While we wait for more updates on the Israel-Hamas conflict, major economies like the U.S. and China will print economic reports that may give us more clues on their growth trajectories.

Meanwhile, countries like the U.K., Canada, Eurozone, Japan, and New Zealand will drop their latest inflation figures and give us a clearer picture of global price trends.

Before all that, ICYMI, I’ve written a quick recap of the market themes that pushed currency pairs around last week. Check it!

And now for the closely-watched economic indicators on the calendar this week:

U.K.’s labor market data

On October 17 at 6:00 am GMT, the U.K. is expected to print more jobless claimants and less wage growth in September compared to August.

Claimant count may pump up from 0.9K to 2.3K, average earnings could slow down from 8.5% to 8.3%, and the unemployment rate is expected to steady at 4.3%.

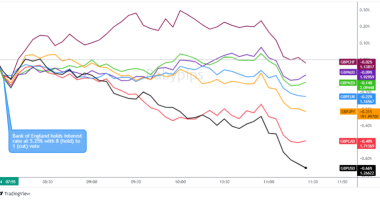

Remember that last week’s shaky GDP report already supported the Bank of England’s (BOE) decision to keep its interest rates steady in September. If we see weaker labor and wage data as leading indicators suggest, then concerns over a second round inflation or a higher BOE interest rate may ease.

Inflation reports

Will this week’s inflation reports encourage concerns of stubbornly high global inflation and a higher-for-longer interest rate environment?

Higher petrol prices are expected to have boosted New Zealand’s consumer prices (Oct 16, 9:45 pm GMT) from 1.1% in Q2 to 1.9% in Q3.

Ditto for Canada (Oct 17, 12:30 pm GMT), which could see its annual inflation speed up from 4.0% to 4.5% in September even as its core CPI steadies at 3.3% and its monthly CPI slows down from 0.4% to 0.0%.

Traders will pay closer attention to Canada’s CPI release this week as it’s one of the last major indicators due before the hawkish Bank of Canada (BOC) announces its October monetary policies next week. Hotter-than-expected Canadian inflation ups the odds of a BOC rate hike.

Meanwhile, U.K. inflation (Oct 18, 6:00 am GMT) is expected to ease from August to September. Annual headline CPI could slow down from 6.7% to 6.6% while core CPI slips from 6.2% to 6.0%.

The Eurozone (Oct 18, 9:00 am GMT) will also publish its final CPI reading but the markets mostly expect the region to maintain its initial 4.3% headline and 4.5% core CPI figures.

Last but not least, Japan’s national core CPI will be printed on Oct 19, 11:30 pm GMT. Consumer prices could slow down from 3.1% to 2.7% in September even amidst speculations that BOJ members have raised their inflation expectations.