BRITS can start claiming a state pension when they reach a certain age to cover essential costs.

The amount people get rises each year in order to keep up with any food or household bill price increases.

The annual hike is usually calculated through what is known as the triple lock, first introduced by the Government in 2010.

Under the mechanism, state pension payments rise by whatever is highest out of 2.5%, inflation from the previous September and wage growth from the previous May to June period.

Growth in employees’ wages from May to June 2023 was 8.5%, higher than inflation for September the same year, which was 6.7%.

That means both the old and new-style state pension increased by 8.5% in April in a boost for older households.

READ MORE IN MONEY

How much is the state pension in 2024?

State Pension payments were increased in April.

The full rate of the new State Pension rose from £203.85 a week to £221.20 a week – or £11,502.40 in total over a year.

This is what the state pays those who reach state pension age after April 6, 2016.

The full basic State Pension under the old system is now £169.50 per week in 2023/24 after rising by 8.5%.

Most read in Money

This is paid under the old pension system and is for those who retired before April 6, 2016.

How much state pension will I actually get?

The amount of new state pension will receive depends on your National Insurance (NI) record throughout your adult life.

If you have made at least 35 years of qualifying NI contributions, you may qualify for the maximum amount, outlined above.

The same is true if you have received equivalent credits on your NI record for raising children or providing care.

If you don’t have 35 years, you may be able to top up your record by paying in voluntary NI contributions.

To get the full basic state pension you will need 30 years of NI contributions or credits.

To get any state pension at all, you will need at least 10 years on your NI record.

What age do I get the state pension?

In response to rising life expectancy, the age at which you become eligible to receive the state pension has been going up.

The age is now 66 for both men and women and is set to reach 68 between 2044 and 2046.

How do I claim the state pension?

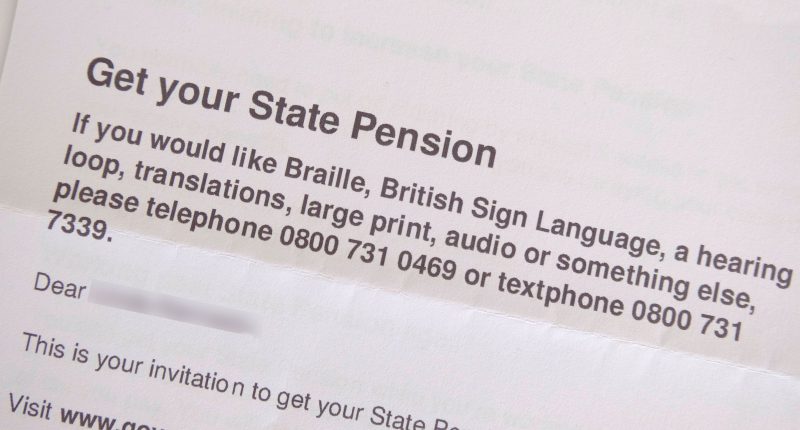

You won’t automatically get the state pension – you need to claim it once you’re eligible.

You should receive a letter no later than two months before you reach state pension age, explaining what to do.

You can find out more here.

You can choose to defer getting the state pension – you don’t have to take it as soon as you are eligible when you reach state pension age.

Leaving your state pension untouched can boost the amount you eventually get.

If you opt to defer your state pension, your entitlement increases by the equivalent of 1% for every five weeks you do so.

As the state system can be tricky to navigate, a key part of any pension planning involves requesting a state pension forecast.

READ MORE SUN STORIES

This will help you get your head around how much you could be eligible to receive, and from what age.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories