MARTIN Lewis has issued a warning to millions of households missing out on up to £1,000 in Council Tax support.

The MoneySavingExpert (MSE) founder said that almost three million people are missing out on a share of £2.9billion worth in bill help.

Council tax support is a benefit to help some people pay their council tax.

You could get a discount of up to 90%, or you may not have to pay anything at all.

Many households do not claim the support because they don’t know it exists.

It is also the case that the application process involved in making a claim can put some people off.

READ MORE IN MONEY

What support you can get depends on your circumstances and where you live, as each council decides what help to offer those in its area.

Factors that will determine how much of a discount you can get include your household income, whether you have children, and if you receive any benefits.

But Martin Lewis said that households who receive certain benefits should check if they are eligible for support worth up to £1,000.

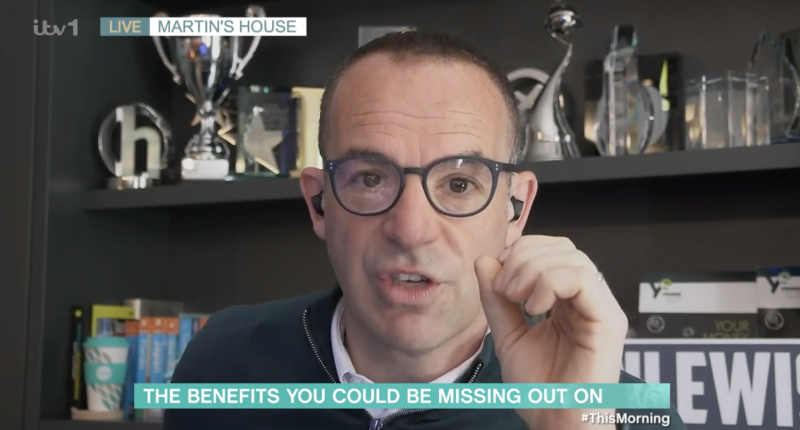

Speaking on ITV’s This Morning, he said: “Here’s the key, if you are on Universal Credit or Pension Credit, or a similar legacy benefit, and you don’t get Council Tax Support, it’s worth getting in touch with your council to see if you’re eligible.

Most read in Money

“The reason so many people miss out on it is they think that if they get Universal Credit, and they’re eligible for Council Tax Support, they’ll be given it, but it’s actually two separate applications.”

Universal Credit is a welfare scheme which was designed to combine several of the old “legacy benefits” into a single monthly payment.

Whether you are eligible will depend on your specific circumstances, but you can claim if you’re on a low income or out of work.

Meanwhile, Pension Credit gives you extra money to help with your living costs if you’re over State Pension age and on a low income.

If you are on a low income or receiving benefits, you could be eligible for some help towards your council tax.

Whether you are eligible will vary depending on where you live.

And if you find yourself struggling to pay your bill, you may also be able to get a deferral or speak to your council about setting up a payment plan to manage the cost.

But one thing to remember is if you are struggling you should contact your council as early as you can.

Universal Credit

HERE’S everything to know about Universal Credit:

More ways to reduce your Council Tax bill

Retirees

Pensioners may also find themselves eligible for a council tax reduction.

If you receive the Guarantee Credit element of Pension Credit, you could get a 100% discount.

If not, you could still get help if you have a low income and less than £16,000 in savings.

And a pensioner who lives alone will be entitled to a 25% discount too.

Single people

If you are living alone you can get 25% off your council tax bill.

The same applies if there is one adult and one student living together in a property, or if there is one adult and one person classed as severely mentally impaired in the home.

You could be entitled to a larger reduction of up to 50% if you live with someone who doesn’t have to pay council tax, such as a carer or someone who is severely mentally impaired.

And, if you live in an all-student household, you could get a 100% discount.

A full list of circumstances that exempt you from paying council tax can be found on Citizens Advice.

How to apply for a reduction

You can apply for a reduction through the Government website.

You’ll need to have your national insurance number, bank statements, a recent payslip or letter from the Jobcentre, and a passport or driving licence to hand.

If there are other adults in the household, you might need the same information for them too.

You can check what council tax bracket your home falls in by entering your postcode on the government website.

Check which local authority you live in to find out how much your council changes for each band, as it varies.

You could also potentially get your house re-banded if you think you’re overpaying on council tax.

To do this, you’ll need to check which band your neighbours are in and work out how much your property was worth in 1991, as this is when council tax bands were decided.

MoneySavingExpert has a free calculator tool to help you do this.

Be warned though – applications are not always successful, and you could even end up being moved to a HIGHER band and paying more.

READ MORE SUN STORIES

A savvy mum revealed how she bagged herself a £600 refund on her council tax after taking up a Martin Lewis tip.

As of April 1 many households saw an increase in their household bills, we put together a list of increases with some tips on how to manage to keep your costs down.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories