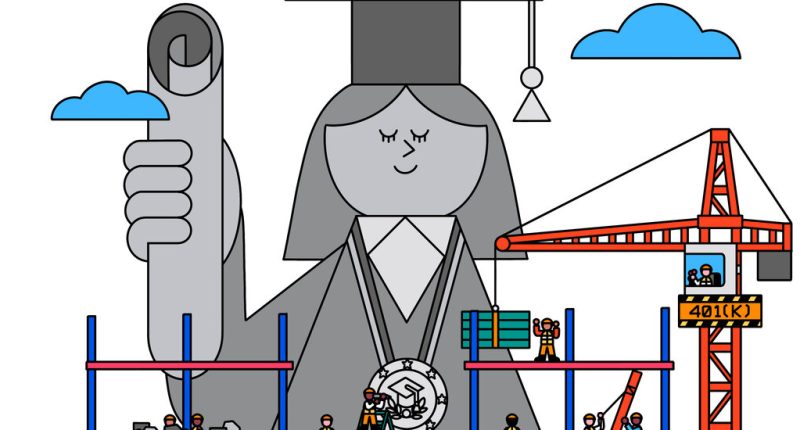

Student loan borrowers who are lucky enough to have access to a 401(k)-type plan, but are too stretched to save in it, may soon be helped by a new workplace benefit: Paying off their student loans can generate retirement savings contributions from their employer.

Starting this year, workers with student loans can receive employer matching contributions in workplace plans, even if they’re not able to save anything on their own. The loan payments count instead.

The new feature was made possible by legislation known as Secure 2.0, which included a package of retirement-related provisions intended to boost savings. It’s hard to know exactly how many companies are planning to offer the benefit — they aren’t required to — but several large companies, including Dow Inc., News Corp., Masco Corp., Unilever and others, recently introduced it to employees, according to Fidelity Investments, one of the nation’s largest plan administrators for retirement and student loan benefits.

“Employers can distinguish themselves in attracting and retaining workers by offering such benefits,” said Craig Copeland, director of wealth benefits research at the Employee Benefit Research Institute, a nonprofit, particularly those “who are struggling with their finances and have student loan debt.”

The student loan benefit takes effect just months after 28 million people restarted federal student loan payments after a nearly 42-month pandemic-related pause. There is already evidence that many people are struggling to add those payments to their household budgets, which have already been squeezed by inflation.

“Since the student loan repayment moratorium ended in September, we’ve seen a real spike in customers looking to add support for student loan repayment to their benefits package,” said Edward Gottfried, senior director of product management at Betterment at Work. “Many of those customers have been eager to find a way to marry their student loan benefits more naturally with their 401(k) plan.”

Source: | This article originally belongs to Nytimes.com