Interest rate decisions have come fast and furious since the Bank of England began hiking borrowing costs in December 2021, raising them a dozen times to the current 4.5 per cent.

The most noticeable knock-on effect has been on the cost of mortgages.

However, given the scale of the repricing, the impact on Britain’s ever buoyant residential market has been modest, despite some lurid predictions of a housing crash.

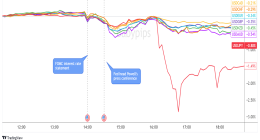

The nature of the Bank of England’s policy dilemma ahead of next week’s session of the interest rate setting Monetary Policy Committee (MPC) will be illustrated by what is happening elsewhere.

Core inflation in the US, which seeks to strip out energy and food prices, remain sticky, but it is expected that the Federal Reserve will hit the pause button tomorrow.

Holding back: Core inflation in the US, remains sticky, but it is expected that the Federal Reserve (pictured) will not raise rates above their current level

The US central bank has lifted rates by five percentage points to the 5 per cent to 5.75 per cent range since it began its tightening.

The scale and speed of the hikes led to the collapse of SVB and First Republic and delivered high levels of stress to US regional banks. It also has scuttled commercial property values and is showing signs of slowing jobs growth.

The increases have come through much more slowly at the European Central Bank and rates stand at 3.75 per cent. There are good reasons for not going further this Thursday at the next decision meeting.

The German economy is in technical recession, dragged down by manufacturing. But there is pressure from hawkish Bundesbank president Joachim Nagel to keep his foot on the brakes.

His concern is that core inflation of 5.3 per cent could become embedded. A quarter point hike is seen to be on the cards.

Where does this leave the Old Lady? Should it fall in with the leadership of the Fed or, like the ECB, continue to worry that tougher action is required if the cost of living is to be tackled?

MPC external member Jonathan Haskel argues that the Bank needs to ‘lean against’ the risks of inflation and further rate rises should not be ruled out.

Certainly inflation is impacting personal budgets and all sectors of the economy. Monetary policy is a blunt instrument, its impact unpredictable and the time lags considerable.

At a moment when the economy is showing healthy signs of spluttering back to life, the Bank should take a leaf from the Fed’s book and hold back.

After all, headline inflation should come down with a jolt as 2022 fuel prices drop out of indexes.

Lords a leaping

The House of Lords is very much in the headlines. Boris Johnson’s honours list, the second chamber’s efforts to roll back Rishi Sunak’s small boats bill and former PM Gordon Brown’s ideas for an overhaul demonstrate it is far from irrelevant.

Today’s appearance by Bank of England governor Andrew Bailey before the Economic Affairs Committee, with a membership including former governor Lord King and ex-Treasury mandarin Lord Turnbull, should be fascinating.

It will address several perceived problems, including the prevalence of ‘group think’ among members of the MPC and the make-up of key committees.

Only recently, the Bank owned up to a misfiring economic model and acknowledged there were big lessons to be learned.

Labour, which granted the Bank full independence back in 1997, has concerns about diversity and other issues, as the Mail on Sunday reported last weekend.

Shadow Chancellor Rachel Reeves is clear that the Bank’s inflation-fighting mandate will not be changed should Labour return to government.

The Lords review is timely given rancour over the Bank’s cost-of-living blunder.

Epstein shadow

The connection between JP Morgan, and the late convicted sex offender Jeffrey Epstein is becoming a little too close for comfort.

Until now, America’s most blue-blooded bank and its chairman Jamie Dimon, have been in the ‘nothing to see here’ camp.

But a £234million settlement with an unidentified woman on behalf of up to 100 victims who alleged sexual abuse by Epstein, after the bank was warned of his unspeakable behaviour, suggests that the tussle about the bank’s involvement is far from over.

JP Morgan still faces charges brought by the US Virgin Islands and is also in dispute with former Barclays chief Jes Staley over who knew what and when.

Is Dimon’s halo in danger of slipping?

This post first appeared on Dailymail.co.uk