Keir Starmer is a fortunate leader. Labour’s U-turn on climate change spending has been remarkably absent from the public eye.

It is hugely important because the Labour leader and Shadow Chancellor Rachel Reeves chose to make a £28billion a year green investment pledge the central feature of a plan to rebuild Britain as a manufacturing, regional and carbon free powerhouse.

Labour also plans to catapult the UK to the top of the Group of Seven (G7) growth league in its first term.

At the core of the Reeves blueprint of Securonomics is the ‘green prosperity plan’. As originally conceived and pushed by the Shadow Energy Secretary Ed Miliband, it envisaged a spend of £28billion a year, or £140billion of capital outlays over the next Parliament.

To place that in context, it is more than the much-savaged £98billion cost of the HS2 high speed infrastructure project.

Watching brief: Labour leader Sir Keir Starmer and Shadow Chancellor Rachel Reeves

It matches President Biden’s outlays of £28.9billion a year of subsidies designed to switch carbon neutral production, such as battery factories, from other geographies to the US.

Given that America’s total output is five times larger than that of Britain, one better understands the boldness of the original Labour proposal.

It was eight days ago – on June 9 – that Reeves did her backtracking.

Speaking on Radio 4, she said that ‘economic stability must come first’ and there would be a slower build-up to the annual £28billion outlays, which would be reached midway through Labour’s period in power.

The Shadow Chancellor noted that high UK interest rates, as a result of the Tories’ great inflation, had elevated the current costs of government spending.

One began to understand the scale of the retreat when silver-tongued Lord Mandelson, a veteran of the Blair-Brown years, took to the airwaves.

Labour’s former Business Secretary – and a European Commissioner for Trade – told us all that the switch was a good thing because investing slowly and building to the big number was better than spending more.

Voters committed to the carbon neutral goals might find the ‘less is more’ message underwhelming, however.

Labour is right to be nervous about the scale of the green promise.

Inflation is an enormous threat to the public finances.

It raises the cost of welfare bills, embeds higher wages into public sector deals and raises the cost of financing the nation’s borrowing.

The UK is uniquely exposed to the market for government bonds or gilts because of high dependence on bonds that are index-linked to the retail prices index (RPI) which runs hotter than consumer prices.

Almost 25 per cent of the nation’s accumulated debt is in this form.

As significantly, ever since the Trussonomics tax cuts were blown out of the water, sending gilt yields – the return on UK government bonds – to record levels in October 2022, markets have been hyper-sensitive to developments in the political economy. The current turmoil was triggered by April cost-of-living data which showed that core inflation – stripping out energy and food costs – has become sticky at 6.2 per cent.

The pass-through from toppy wage deals and an element of ‘greedflation’ in the services sector is taking its toll.

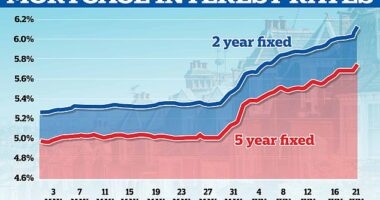

The panicky moves in the market for fixed rate mortgages have been triggered by the surge in gilt yields with the two-year, five-year and ten-year bonds currently at levels not seen since the Truss tantrum in September last year.

The current market and conventional wisdom is that the Bank of England’s rate will have to rise to 5.75 per cent this year from its current 4.5 per cent, precipitating a recession.

A further quarter of a percentage point rise is expected next week in spite of the US Federal Reserve’s decision on Wednesday to hit the pause button in the US.

All of this threatens the Reeves plan to balance the current budget, leaving borrowing headroom for long-term green spending.

It is becoming ever harder for the numbers to make sense and the fear is that the extravagance of the £28billion carbon free investment promise would leach into market psychology.

With a year or more to go to the next general election, Labour’s pledge to rebuild a greener prosperity for the whole of the UK already in the slow lane.