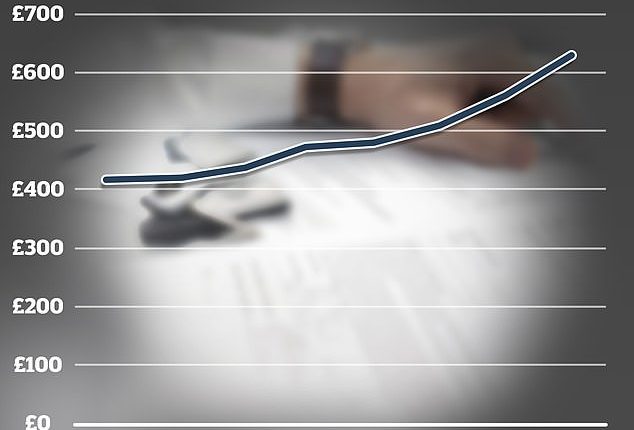

The average car insurance premium rose 25 per cent in 2023, according to official insurer figures.

The average 2023 premium was £543, up from £434 in 2022, the Association of British Insurers (ABI) said.

Meanwhile the typical driver paid £627 to insure their car in the final quarter of 2023, a rise of 12 per cent on the previous three months showing costs continuing to balloon.

The ABI said the steep rise in premiums was due to insurers’ spiralling claims costs.

The trade body said payouts for vehicle thefts rose 35 per cent in Q3 2023 (vs Q3 2022), according to its most recent claims figures.

Longer repair times drove up the cost of providing replacement vehicles by 47 per cent in the same period.

Meanwhile the cost to replace written-off vehicles has increased as the average costs of new cars rise (up 43 per cent over a five-year period).

However, the largest single factor is repair costs, which jumped 32 per cent in Q3 to £1.6billion, the ABI said.

This reflects a mixture of cost of labour, energy and also the fact that vehicles are becoming more sophisticated.

Early research suggests that electric vehicles are approximately 25 per cent more expensive to repair than their petrol or diesel equivalents and take 14 per cent longer to fix.

Analysts at EY estimate that for every £1 motor insurers received in premiums in 2022 they paid out £1.11 in claims and operating costs.

However, this does not take into account the money that insurers make from investments, a crucial income stream.

Mervyn Skeet, director of general insurance policy at the ABI, said: ‘We’re acutely aware of the impact that rising motor insurance premiums continue to have on motorists.

‘Rising repair costs and other factors outside of insurers’ control mean there is no single action that could bring down premiums. However, we are determined to do all we can to put the brakes on.’

Skeet also renewed the ABI’s calls for the Government to cut Insurance Premium Tax, or IPT.

IPT is a stealth tax insurers pay on premiums, and is set at 12 per cent for car insurance.

The average motor premium is inflated by £67 by IPT, as insurers typically pass the cost on in full.