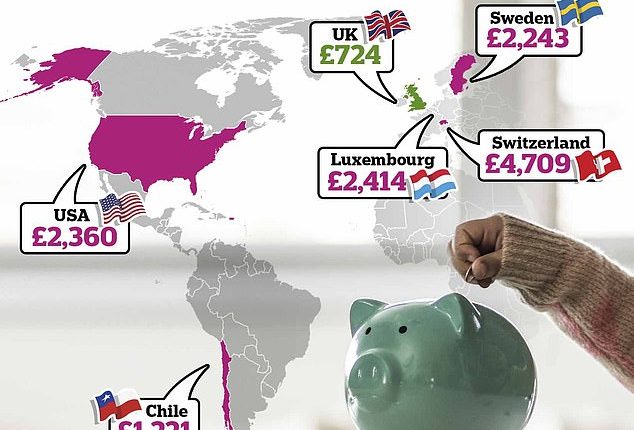

Savers in Britain are tucking away less than most other countries with similar levels of disposable household incomes, data shows.

UK households save £724 of their disposable income annually, an average of 3.25 per cent per year a new study from CityIndex claims.

This puts the UK in 17th place out of 35 countries when it comes to how much people tuck away into savings.

The report analysed OECD data on household savings, including average disposable income, average household savings and long-term interest rates in each country to rank them.

The UK is lagging behind other countries on how much disposable income households put into savings

Households in the UK have an average disposable income of £22,956, yet save just £724 of this yearly.

By contrast, households in Sweden, which has a similar disposable household income to the UK of £22,805 manage to save £2,243 a year.

That’s 10 per cent of their household disposable income and a savings gulf of £1,519 between the UK and Sweden.

| Country | Avg. household disposable income | Avg. household savings in USD from disposable income | % of disposable income put toward saving | Avg. long-term interest rates |

|---|---|---|---|---|

| Switzerland | £28,145.81 | £4,709.17 | 17% | 1.44 |

| Luxembourg | £32,198.18 | £2,413.57 | 7.5% | 2.35 |

| United States of America | £33,949.37 | £2,360.16 | 7% | 3.21 |

| Chile | £11,162.35 | £1,221.13 | 11% | 5.19 |

| Germany | £26,301.35 | £2,843.99 | 11% | 2.28 |

| Austria | £25,340.87 | £2,437.48 | 10% | 2.61 |

| Netherlands | £24,951.89 | £1,972.78 | 8% | 2.47 |

| France | £23,643.88 | £2,292.41 | 9.7% | 2.62 |

| Belgium | £23,782.57 | £2,214.3 | 9% | 2.75 |

| Sweden | £22,805.35 | £2,242.99 | 10% | 2.55 |

| United Kingdom | £22,956 | £724 | 3.25% | 3.00 |

| Source: CityIndex | ||||

Switzerland tops the list for how much disposable income residents put away in savings.

Households there put away on average 17 per cent of their household income towards savings – adding up to £4,709 a year.

That’s despite a typical long-term savings rate of 1.44 per cent compared to 3 per cent in Britain.

Even some countries with lower disposable incomes than the UK put away more.

For example Chile, which has an average disposable income of £11,162 puts away £1,221 in savings – that’s 11 per cent.

That may be because it has one of the highest long-term interest rates, standing at 5.19 per cent. according to OECD data.

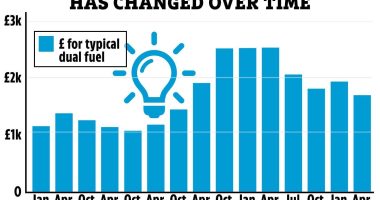

Between December 2021 and September 2023, the Bank of England hiked the base rate 14 times in a row from a record low of 0.1 per cent to where it stands today at 5.25 per cent in an attempt to curb rapidly rising inflation.

Now that inflation has started to ease from its peak of 11.1 per cent in October 2022, the bank has held the base rate at this level and economists are largely forecasting that interest rates will begin to be cut this year.

Due to successive interest rate rises, for the last six months savers have seen some of the best savings rates since 2008 as savings providers scrambled to offer savers table topping savings deals.

In October 2023, National Savings and Investments unleashed a 6.2 per cent one-year fixed-rate bond which signalled the peak of the savings market, as no providers could beat this deal.

Today, average one-year savings accounts sit at 4.81 per cent according to rate scrutineers Moneyfacts Compare and the best one-year deal savers can find is a 5.5 per cent account from Al Rayan Bank.

The average easy-access savings rate is 3.16 per cent and the best easy-access account from Ulster Bank pays 5.2 per cent.

What’s behind the savings lag?

With the cost of living crisis and high inflation, essential expenses like housing, utilities, and groceries have eaten away at the funds available to put into savings – but the same could be said of other countries.

Food prices have seen their steepest rise in 45 years and are still high while utility bills have soared.

Savings inertia is another huge barrier which has long been the enemy of savers. Not moving money into high interest savings accounts could be costing UK savers £1,500 worth of interest.

A quarter of savers have never switched to a different savings account or opened an additional one despite record rates being on offer over the last 18 months, new data from Shawbrook Bank reveals.

The advice to those who are able to put money away into savings has been to keep on top of the changing savings market if they want to secure a good deal.