THE Bank of England is expected to raise rates again this week and they could hit 5 per cent by summer’s end, experts warned yesterday.

A 12th increase in a row, when its Monetary Policy Committee meets tomorrow, would see the rate return to 2008 levels.

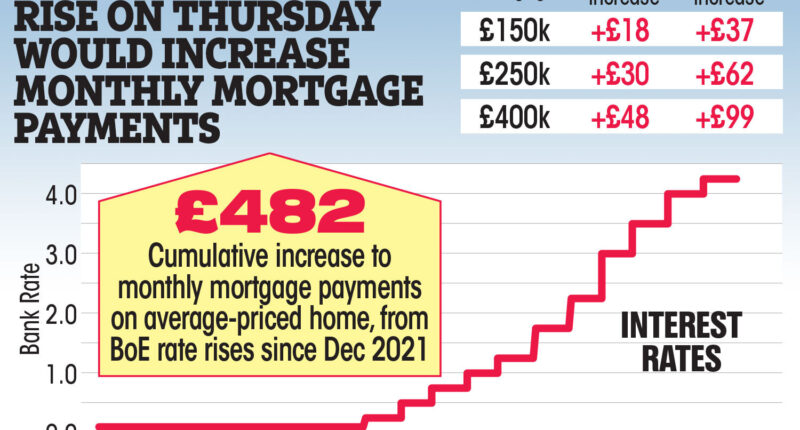

And a 0.25 per cent rise to 4.5 per cent would add £30 a month to costs for a £250,000 mortgage.

Households with that size of mortgage are already paying £612 more a month compared with November 2021 when rates were 0.1 per cent, according to TotallyMoney.

Goldman Sachs economists have raised their expectations for interest rates to peak at 5 per cent, after earlier estimates that the Bank would keep rates flat at 4.25 per cent.

They believe “ongoing inflationary pressures” mean the Bank will raise rates by increments of 0.25 per cent “until reaching a terminal rate of 5 per cent in August”.

Analysts at Deutsche Bank also expect another 0.25 per cent rate rise in June.

Simon French, at Panmure Gordon, said: “The Bank is seen as doing two to three more hikes by the market, the peak has moved up from 4.25 per cent in January to around 4.8 per cent.”

He said markets were still spooked by “hot inflation” figures showing the Bank’s efforts have had little results.

The Bank of England wants to get inflation back down to 2 per cent by the end of the year, but it so far remains stubbornly five times above that.

Most read in Business

Soaring food prices have been blamed, and some food companies have been using industry-wide costs as a cover to hike prices well above inflation.

Some Bank officials such as Swati Dhingra have called for a halt to rises, flagging that many households will only start to feel the pain when their two-year mortgages come to an end.

A.I fears split

MORE than half of middle-aged consumers say they would not use artificial intelligence, a new poll reveals.

The biggest worries were data privacy and jobs.

That compares with less than a third of young Brits who fear it.

They said cost was the biggest barrier but would use it for facial recognition and customer service chatbots.

In total, more than 80 per cent of Brits have some concerns, according to a KPMG survey of 3,000.

Experts say many may be unaware that they already interact with AI.

Family of-air

EASYJET’S move to hire more over-50s has led to the parents of flight attendants working alongside their kids.

Neil Brown, 59, followed daughter Holly Sauble, 29, to become cabin crew, after working in engineering and sales.

He told The Sun: “I decided I needed a new challenge. Knowing how much Holly loved the job I applied and I’ve loved it ever since.”

Karen Brodie, 54, was also inspired to work in the cabin after daughter Daniela, 21, started at the airline last year.

Karen, once a holiday rep, said: “I’ve always loved travelling and exploring new places, and I’m a real people-person.”

easyJet says the over-50s often have valuable life experiences.

JD’s in running

JD Sports is putting its best foot forward with a planned £283million takeover of French trainer chain Courir.

The retailer is in exclusive talks to buy the firm, which has 313 shops across Europe.

JD Sports has expanded to 3,400-plus outlets in 32 territories.

It was forced to unwind a move for Footasylum last year by competition regulators.

Courir would be its biggest deal since new French boss Regis Schultz took over last year.

He said he wants to turn JD into a “powerhouse”, and double sales and profits.

Switch off hits Nintendo

NINTENDO has admitted sales of its Switch console are suffering a much bigger slowdown than anticipated.

The game-maker yesterday said that it sold 18million consoles during its last financial year but expects to sell only 15million this year.

That is down from 23million sold in 2021 and 28million the year before that.

President Shuntaro Furukawa said: “Our goal of 15million units this fiscal year is a bit of a stretch, but we will do our best to bolster demand going into the holiday season so we can achieve the goal.”

The Japanese firm also told analysts its next console will not be out until next April at the earliest.

Nintendo has sold 125 million Switch consoles since launching six years ago.

It hailed the recent success of its Super Mario Bros Movie, which raked in more than $1billion at the box office — earning them an estimated £200million in royalties.

Line Ups its covered

DIRECT Line has hiked the cost of its car insurance premiums by 19 per cent as it faces rising costs for repairing damaged vehicles.

Soaring prices of second-hand cars mean that even when a customer’s vehicle is written off, Direct Line has to pay out more.

And supply chain delays mean a wait for replacement cars, so it has to fund hire car costs for longer.

The insurer has scrapped its dividend and said annual profits are under pressure.

Families battling to plan future

FOR the past year Brits have been making life-changing decisions based on where financial markets think interest rates will end up.

And those predictions have changed on a weekly, if not daily, basis.

Rishi Sunak’s Government fixed the “risk premium”, and mortgage prices fell back to 3.75 per cent in February from almost 6.5 per cent in November.

But inflation continued to race ahead, despite help with energy bills, and it still remains above 10 per cent.

While some traders believed jitters around a new financial crisis — caused by the collapse of SVB, Credit Suisse and other US lenders — would lead to a pause in rate rises, US and European central bank peers have continued to press ahead with further rate hikes.

As a result, traders now reckon this week’s rate rise may not be the last this year.

Around 1.4million households will have to renew their mortgages this year, and every hike the Bank imposes makes their monthly payments even more painful.

Food for thought

A FALL in wholesale prices has prompted Sainsbury’s to lower the cost of bread and butter.

The supermarket is reducing loaves by 11 per cent to 75p, cheaper than rivals, while its butter has been lowered by 5 per cent to £1.89 for 250g.