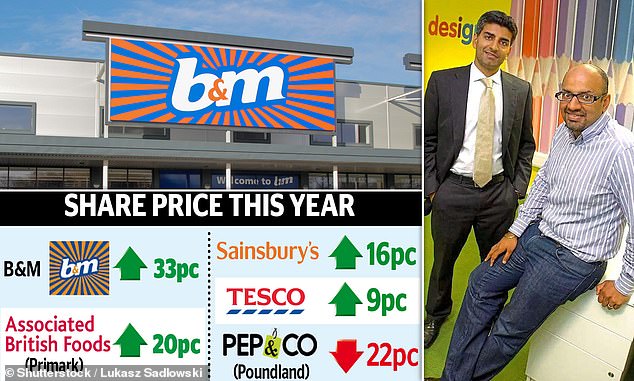

Deutsche Bank considers that this could be the outcome, setting a new 680p target for B&M shares, although they have already risen by 32 per cent this year to 559p.

Deutsche argues that the ‘current valuation is too cheap for the asset’, pointing to higher sales and profit margins, and more payouts for shareholders.

Some will feel this seems too good to be true, like one of the giveaway lines in a B&M store.

But since the forward price-earnings (p/e) ratio – a measure of the expensiveness of a company’s shares – is 14.5 times, slightly below the historic average, it is worth taking a look. This is especially so if, like me, you are trying to add UK shares to your portfolio in the belief that our markets offer more dash for less cash.

Brothers in business: Simon and Bobby Arora own B&M stores

Poor management meant that Wilko failed to capitalise on the cost of living crisis.

But B&M has been more deftly positioned for a tough economic climate in which people still wish to spend on themselves, their homes and their pets, but within a tight budget, particularly for groceries. B&M sells food in its own stores and through its Heron Foods arm, which operates 325 stores.

The company was originally known by the names of its founders – Billington and Mayman. It then became B&M which some say stands for Bargain Madness. This may sum up the B&M cut-price offer, but not the retailer’s carefully-devised strategy with its huge range of merchandise, much of it directly sourced from its own Asian-based buying operation. This gives it an edge on design and value.

Alex Russo, B&M’s chief executive talks of ‘a relentless focus on price, product and excellence’.

Russo took over a year ago from Simon Arora who bought the ailing B&M in 2005 with his brother Bobby, a product-sourcing supremo. Although a billionaire, Bobby will remain as trading director for the next three years.

Meanwhile the Arora family continues to hold 7pc of the company through a Luxembourg vehicle.

The careful choice of store location has fuelled B&M’s ascent. Simon Skinner, head of European investments at the fund manager Orbis which has a large stake in B&M, says: ‘Wilko stores were mostly on the High Street, but B&M has been prioritising convenience, putting stores where consumers want to be, which is on retail parks.’

The perfect B&M site is close to the discount supermarkets Aldi or a Lidl. As data firm Kantar’s figures showed this week, Aldi and Lidl are winning market share.

Some of this is thanks to the bargain-hunting middle classes who fill a trolley with Lidl ‘dupes’ – copies of household brand foods – and then drop by B&M.

Many of these customers developed the B&M habit during lockdown when the 707 UK stores were open. The reach of the group has also been extended to a younger clientele through Tik Tok on which shoppers show off their B&M cosmetic and homeware dupe – or duplicate –’hauls’.

The formula works equally well in France where the company has 105 outlets following the acquisition of the Babou chain in 2018. Most of these shops bear the bold blue and red B&M logo.

Views differ on whether B&M can continue to expand. The ambition is to have 950 UK stores. Skinner argues that it will be able to exploit the weakness of other retailers who will struggle because they cannot ‘execute’, that is, perform in the current environment.

But Jonathan De Mello, boss of the JDM Retail Consultancy, wonders whether B&M is ‘running out of runway’ on out-of-town store openings, given the risk that a new outlet can cannibalise the trade of a nearby store.

He believes that B&M should apply its skills to the High Street, where it has only a small presence, snapping up some of the larger Wilko premises. This could win over a new set of customers to the B&M proposition. Many consumers in their 20s, attracted to such B&M specialities as Barbie biscuits and decor accessories, do not have access to a car.

The question mark as to whether B&M can sustain its growth helps explains why eight of the analysts who follow the company rate the shares a ‘hold’. Another seven are evidently as enthusiastic as Deutsche and have issued ‘buy’ recommendations.

My conviction late last year that Marks & Spencer shares were undervalued has been repaid with an 80 per cent bounce. The possibility that M&S could return to the FTSE 100 could provide a further fillip. Now I am going to be a buyer of B&M, regretfully giving up on the idea that a period of weakness would turn the stock into an even bigger summer bargain than anything in its stores.