A power struggle has broken out at Walt Disney as activist investor Nelson Peltz seeks to shake up one of the world’s best-known entertainment giants.

The 80-year-old billionaire yesterday went directly to shareholders to demand a seat on the board having seen a request turned down by chief executive Bob Iger.

Peltz, whose daughter Nicola is married to David Beckham’s eldest son Brooklyn, owns a 0.5 per cent or £750million stake, through his investment fund Trian Partners.

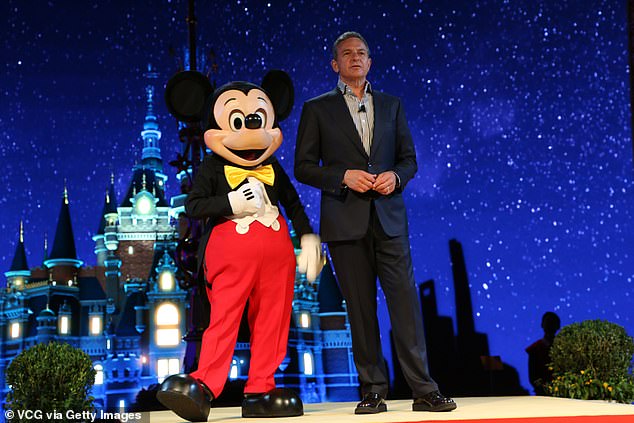

Activist investor Nelson Peltz went directly to Disney shareholders to demand a seat on the board having seen a request turned down by chief executive Bob Iger (pictured)

He is a notorious activist, having pushed his way on to the boards of Procter & Gamble and Unilever and built big holdings in Mondelez and Heinz.

But he may have met his match in Iger, 71, who took the role on in November after the ousting of Bob Chapek.

Disney moved to pre-empt what is likely to be one of corporate America’s biggest boardroom battles in years, this week naming Nike veteran Mark Parker as chairman in a bid to bolster its defences.

He will lead the search for a chief executive to replace Iger when his two-year contract expires.

But in a sign Peltz is in no mood to back down, he this week described Disney as ‘a company in crisis’ with ‘self-inflicted’ problems.

His firm, New York-based Trian, blamed reckless spending for the magic kingdom’s rocky time on the Nasdaq, where shares are at an eight-year low, tumbling nearly 40 per cent over the past year.

The fund took particular issue with Disney’s ‘poor judgment’ when acquiring Fox’s entertainment assets for £60billion in 2019, and ‘over-the-top’ executive pay.

‘Fox hurt this company. Fox took the dividend away. Fox turned what was once a pristine balance sheet into a mess,’ Peltz said as he filed a proxy statement to win a seat on the board.

Disney’s streaming business has haemorrhaged cash as it expands and tries to keep up with tech rivals Netflix and Amazon Prime Video.

Losses more than doubled in the last quarter to £1.25billion. Paolo Pescatore, a tech analyst at PP Foresight, said the ‘streaming pandemic party is well and truly over,’ explaining that all firms need to be investing heavily to gain market share.

Notorious: Nelson Peltz with daughter Nicola

But a failure to rally momentum sealed the fate of Chapek. Not only did he fail to convince investors that he could steer Disney post-pandemic, but he also sparked culture wars over Florida’s Don’t Say Gay bill, which banned discussions of sexual orientation or gender identity in primary schools.

Although Iger – who previously served as Disney’s chief executive for 15 years – said it was ‘ridiculous’ he would ever return, Chapek’s demise meant he was back by Christmas.

Wedbush tech analyst Dan Ives said any big fight between Iger and Peltz would spell even more ‘choppy times’. ‘This is the moment of truth for Iger,’ he said.

There is also the sense that Disney is trying to stand its ground after it was swayed by another activist less than six months ago.

Although Third Point’s Daniel Loeb failed to convince it to spin off cable sports channel ESPN, the notorious investor, who owns a £800million-plus stake, did secure an agreement to get media veteran Carolyn Everson on the Disney board in October.

Hargreaves Lansdown analyst Sophie Lund-Yates said Disney’s robust response to Peltz shows how it doesn’t want to be ‘bullied’. ‘It doesn’t look good for a company to be playing a corporate game of chess,’ she said.

She said the appointment of Parker was Disney ‘moving all its chess pieces’ to push back against Peltz. But if Peltz continues to invest, Disney won’t be able to ignore his requests in a world where money talks.

Michael Gartenberg, analyst at Flash Advisory & Research and a former Apple executive, said Iger’s best bet would be to manage costs to appease Peltz. It could get out of streaming or buy competitor Hulu.

He added: ‘While Peltz won’t take over Disney any time soon, he is one more thorn in Iger’s side and could become more hindrance than help as Iger tries to get the little kingdom… back on the path to global media powerhouse instead of princess’s palace with crumbling walls.’