GBP/AUD hits the top of the watchlist today as the pair retests a major resistance area ahead of U.K. and Australia economic data.

Before moving on, ICYMI, today’s Daily U.S. Session Watchlist looked at a potential setup on a break-and-retest setup on GBP/CAD, so be sure to check that out to see if there is still a potential play!

Intermarket Update:

| Equity Markets | Bond Yields | Commodities & Crypto |

|

DAX: 15129.51 -1.55% FTSE: 6859.87 -2.00% S&P 500: 4134.94 -0.68% NASDAQ: 13786.27 -0.92% |

US 10-YR: 1.561% -0.038 Bund 10-YR: -0.259% -0.001 UK 10-YR: 0.731% 0.00 JPN 10-YR: 0.086% 0.00 |

Oil: 62.61 -1.21% Gold: 1,779.20 +0.48% Bitcoin: $57,028.12 +1.80% Ethereum: $2,324.99 +6.06% |

Fresh Market Headlines & Economic Data:

Dow closes 250 points lower for back-to-back losses, reopening plays lead decline

Fed will limit any overshoot of inflation target, Powell says

Bank of Indonesia holds key rate steady and cuts GDP outlook

Oil hits $68 on Libya force majeure despite pandemic surge

EU regulator finds possible blood clot link with J&J vaccine, but says benefits outweigh risks

U.K. labor market weakens with unexpected drop in payrolls

Global dairy prices fall -0.1% since the last auction on Apr. 6th

Dogecoin cryptocurrency slumps after hashtag-fueled surge to record high

Bitcoin rally this year is the start of going mainstream, not a bubble, says investor Bill Miller

Upcoming Potential Catalysts on the Economic Calendar

Australia Retail Sales, Leading Index at 1:30 am GMT (Apr. 21)

U.K. Inflation Rate at 6:00 am GMT (Apr. 21)

Bank of England Governor Bailey speech at 10:30 am GMT (Apr. 21)

What to Watch: GBP/AUD

GBP/AUD has made quite the moves over the past week, first dropping quickly from the 1.8000 major psychological area down to 1.7750, where it quickly find buyers to send the pair back up almost as fast. With the market now retesting that 1.8000 resistance area once again, is it due for an upside breakout or reversal back lower?

Of course we’ll have to wait and see, but the action in GBP/AUD is likely to stay lively with the latest Australian retail sales data and U.K. inflation data right around the corner. These are mid-tier events, so we could see a continued directional bias (or maybe a reversal) depending on the outcome.

On the one hour chart above, technical arguments could be made for both the bulls and the bears, so it’s likely the fundies will be the main driver for now. And with data improving from both the U.K. and Australia, the short-term move is likely gonna be dependent on today’s data.

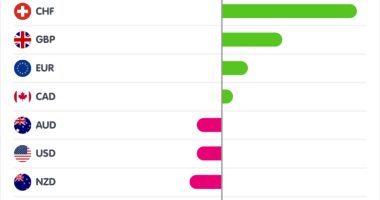

For us, given that Sterling has been an under performer against Aussie for a while now, and with covid case trending lower in the U.K., the short-term favors Sterling for now. And if we see both faster inflation in the U.K. and disappointing retail sales data from Australia, we think the odds are good that the upside momentum may lead to a break above the 1.8000 – 1.8050 level, and a fresh swing long opportunity.

But if we see the opposite scenario play out where Australian retail sales data improved substantially and the U.K. inflation situation weakens, that bearish divergence signal may draw in both technical and fundamental traders that could push the pair back to the 1.7900 handle, based on the daily ATR of around 120 pips.