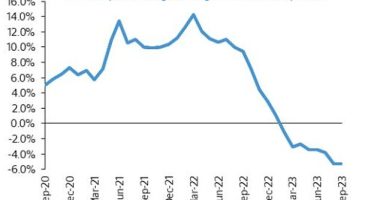

Asos has warned full-year profits are set to be towards the bottom end of guidance after weaker-than-anticipated summer sales.

The online fashion retailer, which has struggled in recent times with sliding demand, anticipates underlying earnings of £40million to £60million for the 53 weeks ending 3 September.

It reported like-for-like turnover fell by 11 per cent on a constant current basis during the period following a continued slowdown in orders across multiple markets.

Forecast: ASOS, which has struggled in recent times with sliding demand, anticipates underlying earnings of £40million to £60million for the 53 weeks ending 3 September

Although warm weather drove strong sales in June, fourth-quarter revenues declined by 15 per cent as rain damaged trade in July and August.

Asos has also been affected by elevated cost-of-living pressures, higher customer returns, supply chain troubles, and a widespread post-pandemic drop in the e-commerce sector.

Still, it expects the final three-month period to be profitable thanks to £300million of recent cost savings and improvement in core profitability as part of its ‘Driving Change’ turnaround programme.

Lower duty and freight costs helped the London-based firm more than double its second-half gross margins, although they came in below guidance because of significant discounting activity aimed at reducing inventory levels.

Despite slashing its stock by 30 per cent last year, the business expects price cuts to remain until late 2024 as it aims to eliminate inventory from last year’s autumn/winter season.

José Antonio Ramos Calamonte, chief executive of Asos, said: ‘We continue to focus on bringing the best fashion and the most engaging proposition to our customers as we make progress on our journey to sustainably profitable and cash-generative growth.’

Asos was relegated from the FTSE 250 Index in June, having seen its market cap plummet in the previous two years from over £7billion to less than £500million.

Sales on its website soared during the height of the pandemic when the temporary closure of apparel stores due to lockdown restrictions produced a major windfall for online retailers.

Growth subsequently slowed as customers returned to purchasing their clothes on the high street, and cost-of-living problems have hurt its young-adult target audience.

The company has also faced stiffer competition from the likes of Marks & Spencer, Next and Chinese fast fashion giant Shein.

Pressure on Asos has seen it become a potential takeover target, with Turkish online retailer Trendyol putting forward a £1billion approach last December.

Another potential suitor is Mike Ashley’s Frasers Group, the owner of Sports Direct and Evans Cycles, which has built a near-17 per cent stake in the brand.

Russ Mould, investment director at AJ Bell, said: ‘The danger for Asos is it is just no longer as relevant in a world where people can buy clothes in stores again and where the tide has turned away from the whole fast fashion concept.

‘And by failing to fix the roof while the sun was shining bright for it during the pandemic, the business is left really exposed.’

ASOS shares were 1.5 per cent, or 5.8p, lower at £3.81 on Tuesday morning.