A LITTLE-KNOWN challenger bank has launched a new market-leading savings account.

Savers looking to make the most of their deposits can now get up to 5% interest back with a boosted easy access savings account.

Tandem Bank’s Instant Access Saver pays savers 5% back on their deposits thanks to a 12-month 0.35% interest boost.

The underlying annual interest rate is 4.65% but you’ll be able to top it up to 5% once you’ve opened an account on the app and clicked the ‘top-up’ button.

It’s unclear if customer’s will be able to top up their rate after the 12 month period – but banks usually reoffer these incentives to keep customers on their books.

The offer comes in the same week that NS&I raised the Premium Bond prize fund to the highest rate in more than 24 years.

From next month’s draw Premium Bond holders will have an effective prize fund rate of 4.65%.

But easy access savings accounts like the one offered by Tandem do what they say on the tin – they tend to allow unlimited cash withdrawals.

Tandem’s account has no restrictions on the number of withdrawals you make and you don’t need to give notice before doing so either.

The account also comes with no minimum deposit – so you can deposit any amount from £1 all the way up to £250,000.

Most read in Money

So if you deposited the minimum £1,000 in the account you’ll gain £50 in interest at the end of the full term.

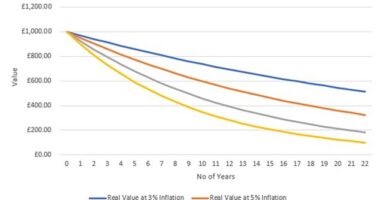

But it’s also important to note that if the Bank of England’s base rate rise or falls in the future this account’s savings rate could change too.

This is because the account has what’s known as a variable interest rate.

If Tandem decides to increase the underlying interest rate or top up, it may change it with immediate effect and inform you afterwards.

But if it decides to reduce the underlying interest rate or top up, Tandem will give you at least 30 days’ notice before the change comes into effect.

Customers wishing to open Tandem’s instant access saver will need to download the bank’s app on the App Store or Google Play.

The next best easy access savings account pays customers 4.65% back on their deposits.

Secure Trust Bank’s access account requires a minimum deposit of £1,000 and pays interest on savings on a monthly basis.

This account can be opened online and over the phone.

What are the alternatives?

There’s a handful of other types of savings accounts available to customers which might better suit your circumstances.

These include other easy-access accounts and regular savings accounts which allow greater flexibility when it comes to withdrawing your cash to spend on emergencies.

Of course, if you’re looking for a new savings account it’s always worth having a browse on price comparison websites.

Moneyfactscompare, Compare the Market, Go Compare and MoneySupermarket will help save you time and show you the best rates available.

These sites let you tailor your searches to an account type that suits you.

It’s worth checking the latest savings rates frequently as more movement in the market is predicted.

The Bank of England is expected to increase the base rate further in the coming months and this would see banks and building societies continue to battle it out to offer market-leading interest rates

Here’s a list of the other types of savings accounts on offer.

Notice savings accounts – up to 5.45%

Notice accounts offer slightly higher rates than easy-access accounts.

But you’ll need to give advance notice to your bank (up to 180 days in some cases) before you can make a withdrawal or you’ll forfeit the interest.

Savers can currently get 5.45% on a 120-day notice account from Dudley Building Society.

Savers depositing £1,000 in this account can expect to gain £54.50 in interest after 12 months.

Regular savings accounts – up to 7%

These accounts generate decent returns but only on the basis that you pay in a set amount each month.

To get the best rates you’ll also need to hold a current account with the providers below as these linked regular savings accounts pay the top rates.

First Direct offers a regular saver paying 7% in interest.

You’ll need to save between £25 and £300 a month, and up to £3,600 a year.

For example, if you were to save £300 every month for 12 months with this account, you’ll earn approximately £136.50 in interest.

Lloyds Bank’s Club Lloyds Monthly Saver will pay 6.25% interest on savings of up to £400 a month, so if you’re looking to put away a little here and there it could be a good account for you.

If you deposit £400 every month for 12 months you will have a balance of £4950 after all interest is paid – but you’ll need to be a Club Lloyds member to have access to this account.

Fixed bond savings accounts – up to 6.05%

These offer some of the highest interest rates – but this comes at the cost of being unable to withdraw your cash within the agreed term.

If interest rates increase during your term you can’t move your money and switch to a better account.

Some providers do all withdrawals but you’ll be charged a hefty exit fee and will likely have to forfeit any interest gained.

GB Bank’s one-year fixed bond savings account pays savers 6.05% back on deposits between £1 and £100,000.

If you were to save £1,000 in the fixed bond over 12 months you’d expect to gain £60.50 in interest payments.