The latest data on U.S. consumer inflation rates (CPI) and jobless claims came out on Thursday, and they painted a mixed picture of the U.S. economy. Here are some of the key takeaways:

Broad U.S. consumer inflation metrics rose more than expected in December, driven by higher shelter costs and motor-vehicle insurance. The annual inflation rate reached 3.4% y/y, well above the Fed’s target of 2%.

The core inflation rate, which excludes food and energy, also increased to 3.9% y/y, matching the pace of the “supercore” inflation rate (the core inflation rate excluding housing). These metrics suggest that inflation pressures are broad-based and persistent.

The U.S. weekly jobless claims update showed 202,000 new claims, beating the forecast of 209,000. The continuing jobless claims number also declined from 1.868M to 1.834M.

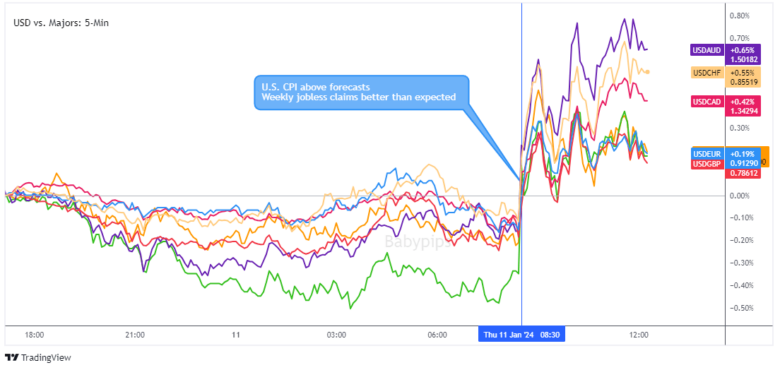

These updates paint a stable jobs sector and sticky inflation environment, which likely lower the odds of significant rate cuts from the Federal Reserve. This was reflected in the markets by the jump in the U.S. dollar against the major currencies (a scenario touched on in our U.S. CPI Event Guide), and the spike higher in the U.S. 10-year Treasury yield, back above 4.00%.

USD Pairs after U.S. data released

Overlay of USD vs. Major Currencies 5-min Forex Forex Chart by TradingView