This week Microsoft and other titans of tech announced bumper profits driven by the generative artificial intelligence (AI) industrial revolution.

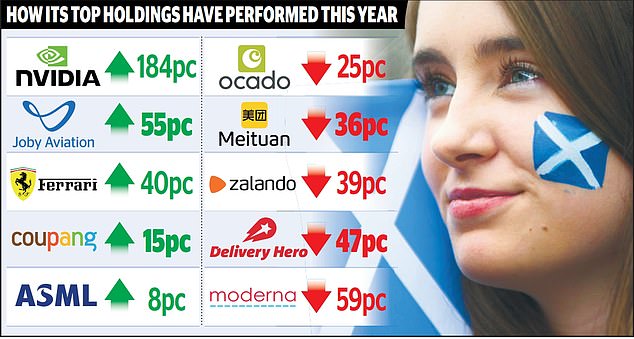

But Scottish Mortgage, the £9.18billion FTSE 100 member investment trust that backs innovation in AI and every other form, is not fizzing with excitement. The trust’s shares, which have fallen by 35 per cent since 2020, stand at an embarrassingly wide 19 per cent discount to its net asset value (NAV) although it owns stakes in two AI powerhouses, equipment manufacturer ASML and semiconductor maker Nvidia.

This week I was granted a rare opportunity to look one of the Scottish Mortgage managers in the eye, to quiz him about what was being done to improve prospects for disappointed investors. Lawrence Burns, deputy manager, acknowledges the pain being felt by shareholders in the trust, formerly the most eminent name in the Baillie Gifford stable, but now lagging behind its benchmark index – the FTSE All World. He also recognises there may be more volatility ahead.

But he argues that AI is set to have an impact on the economy and society equal to the invention of Gutenberg’s printing press in the early 15th century. Investing in such progress is the mission of Scottish Mortgage.

But, as Burns puts it, ‘sometimes progress does not go in a straight line’.

This may be true. But should shareholders shrug their shoulders and take a five-year view, having faith that ASML and Nvidia will continue to dazzle, and that lesser known stocks, such as the Korean e-commerce entity Coupang, could also excel? According to Burns, Coupang’s systems make those of Amazon, which Scottish Mortgage also owns, appear almost archaic.

Or should shareholders conclude that Scottish Mortgage’s structure – about 30 per cent is invested in private companies – will be a persistent obstacle to the revival of its share price?

These 52 unlisted stakes are a source of increasing concern, especially, as Jason Hollands of Bestinvest points out, their number now exceeds that of the 47 quoted holdings.

The list includes ByteDance, owner of TikTok, the video app which has 1bn users worldwide; Space X, Elon Musk’s rocket company; Stripe, the payments company; Ant Group, part of the Chinese giant Alibaba and battery developer Northvolt.

Earlier this year, a former member of the trust’s board, academic Amar Bhide, questioned whether Scottish Mortgage had ‘the capabilities and governance clout to be able to monitor these illiquid investments’.

The managers disputed this assertion and Burns considers that ‘these holdings are not our Achilles heel, they are our strength’. They are very large businesses, not start-ups and much more frequently revalued than before.

In normal circumstances, some of these enterprises would be seeking to go public through an IPO (initial public offering). But Burns says that they are being deterred by the chilly conditions in the IPO sphere.

However, this poses another problem for Scottish Mortgage, as Hollands highlights: ‘The trust would struggle to provide additional funding to any of these companies as this would breach the 30 per cent limit approved by shareholders. Unable to participate, Scottish Mortgage risks ending up being diluted.’

Burns comments: ‘This is not a permanent situation. At some point the IPO market will come alive.’ He is also hoping for reassessment of the potential of some of the quoted stakes, such as Delivery Hero, whose shares have tumbled by 47 per cent this year. The Berlin-based food delivery business is ‘making real strides in the shift towards profitability’.

In recent years, Scottish Mortgage has been linked with every type of transport, with bets on flying taxis and Ferrari. Tesla, Elon Musk’s electric vehicle group, is a major holding. Asked whether this is wise, given Musk’s acquisition of Twitter/X, Burns says that Tesla and SpaceX have good managers.

The hours that Musk is now devoting to Twitter/X may be about the same as he used to spend posting on the platform.

Burns says that the trust’s connection with the automobile goes back to its beginnings in 1909, as a vehicle for the financing of Malaysian rubber plantations whose product went to make the tyres of the Model-T Ford.

This is a novel interpretation. Burns is convinced that the name of the trust has history and brand recognition. But I consider that it sounds solid, rather than racy which some investors may have not fully grasped to their cost. Those who bought into the trust one, three or five years ago have experienced what Ed Monk of Fidelity International calls ‘a rollercoaster ride’.

Like other analysts, Monk does not think the discount will narrow soon. He adds, however: ‘Things can change, of course, and now would appear to be the moment of maximum pessimism – often a great time to buy.’

As someone who has been putting money into Scottish Mortgage for about a decade, I have seldom felt so pessimistic, despite the profit I have made. Like other investors, I want to see progress made soon on the shrinking of the discount.

This post first appeared on Dailymail.co.uk