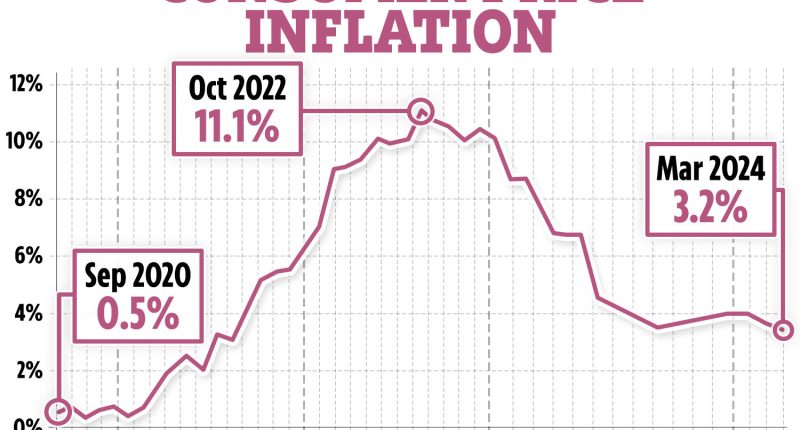

THE UK’s inflation rate fell last month to the lowest level in two and a half years.

Consumer Prices Index inflation stood at 3.2% in March according to new data from the Office for National Statistics (ONS).

Economists had predicted inflation could fall to as low as 3.1%.

Inflation is now closer towards the Bank of England’s 2% target.

Chancellor of the Exchequer, Jeremy Hunt said: “The plan is working: inflation is falling faster than expected, down from over 11% to 3.2%, the lowest level in nearly two and a half years, helping people’s money go further.

This welcome news comes on top of our cuts to national insurance, which save the average worker £900 a year, so people should start to feel the difference as well as see it in their pay cheques.”

Read more money stories

Inflation is a measure of how much the prices of everyday goods like food and clothes, and services like train tickets and haircuts, are now compared to a year earlier.

This month’s figure is the lowest inflation rate since September 2021.

The fall is off the back of easing food prices.

CPI food inflation is also continuing to ease, edging down to 4% in March from 5% in February.

Most read in Money

ONS chief economist Grant Fitzner said: “Inflation eased slightly in March to its lowest annual rate for two-and-a-half years.

“Once again, food prices were the main reason for the fall, with prices rising by less than we saw a year ago.

“Similarly to last month, we saw a partial offset from rising fuel prices.”

Inflation was at 3.4% in February – down from 4% in January and the lowest since September 2021.

What it means for your money

If inflation is high it means that the cost of your everyday essentials is going up – therefore your money doesn’t go as far.

It’s important to note that when inflation drops it doesn’t mean that prices have stopped rising, it just means they are going so at a slower pace.

Alice Haine, personal finance analyst at Bestinvest, said: “Easing inflation will certainly deliver some cheer to households as it signals the rapid price rises seen at the height of the cost-of-living crisis can now be consigned to history.”

Alice warns this doesn’t mean shopping bills will drop prices are still going up but supermarkets will be able to offer more discounts.

Shoppers should still compare prices carefully and make use of deals and loyalty schemes.

The Bank of England (BoE) and the UK’s central bank may hike its base rate to try and bring inflation down when it’s too high

When this happens people with savings may see a boost but homeowners will feel the pinch as interest rates on mortgages will rise.

But falling inflation offers some hope to mortgage holders and prospective buyers, who will be hoping for interest rate cuts.

Alice says: “The latest inflation data will be a relief for buyers and those looking to remortgage hoping for interest rate cuts.”

However, there is still uncertainty over when the will actually happen.

Decision makers decided to keep the Bank’s base rate 5.25% last month for the fifth consecutive time.

As a result mortgage rates have started to creep back up with the average two-year fix rate rising back to 5.8%.

READ MORE SUN STORIES

Pressure is now on the BoE to reduce interest rates.

Megan Greene, one of the Bank’s rate-setters said last week that interest rate cuts “should still be a way off”.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories