There has been a huge leap in the number of Britons who have a current account with a digital-only bank, new exclusive data for This is Money suggests.

For the first time, more than a third (36 per cent) have an account with a bank that doesn’t have a physical high street presence, the research from comparison website Finder shows.

This is the biggest jump ever recorded. In 2022, fewer than a quarter of the population had an account with one of the digital banks such as Chase, Monzo and Starling.

However, Finder believes the age-old problem persists for digital-only banks – that many people are using them as a secondary account, rather than their main current account.

Growing numbers: More people are heading to digital-only banks – but convincing people to make it their main account appears to still be a problem

The digital banks include names such as Starling, Monzo, Revolut (which doesn’t have a full banking licence) along with Chase, Triodos and also First Direct.

It points to data from the Current Account Switching Service as some evidence of this. Although banks such as Monzo and Starling are managing to gain switchers, they are losing them at a faster rate, as we explain below (see: are digital banks being used as a spare?)

The jump in numbers of digital only banks can be attributed to a switching deal from First Direct and good interest rates from Monzo and Starling, and cashback from Chase, according to Finder.

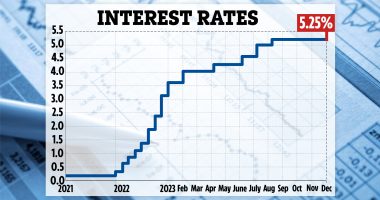

Kate Steere, deputy editor at Finder, said: ‘Near-constant switching deals that First Direct offer (a rarity from digital banks) and the interest rates offered by Starling and Monzo, that are generous in comparison to high street bank rates – one in five of those who have a digital-only account, or plan to, said that the fact they would get better interest rates was a factor.

‘There are also additional features that are attractive to consumers like the cashback feature offered by Chase, while the fee-free spending abroad is a big pull for most of the digital banks as well.’

A quarter of those who have opened or intend to open a digital-only bank account said that they did (or would do) so because digital-only seemed to be the easiest option when opening an additional account.

Almost a quarter said that they wanted to use this type of account to transfer their money more easily, and 17 per cent wanted to get cheaper or free transactions abroad.

The research also showed that digital banks aren’t winning everyone over, with 35 per cent of adults claiming they would not consider opening this type of account. This is up from 32 per cent in 2023.

A further 16 per cent were unsure about opening a digital-only bank account, claiming they would need more information before considering this option. This means that currently half of Britons are either unsure or unwilling to open a digital-only bank account.

When asked why they were either unsure or would not consider opening a digital-only bank account, more than half cited their current bank always having treated them well as one of the reasons behind their reluctance.

A further 37 per cent of these customers said that they prefer having the option to speak to someone in person and use in-branch services, however with many local bank branches facing closure in recent years, this could potentially force the hand of these customers to shift to digital banking.

Another common concern amongst those who were unsure was the risk of payment fraud or cybersecurity breaches with a digital-only bank account, with one in five citing this reason.

This issue is currently a huge concern amongst British consumers, as recent research from Finder found that more than four in five believe that more needs to be done to tackle the issue of identity fraud in the UK.

Finder has been running the survey of 2,000 people reflective of the general population since 2019.

Kate Steere adds: ‘The rise in digital bank account ownership in the past year shows that digital banks are offering customers what they want.

‘Whether this is better convenience or greater agility when it comes to passing on higher interest rates, they’re making sure they address customer needs.

‘Brand loyalty is still a big factor when it comes to switching, but if digital banks continue to innovate and offer services that beat out the traditional banks, we’ll likely see this trend towards digital banking adoption continue.’

Are digital banks being used as a spare?

While more than a third of Britons now have a digital-only bank account, that doesn’t mean they are exclusively with them.

Indeed, Finder believes that a large chunk continue to use them as a spare account.

In the first nine months of 2023, digital banks saw a total loss of more than 25,000 accounts via the switching service.

Monzo lost nearly 20,000 more customers than it gained while this was 4,631 for Starling.

In comparison, some of the high street banking names have seen a switching glut. For example, NatWest gained 59,158 switchers between July and September 2023, and HSBC (which includes First Direct) 25,037.

Challenger digital bank have reeled in millions of customers by offering fee free spending abroad, Finder says.

Many of the customers who have opened accounts in this way have done so to transfer money into them via their main account, and then use it as a spending pot abroad.

But some of the big banks have fought back on this front. For example, First Direct last summer scrapped all fees for overseas spending and cash withdrawals on its debit card for both new and existing customers.

Stablemate HSBC also launched its free Global Money Account that current account holders can sign-up to for similar perks.

Many of the banks that have gained switchers through CASS have done so because of cash bribes – and those who want the bribes must use CASS to get them.

For example, NatWest has offered £200 to switchers and First Direct £175. Digital banks such as Monzo and Starling have held off from doing this, which is now being reflected in the CASS results.

Additionally, it is likely that many of the people who are opening accounts with the digital banks are doing so outside of CASS.

For example, Monzo has grown from nothing to 7.5million current account customers without paying switching incentives.

Kate adds: ‘The question is whether the digital-only banks can become consumers’ primary bank.

‘We know that the digital-only banks are desperate to keep growing and become people’s bank of choice, but time will tell if they’re able to do this.’